US Crypto ETFs Saw Combined Outflows of Over $105 Million

10.08.2024 14:00 1 min. read Kosta Gushterov

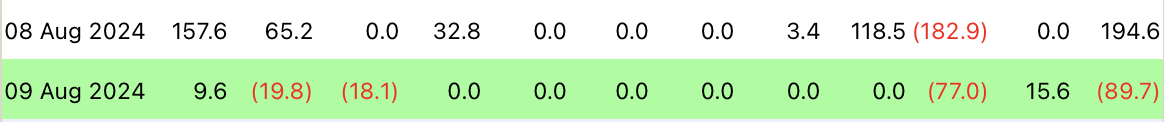

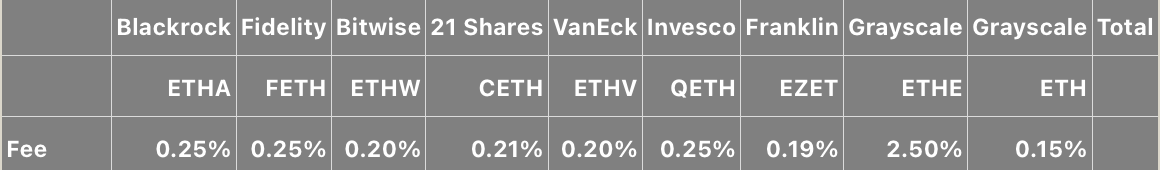

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded net outflows of $89.7 million on August 9, after attracting just over $194 million the day before.

According to Farside, Grayscale’s GBTC converted fund led the outflows with $77 million, followed by Fidelity’s FBTC with $19.8 million and Bitwise’s BITB with $18.1 million.

BlackRock’s Bitcoin fund (IBIT) was one of two funds to see inflows, adding $9.6 million. Hashdex’s DEFI was the best performer for the day, adding $15.6 million.

Interestingly, BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, reported zero flows on Tuesday, along with seven other funds.

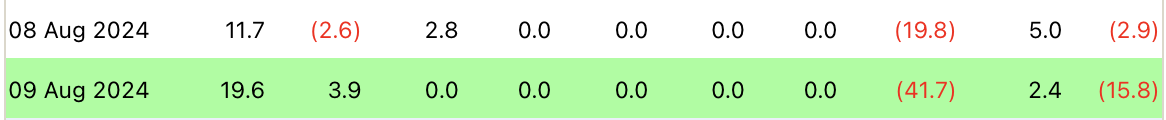

On the other hand, spot Ether ETFs also saw net outflows on Friday, with total outflows amounting to $15.8 million.

The largest inflow was recorded by BlackRock’s ETHA, which saw $19.6 million. Fidelity’s FETH received inflows of $3.9 million, Grayscale’s mini fund (ETH) attracted $2.4 million, while the rest remained neutral.

Grayscale’s ETHE, on the other hand, experienced the largest outflow of the day, seeing outflows of $41.7 million.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read