Bitcoin ETFs Record Positive Inflows – What’s Happening With Ethereum ETFs?

09.08.2024 10:22 1 min. read Kosta Gushterov

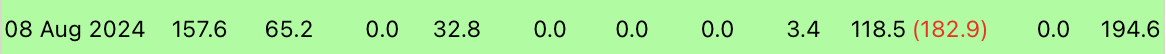

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. recorded net inflows of $194.6 million on Tuesday, reversing Monday's outflows.

According to Farside, BlackRock’s IBIT led the positive results with $157.6 million raised, followed by Wisdomtree’s BTCW with $118.5 million and Fidelity’s FBTC with $65.2 million.

The ARK 21Shares Bitcoin ETF (ARKB) also saw inflows of $32.8 million.

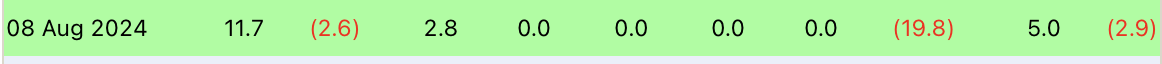

On the other hand, spot Ethereum ETFs saw slight outflows, with total outflows amounting to $2.9 million.

The largest inflow was recorded by BlackRock’s ETHA, which saw $11.7 million, while the largest outflow was recorded by Grayscale’s ETHE at $19.8 million.

Grayscale’s mini trust (ETH) posted the second-best results of the day, attracting $5 million, followed by Bitwise’s ETHW with $2.8 million.

Grayscale’s ETHE, on the other hand, experienced the weakest outflow since its inception, with only $39.7 million leaving the fund, a significant decrease from the $484 million it registered at launch.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read