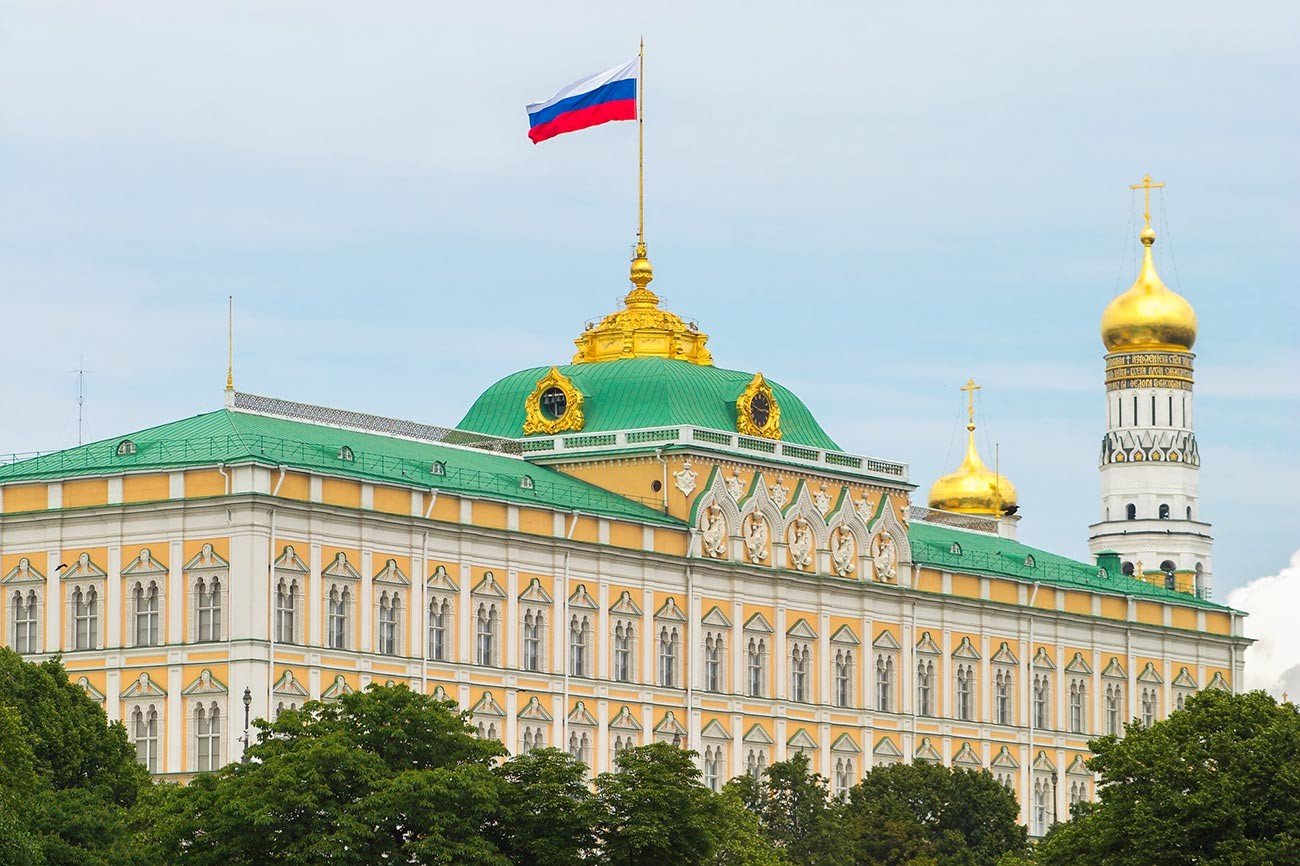

Russia Shifts $2.3 Billion in Cash as Sanctions Bite and Yuan Push Falters

15.08.2024 18:00 1 min. read Alexander Stefanov

Russia is back in the spotlight after recent issues with the Libyan dinar, which Libyan officials attribute to a surge in counterfeit bills reportedly linked to Russia.

Newly analyzed customs data reveals Russia has moved $2.3 billion in cash to Moscow, with Turkey and the UAE facilitating these transfers amidst sanctions. Interestingly, over half of this cash’s origin remains unknown.

Despite the Kremlin’s push to promote the Chinese yuan, many Russians still prefer holding dollars and euros for their reliability. Dmitry Polevoy of Astra Asset Management notes that the dollar continues to be a favored currency among Russians.

This ongoing preference highlights a gap between Russia’s official economic policies and the practical choices of its citizens. The high demand for foreign cash is driven by travel and savings needs.

Additionally, President Putin’s legalization of Bitcoin mining represents a move to overcome financial barriers. Russia’s recent presidency of the UN Security Council has also been used to promote a “multipolar world” and challenge the dominance of the US dollar, aligning with the goals of the BRICS nations.

-

1

New Ethereum Initiative Targets Institutional-Grade Security Standards

16.05.2025 14:00 1 min. read -

2

Ark Invest Buys Into eToro as Shares Surge on Nasdaq Debut

16.05.2025 8:00 1 min. read -

3

JPMorgan CEO Warns Market Is Overlooking Risks from Tariff Tensions

22.05.2025 8:00 1 min. read -

4

FIFA Teams Up with Avalanche to Launch Its Own Blockchain

23.05.2025 9:00 1 min. read -

5

Charles Hoskinson’s Long-Standing Crypto Prediction Is Playing Out

24.05.2025 17:00 2 min. read

Less Income, No Buybacks: UBS Revises Berkshire Hathaway Forecast

UBS analyst Brian Meredith has revised his outlook on Berkshire Hathaway’s Class B shares, trimming the price target from $606 to $591, while maintaining a “buy” rating.

U.S. Treasury Launches Record-Breaking Bond Buyback Amid Market Volatility

In a move not seen in decades, the U.S. Treasury Department has initiated a historic $10 billion bond buyback—its largest ever—targeting securities set to mature between mid-2025 and mid-2027.

Yuga Labs Moves to Dismantle ApeCoin DAO in Favor of Centralized Structure

In a bold move to reshape the future of ApeCoin, Yuga Labs has introduced a proposal that would dissolve the existing ApeCoin DAO and replace it with a streamlined management body called ApeCo.

ARK Invest Makes Bold Bet on Circle as Stablecoin Giant Enters Wall Street

Circle’s arrival on the New York Stock Exchange sent shockwaves through the market, and Cathie Wood’s ARK Invest wasted no time jumping in.

-

1

New Ethereum Initiative Targets Institutional-Grade Security Standards

16.05.2025 14:00 1 min. read -

2

Ark Invest Buys Into eToro as Shares Surge on Nasdaq Debut

16.05.2025 8:00 1 min. read -

3

JPMorgan CEO Warns Market Is Overlooking Risks from Tariff Tensions

22.05.2025 8:00 1 min. read -

4

FIFA Teams Up with Avalanche to Launch Its Own Blockchain

23.05.2025 9:00 1 min. read -

5

Charles Hoskinson’s Long-Standing Crypto Prediction Is Playing Out

24.05.2025 17:00 2 min. read