Here are the Top Performers in Bitcoin Mining in Q2

15.08.2024 15:00 1 min. read Alexander Stefanov

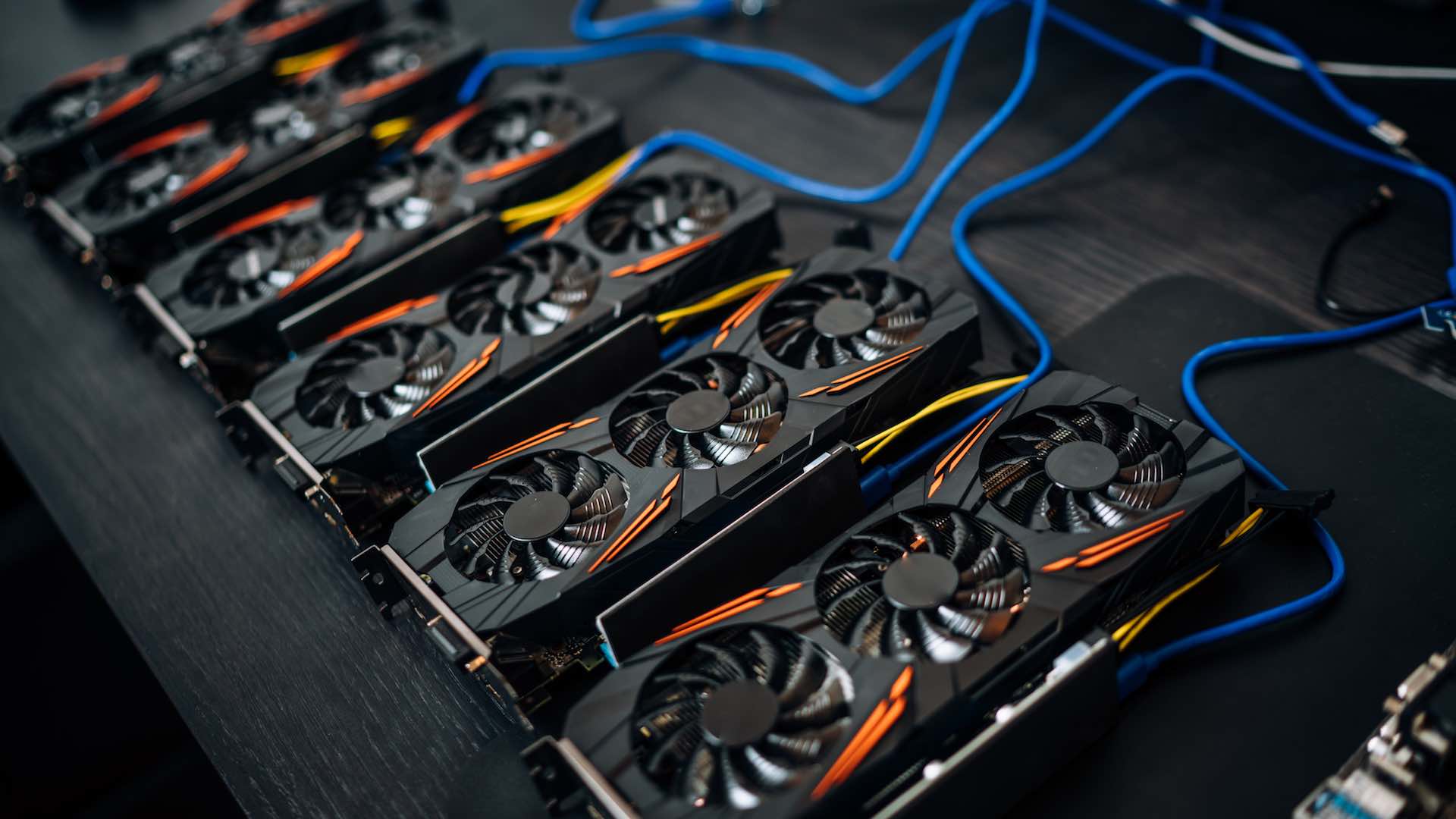

Recent Q2 reports from Bitcoin mining companies have highlighted their performance post-April halving, which increased mining difficulty and reduced hash prices.

Nishant Sharma of BlocksBridge Consulting pointed out that companies with lower hash costs and higher hash rate utilization are best positioned. CleanSpark led with the lowest hash cost in Q2, while Bitdeer, Bitfarms, and CleanSpark topped in hash rate utilization in July. Conversely, Marathon Digital had higher hash costs.

Bitfarms made board changes, and Riot Platforms increased its stake in Bitfarms to 18.9%. Joe Flynn from Compass Point noted Bitfarms’ growth potential and acquisition interest as protective for the stock.

Marathon bought $100 million in BTC in July despite mining at a loss and plans to raise $250 million to buy more Bitcoin. Flynn compared Marathon to MicroStrategy but lowered the price target.

Some miners are diversifying into high-performance computing (HPC) and AI. Core Scientific is adding 112 megawatts of HPC infrastructure via a deal with CoreWeave. Terawulf is developing a 2MW AI/HPC project, which boosted its stock after Q2 earnings.

Hut 8, with 9,102 BTC as of June 30, aims to expand its HPC capabilities for AI. Analyst Mark Palmer suggested new AI partnerships or advanced mining rig orders could significantly boost Hut 8’s stock.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read