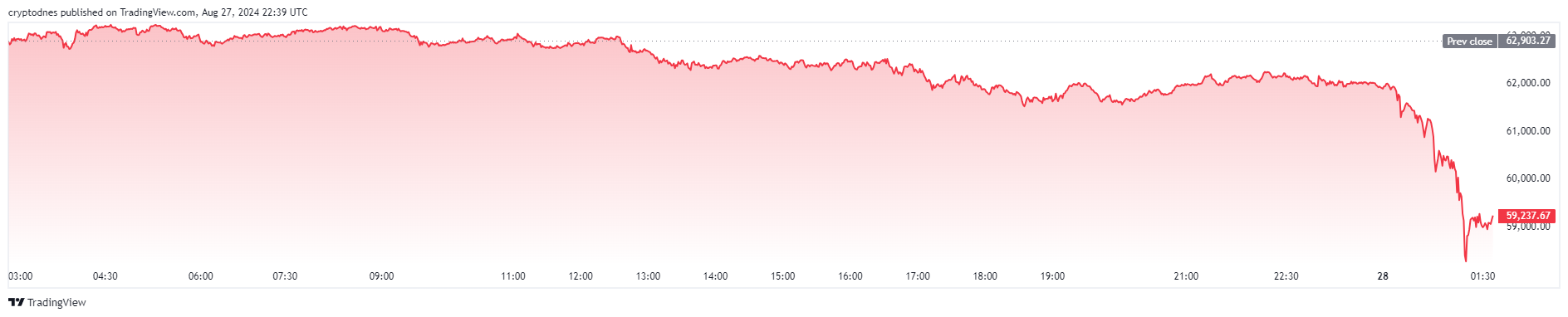

Crypto Market is Bleeding Again – Bitcoin Falls Below $59,000

28.08.2024 1:48 1 min. read Alexander Stefanov

The crypto market is experiencing serious selling pressure, leading to major price declines across the board.

Bitcoin (BTC) lost 6.5% of its value in just 24 hours and briefly dipped below $59,000. At the time of writing, the cryptocurrency managed to rise above the $59,000 level.

The 24-hour trading volume hit $36.6 billion as BTC’s market cap reached $1.17 billion.

Ethereum (ETH) also took a nosedive and is currently trading at $2,440 after losing 10% in the past 24 hours with $16.75 billion in trading volume.

In the past 24 hours, $311.29 million were liquidated from the market with $281.59 million being long positions and $29.70 in shorts. Out of all these positions $100.08 million were in Ethereum and $93.74 million were in Bitcoin

The 1-day technical analysis from TradingView seems extremely bullish as the summary and moving averages show “strong sell” at 17 and 15, respectively, while oscillators remain “neutral” at 8.

-

1

Ukraine Allegedly Eyes Bitcoin Reserves in Bold Crypto Policy Shift

15.05.2025 18:00 2 min. read -

2

New Proposal Aims to Replace Satoshis with Simplified Bitcoin Unit System

20.05.2025 13:00 2 min. read -

3

Bitcoin Will Hit $1 Million Within 3 Years, According to BitMEX Founder

16.05.2025 16:00 1 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

Economic Instability and Political Shift Fueling Bitcoin’s Rise – Galaxy Digital CEO

23.05.2025 12:00 2 min. read

Are We Witnessing the Final Bitcoin Cycle as We Know It?

Swan, a Bitcoin-focused financial firm, has issued a striking market update suggesting that the current BTC cycle isn’t just another repeat of the past—it might be the last of its kind.

Ross Ulbricht Receives $31M in BTC — Who Sent It, and Why Now?

Ross Ulbricht, founder of the infamous Silk Road marketplace, is back in the headlines after receiving a mysterious transfer of 300 BTC—valued at roughly $31 million.

Bitcoin at Risk of Deeper Pullback as Momentum Stalls, Analyst Says

Bitcoin could be heading for a notable dip if it fails to stay above a key price zone, according to market watcher DonAlt.

Over 7 Million Bitcoins May Be Lost Forever, Study Finds

A new report from Cane Island reveals a startling truth about Bitcoin’s supply: by late 2025, over 7 million BTC could be permanently lost—more than one-third of all coins ever mined.

-

1

Ukraine Allegedly Eyes Bitcoin Reserves in Bold Crypto Policy Shift

15.05.2025 18:00 2 min. read -

2

New Proposal Aims to Replace Satoshis with Simplified Bitcoin Unit System

20.05.2025 13:00 2 min. read -

3

Bitcoin Will Hit $1 Million Within 3 Years, According to BitMEX Founder

16.05.2025 16:00 1 min. read -

4

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

5

Economic Instability and Political Shift Fueling Bitcoin’s Rise – Galaxy Digital CEO

23.05.2025 12:00 2 min. read