Crypto Whale Activity Declines: Market Concerns or Signs of Accumulation?

03.09.2024 14:00 2 min. read Alexander Stefanov

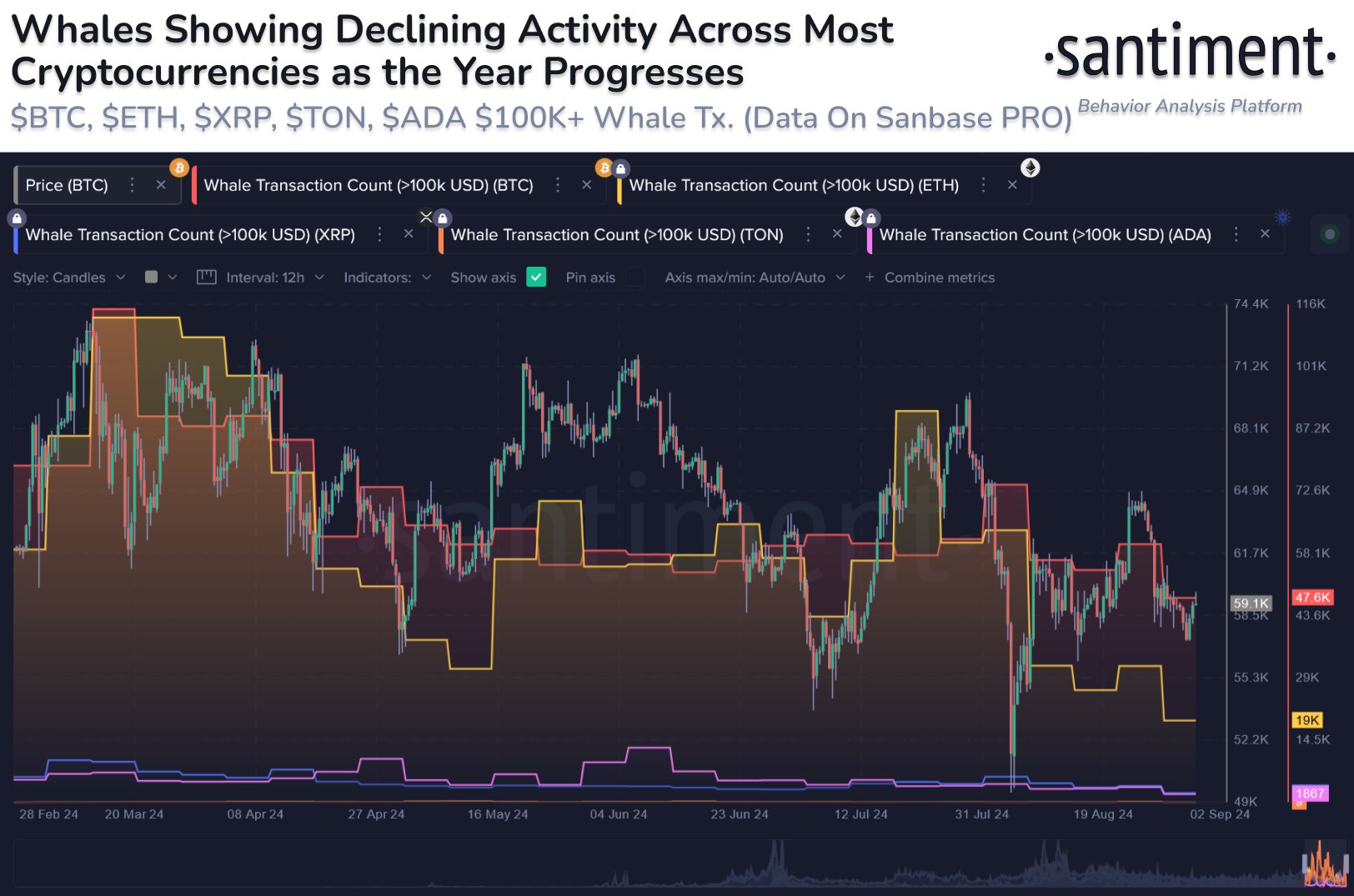

The recent drop in crypto whale activity, especially in Bitcoin and Ethereum, has sparked discussion in the community.

According to data shared by Santiment, between March and August 2024, there was a significant drop in the number of whale transactions. For Bitcoin, they decreased from 115,100 between March 13 and 19 to just 60,200 between August 21 and 27. Similarly, Ethereum saw a drop from 115,100 to 31,800 over the same periods.

The decline in whale activity could naturally cause concern among investors. Normally, whales – which control much of the market – can influence prices, and a decline in their transactions may suggest reduced market interest or liquidity.

In many cases, a decrease in whale activity is associated with a decline in prices due to lower trading volumes and reduced market engagement.

However, there is another view that this trend may signal reduced market volatility. Whales often become more active during periods of high market volatility, moving large amounts of assets to take advantage of price fluctuations. A reduction in their activity may mean that the market stabilises, with less dramatic price movements.

Analyst firm Santiment offers a more optimistic interpretation. Experts believe the current trend may indicate that whales are in an accumulation phase – slowly gathering assets rather than selling them. This behavior could be a sign that whales are confident in the future growth of Bitcoin and Ethereum, anticipating a potential surge in the near future.

If the drop in transactions is indeed due to accumulation rather than a lack of interest, this could bode well for the future of the market.

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Robinhood Launches Ethereum and Solana Staking for U.S. Users

11.07.2025 14:30 2 min. read

Why Most Americans Still Avoid Crypto Despite Growing Adoption

Cryptocurrency ownership in the U.S. has grown steadily over the past few years, but it remains far from widespread.

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Robinhood Launches Ethereum and Solana Staking for U.S. Users

11.07.2025 14:30 2 min. read