Bitcoin Surpasses Ethereum in Risk-Adjusted Performance for the First Time Since July 2022

04.09.2024 14:00 1 min. read Alexander Stefanov

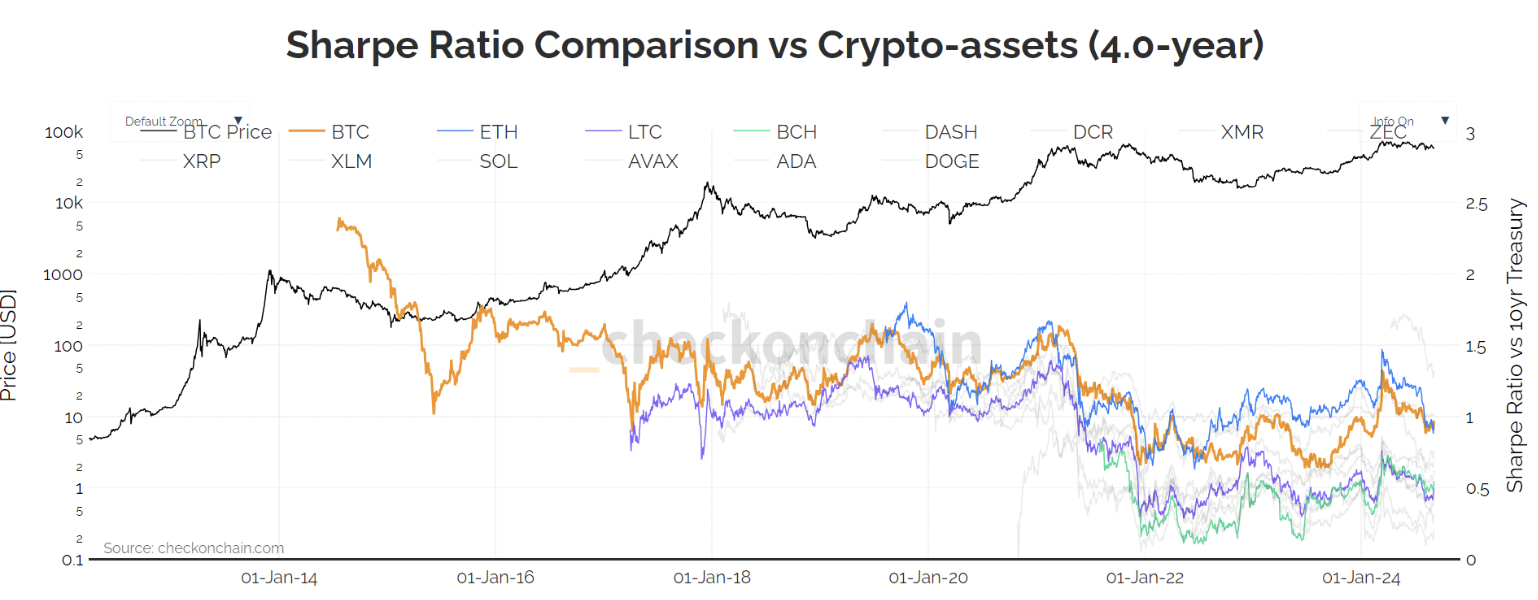

Bitcoin (BTC) currently has a Sharpe ratio of 0.97 on a four-year basis, which implies solid performance given its associated risk.

Interestingly, BTC ‘s Sharpe ratio recently outpaced that of Ethereum (ETH) for the first time since July 2022, with ETH now standing at 0.95.

The Sharpe ratio is a key financial metric that evaluates the return of an investment relative to its risk. This metric helps investors gauge what return they are getting for the level of risk they are taking.44

To calculate it, you need to subtract the risk-free rate from the investment’s return and then divide that difference by the investment’s standard deviation (which measures risk or volatility). A higher Sharpe ratio implies a more favourable risk-adjusted return.

Among known digital assets, only Solana (1.32) and Dogecoin (1) have a higher Sharpe ratio than Bitcoin. In contrast, other major cryptocurrencies such as XRP and ADA have seen their ratios decline, indicating weaker risk-adjusted returns.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read