Bitcoin ETFs See Major Outflows Following Labor Day

04.09.2024 12:00 2 min. read Alexander Stefanov

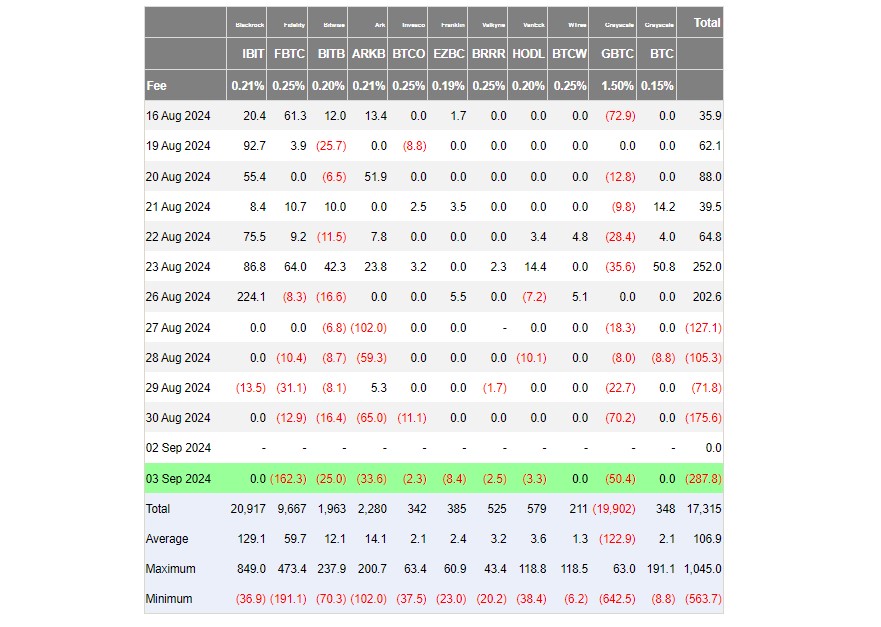

At the start of September, U.S. spot Bitcoin ETFs faced a sharp decline, with about $288 million pulled out yesterday, according to Farside Investors.

This marked the fifth day in a row of net outflows, totaling over $750 million in withdrawals since the previous week.

The market after Labor Day saw significant selling pressure, as 8 of the 11 Bitcoin funds posted losses. Grayscale’s GBTC fund saw over $50 million in withdrawals, while Fidelity’s FBTC fund had $162 million pulled out, marking its second-highest outflow since it was launched.

Other Bitcoin ETFs, including those from ARK Invest, Bitwise, Franklin Templeton, VanEck, Valkyrie, and Invesco, also recorded net outflows. On the other hand, funds from BlackRock, WisdomTree, and Grayscale’s BTC remained stable, with no major inflows or outflows.

Grayscale’s GBTC fund is nearing a significant threshold, with total outflows soon expected to reach $20 billion, based on data from Farside Investors. Despite a recent slowdown in the pace of selling, capital continues to flow out of the fund. The decline in Bitcoin prices has reduced Grayscale’s assets under management to roughly $13 billion.

Some of the withdrawals from GBTC are linked to bankrupt crypto companies from 2022 and 2023, which held Grayscale shares and sold them off to repay creditors. Grayscale CEO Michael Sonnenshein mentioned that this selling activity picked up once the Trust converted to an ETF.

Meanwhile, Grayscale has lost its top spot in the Bitcoin ETF market to BlackRock, whose IBIT ETF has grown to nearly $21 billion in assets, making it the largest Bitcoin ETF globally.

-

1

Ukraine Allegedly Eyes Bitcoin Reserves in Bold Crypto Policy Shift

15.05.2025 18:00 2 min. read -

2

New Proposal Aims to Replace Satoshis with Simplified Bitcoin Unit System

20.05.2025 13:00 2 min. read -

3

Bitcoin Will Hit $1 Million Within 3 Years, According to BitMEX Founder

16.05.2025 16:00 1 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

Economic Instability and Political Shift Fueling Bitcoin’s Rise – Galaxy Digital CEO

23.05.2025 12:00 2 min. read

Are We Witnessing the Final Bitcoin Cycle as We Know It?

Swan, a Bitcoin-focused financial firm, has issued a striking market update suggesting that the current BTC cycle isn’t just another repeat of the past—it might be the last of its kind.

Ross Ulbricht Receives $31M in BTC — Who Sent It, and Why Now?

Ross Ulbricht, founder of the infamous Silk Road marketplace, is back in the headlines after receiving a mysterious transfer of 300 BTC—valued at roughly $31 million.

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

Bitcoin could be heading for a notable dip if it fails to stay above a key price zone, according to market watcher DonAlt.

Over 7 Million Bitcoins May Be Lost Forever, Study Finds

A new report from Cane Island reveals a startling truth about Bitcoin’s supply: by late 2025, over 7 million BTC could be permanently lost—more than one-third of all coins ever mined.

-

1

Ukraine Allegedly Eyes Bitcoin Reserves in Bold Crypto Policy Shift

15.05.2025 18:00 2 min. read -

2

New Proposal Aims to Replace Satoshis with Simplified Bitcoin Unit System

20.05.2025 13:00 2 min. read -

3

Bitcoin Will Hit $1 Million Within 3 Years, According to BitMEX Founder

16.05.2025 16:00 1 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

Economic Instability and Political Shift Fueling Bitcoin’s Rise – Galaxy Digital CEO

23.05.2025 12:00 2 min. read