Ethereum Wallet Growth Outpaces Bitcoin Amid Stablecoin Surge

04.09.2024 20:30 1 min. read Alexander Stefanov

Ethereum wallet adoption is accelerating, outpacing Bitcoin in growth due to its broader functionality beyond just holding cryptocurrency.

While Bitcoin wallet creation has slowed, Ethereum wallets are on the rise, growing by 2% in the past month to 281.7 million. This increase is largely driven by Ethereum’s role in accessing decentralized applications (dApps) and its use in stablecoin transactions, particularly Tether (USDT).

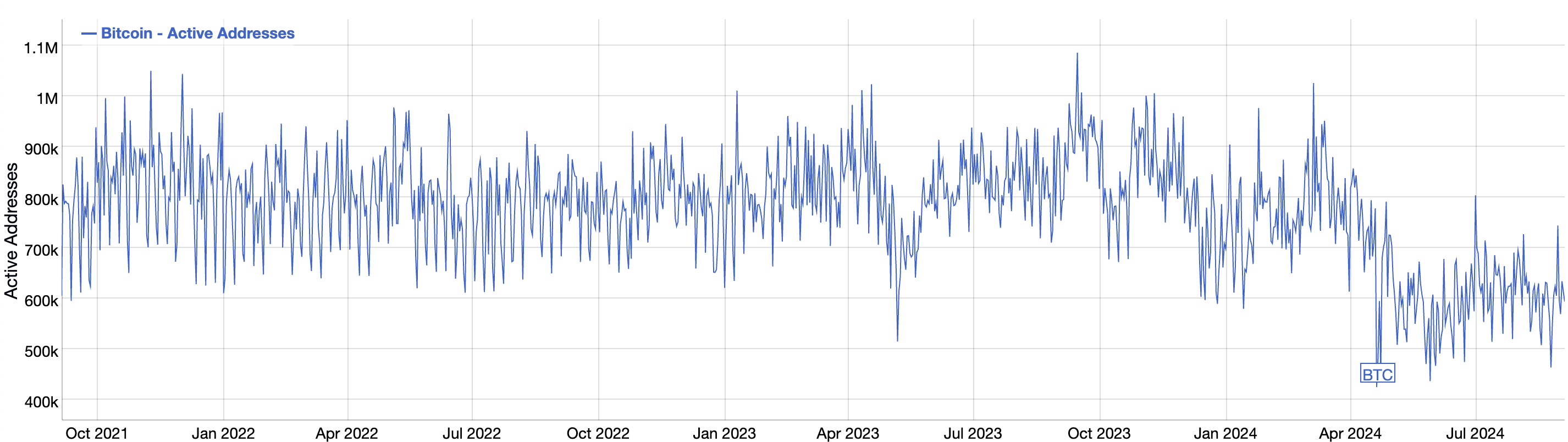

Bitcoin, meanwhile, has seen only a 1% increase in wallets with non-zero balances, reaching 54.1 million. The network’s activity has declined, with fewer daily active addresses and a drop in retail engagement, especially as interest in features like Ordinals and Runes fades.

Ethereum’s wallet growth is also tied to the increasing popularity of stablecoins. Tether, in particular, has seen a rise in users, with more wallets holding USDT as it remains a key source of liquidity in the market.

Despite this, Ethereum’s price continues to face downward pressure, with predictions of further declines before any potential recovery.

At the same time, Ethereum’s role as the backbone for Layer 2 solutions remains strong, with significant funds flowing between Ethereum and these scaling networks. This ongoing activity highlights Ethereum’s central position in the crypto ecosystem, even amid market volatility.

-

1

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read

Solana Price Prediction: Trend Reversal and EMA Crossovers Favor Retest of $100

Solana (SOL) has gone down by 6% in the past week and although the token has recovered in the past 24 hours, technical indicators favor a bearish outlook. Trading volumes have gone up by nearly 18% as bulls managed to reverse an early sell-off during the Asian session. However, meme coins, an important segment of […]

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

A growing number of publicly traded companies are turning to XRP as a potential reserve asset, signaling a shift in how institutions view the utility of digital assets in treasury management.

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

Coinbase has taken another step toward boosting cross-chain utility by introducing wrapped versions of XRP and Dogecoin on its Layer 2 network, Base.

Whale Activity Triggers Caution for Select Altcoins Amid Bitcoin Optimism

While Bitcoin continues to capture attention with its strong 2025 outlook, several altcoins may be facing near-term turbulence.

-

1

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read