Spot Bitcoin ETFs See $71.8 Million in Outflows for Third Consecutive Day

30.08.2024 16:02 1 min. read Alexander Stefanov

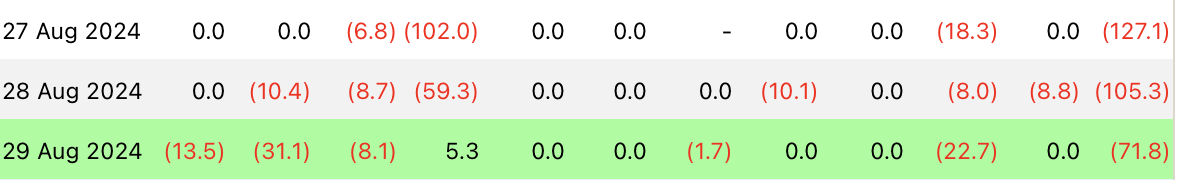

On Thursday, spot Bitcoin ETFs experienced significant net outflows totaling $71.8 million, the third consecutive day of outflows.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset size, recorded its first net outflow since May 1, with negative flows of $13.5 million. Grayscale’s GBTC continued to face investor withdrawals, losing $22.7 million, while Fidelity’s FBTC faced outflows of $31.1 million.

Other spot Bitcoin ETFs, such as Bitwise’s BITB and Valkyrie’s BRRR, also saw outflows of $8.1 million and $1.7 million, respectively.

However, ARKB was an exception, recording net inflows of $5.3 million.

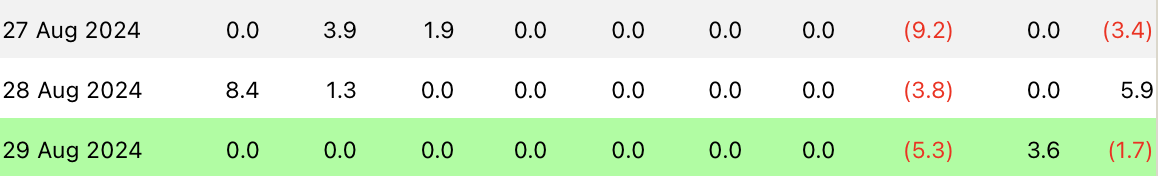

Spot ETFs also saw negative movement, albeit on a smaller scale, with net outflows of $1.7 million on Thursday.

Grayscale’s Ethereum Trust (ETHE) led the losses, with $5.3 million withdrawn. This was somewhat offset by net inflows of $3.6 million into the Grayscale Ethereum Mini Trust (ETH). The other seven spot Ethereum ETFs saw no outflows on the day.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read