Ethereum ETFs Attract $2 Billion, Yet Trail Behind Bitcoin Funds

22.08.2024 14:00 1 min. read Alexander Stefanov

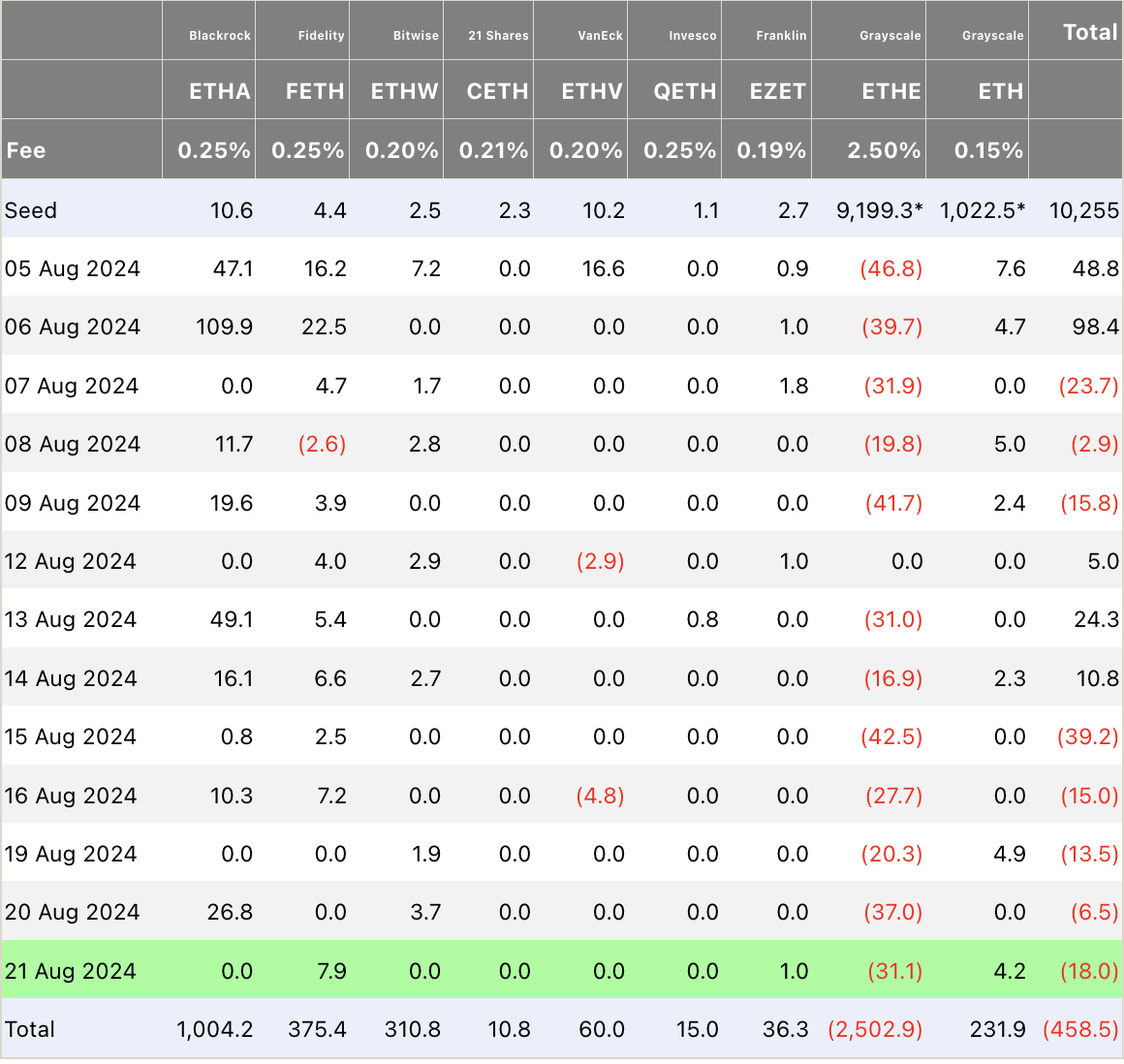

In the past four weeks, spot Ethereum ETFs have attracted over $2 billion in new investments, excluding a major $2.5 billion outflow from Grayscale’s ETHE, as reported by Farside Investors.

Nate Geraci, CEO of ETF Store, remarked that if all Ethereum ETF inflows were consolidated into a single fund, it would rank as the fourth-largest ETF debut ever. Currently, only Bitcoin ETFs—BlackRock’s IBIT, Fidelity’s FBTC, and ARK 21Shares’ ARKB—exceed this total.

Bloomberg’s Eric Balchunas highlighted that, globally, ETF investments have reached $911 billion for the year, with US-based spot crypto ETFs contributing $17 billion, or about 2% of the total. IBIT is now the third-largest ETF by inflows, approaching $20.5 billion, while FBTC has nearly $10 billion.

Despite hitting the $2 billion mark, Ethereum ETFs are not performing as well as their Bitcoin counterparts. Bitfinex analysts link this to Ethereum’s recent downturn, which saw its value fall by 40% in the last month.

The broader economic climate has also impacted the market. Recent interest rate hikes in Japan have cooled investor enthusiasm, and a significant sell-off in the crypto market earlier this year led to notable losses.

Aurelie Barthere of Nansen noted that a subsequent sell-off from July to August further pressured Ethereum due to its increasing correlation with traditional equities, amid slowing US economic growth and high valuations in other risk assets.

-

1

Public Blockchain Firm Pivots From Bitcoin to Ethereum With $57M Acquisition Plan

16.05.2025 13:00 1 min. read -

2

Pi Coin Plummets Over 20% as Community Confidence Erodes

18.05.2025 12:00 2 min. read -

3

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

4

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

5

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

Bitcoin tumbled sharply today, shedding more than 3.5% in a matter of hours and briefly flirting with the critical $100,000 level.

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

Bitcoin is treading water near $105,000, but pressure is building on both sides of the trade as macro forces tighten.

Whale Activity Triggers Caution for Select Altcoins Amid Bitcoin Optimism

While Bitcoin continues to capture attention with its strong 2025 outlook, several altcoins may be facing near-term turbulence.

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

BlackRock is making another assertive move into digital assets, quietly expanding its crypto portfolio with sizable purchases of both Bitcoin and Ethereum.

-

1

Public Blockchain Firm Pivots From Bitcoin to Ethereum With $57M Acquisition Plan

16.05.2025 13:00 1 min. read -

2

Pi Coin Plummets Over 20% as Community Confidence Erodes

18.05.2025 12:00 2 min. read -

3

Binance Expands Futures Platform with New High-Leverage Contract

16.05.2025 15:47 1 min. read -

4

Vitalik Buterin: Ethereum Must Be Ready to Replace Cash

27.05.2025 14:00 1 min. read -

5

Analysts Warn Bitcoin Is Easier to Attack Than Ethereum

18.05.2025 14:00 2 min. read