Stablecoins’ Market Cap Surged to a New All-Time Hight

26.08.2024 18:00 1 min. read Alexander Stefanov

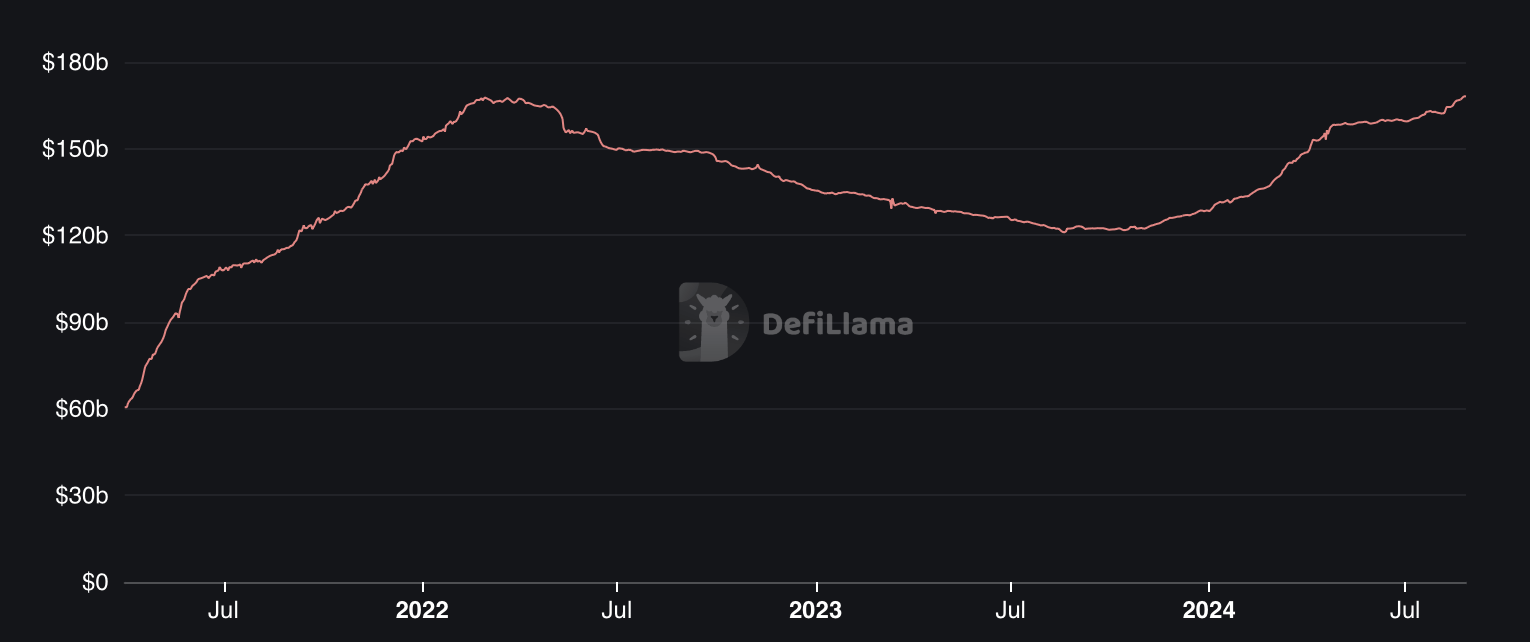

The total market capitalization of stablecoins, excluding algorithmic ones, reached an all-time high of more than $168 billion over the weekend.

Market capitalization had fallen to about $122 billion in October, but has been steadily rising since the start of 2024.

Rachel Lucas, a crypto analyst at BTCMarkets, suggested that the rise in stablecoin market capitalization indicates increased interest from institutional investors who view stablecoins as a safe haven in uncertain market conditions.

She noted that the growing use of stablecoins by institutions underscores the shift toward integrating these digital assets into trading strategies and long-term portfolios.

The market capitalization of USDT, the largest stablecoin, has grown from $91.6 billion in January to $117.889 billion at the time of writing, now accounting for approximately 70% of the segment’s total market cap.

-

1

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

4

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

5

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

A growing number of publicly traded companies are turning to XRP as a potential reserve asset, signaling a shift in how institutions view the utility of digital assets in treasury management.

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

Coinbase has taken another step toward boosting cross-chain utility by introducing wrapped versions of XRP and Dogecoin on its Layer 2 network, Base.

Whale Activity Triggers Caution for Select Altcoins Amid Bitcoin Optimism

While Bitcoin continues to capture attention with its strong 2025 outlook, several altcoins may be facing near-term turbulence.

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

BlackRock is making another assertive move into digital assets, quietly expanding its crypto portfolio with sizable purchases of both Bitcoin and Ethereum.

-

1

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

2

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

3

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read -

4

XRP Price Prediction: Can CME Futures Propel XRP to $4?

26.05.2025 23:49 3 min. read -

5

WalletConnect Launches WCT on Solana with $3M Airdrop

25.05.2025 22:00 2 min. read