Metaplanet Shares Skyrocket After Bitcoin Purchase Announcement

09.08.2024 11:00 1 min. read Kosta Gushterov

An investment company plans to obtain a 1 billion yen loan, equivalent to $6.8 million, to bolster its Bitcoin holdings, according to an August 8 announcement.

Earlier this week, Metaplanet announced its intention to raise 10.08 billion yen (approximately $70 million) by issuing an 11th series of rights to all common shareholders.

This offering allows shareholders to purchase one stock acquisition right per common share, with an option to purchase shares at a price of 555 yen (approximately $4) between September 6 and October 15.

The company believes these acquisitions are critical to its long-term strategy.

They stated:

Our primary policy is to hold Bitcoin for the long term; however, if Bitcoin is used in operations, the applicable Bitcoin balance will be classified as a current asset on the balance sheet.

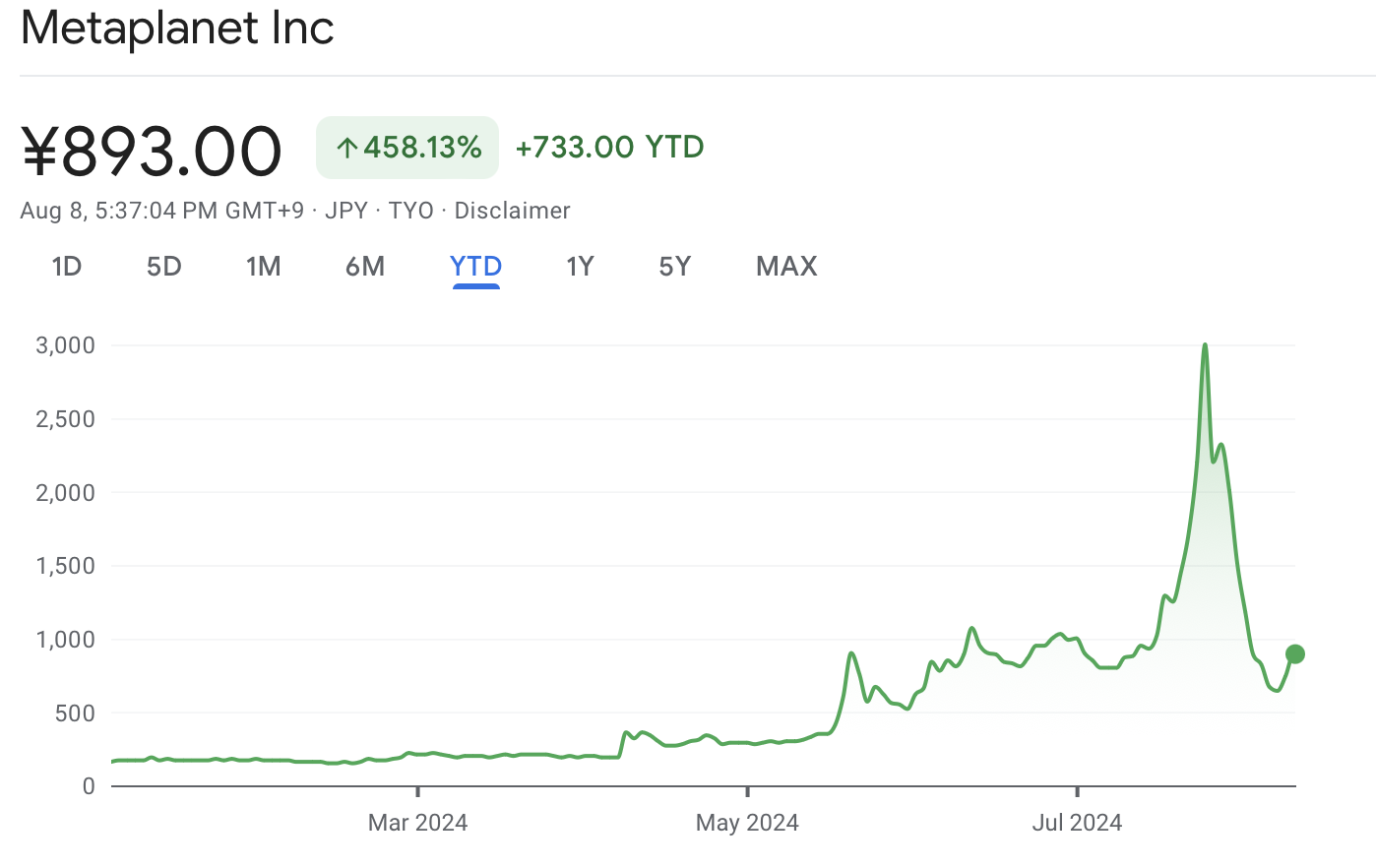

This news reportedly boosted the company’s share price by over 20%, reaching 893 yen at the time of writing.

This is a continuation of the upward trend seen since the company shifted its focus to Bitcoin, with its shares up more than 458.13% since the beginning of the year.

As for the loan, Metaplanet plans to borrow the funds at an annual interest rate of 0.1% for six months.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read