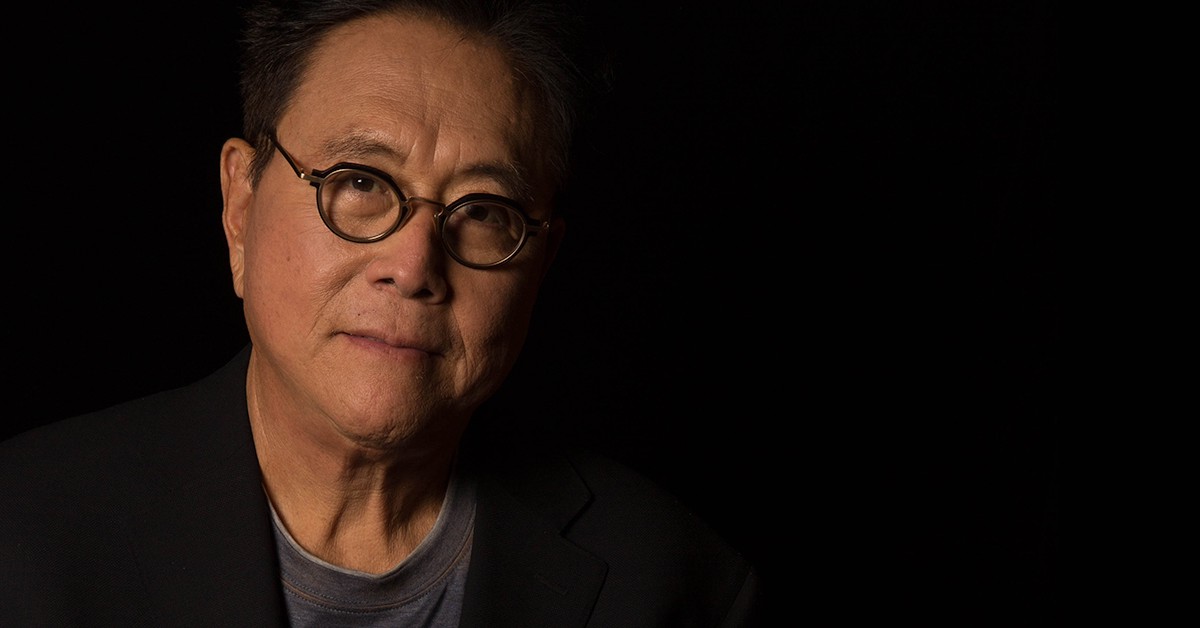

How to Protect Yourself From Fed’s “Criminal” Policy, According to Robert Kiyosaki

09.08.2024 17:00 2 min. read Alexander Stefanov

Robert Kiyosaki, renowned investor and author of the best-selling book "Rich Dad, Poor Dad," has issued warnings about the actions of the United States government, specifically the Federal Reserve and the Treasury Department.

He considers their policies ‘criminal‘ and suggests specific assets that people can use to preserve their wealth in the current economic environment.

He discussed these concerns with Gold Newsletter editor and New Orleans Investment Conference executive director Brian Lundin, as well as entrepreneur and Bitcoin (BTC) advocate Anthony Pomplano.

Kiyosaki outlined strategies to protect wealth against what he considers dangerous Fed policy. The author stressed that in the current era of unlimited quantitative easing (QE), in which the Fed is buying all kinds of bonds – actions that he believes violate the Fed’s constitutional role – investing in gold, silver and Bitcoin is critical.

QE is a monetary policy tool used by central banks, including the U.S. Federal Reserve, to inject liquidity into the economy by purchasing securities such as Treasury bonds and mortgage-backed securities (MBS).

Kiyosaki also explained that he supports assets such as gold, silver and BTC because they operate outside the traditional financial system, making them less vulnerable to Fed and Treasury intervention. He also noted that the average person may not fully understand the implications of the actions of the aforementioned institutions.

According to Kiyosaki, “anyone who invests in gold, silver or Bitcoin is essentially rebelling against the system. Bitcoin and Ethereum (ETH), being open source, cannot be manipulated by the Fed, Treasury or politicians.”

He also stressed that these assets should be viewed not only as investments, but as insurance policies. Kiyosaki argues that the Fed and Treasury are engaging in reckless money printing, even buying substandard bonds, which could lead to unprecedented levels of monetary expansion.

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Robinhood Launches Ethereum and Solana Staking for U.S. Users

11.07.2025 14:30 2 min. read

4 Key Developments That Could Shake the Crypto Market This Week

The final week of July is shaping up to be a pivotal one for global markets, with multiple high-impact U.S. economic events lined up that could trigger volatility across stocks, bonds, and crypto assets.

Why Most Americans Still Avoid Crypto Despite Growing Adoption

Cryptocurrency ownership in the U.S. has grown steadily over the past few years, but it remains far from widespread.

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Robinhood Launches Ethereum and Solana Staking for U.S. Users

11.07.2025 14:30 2 min. read