Binance’s Latest Tokens Tank: What’s Behind the Massive Losses?

08.08.2024 9:00 1 min. read Alexander Stefanov

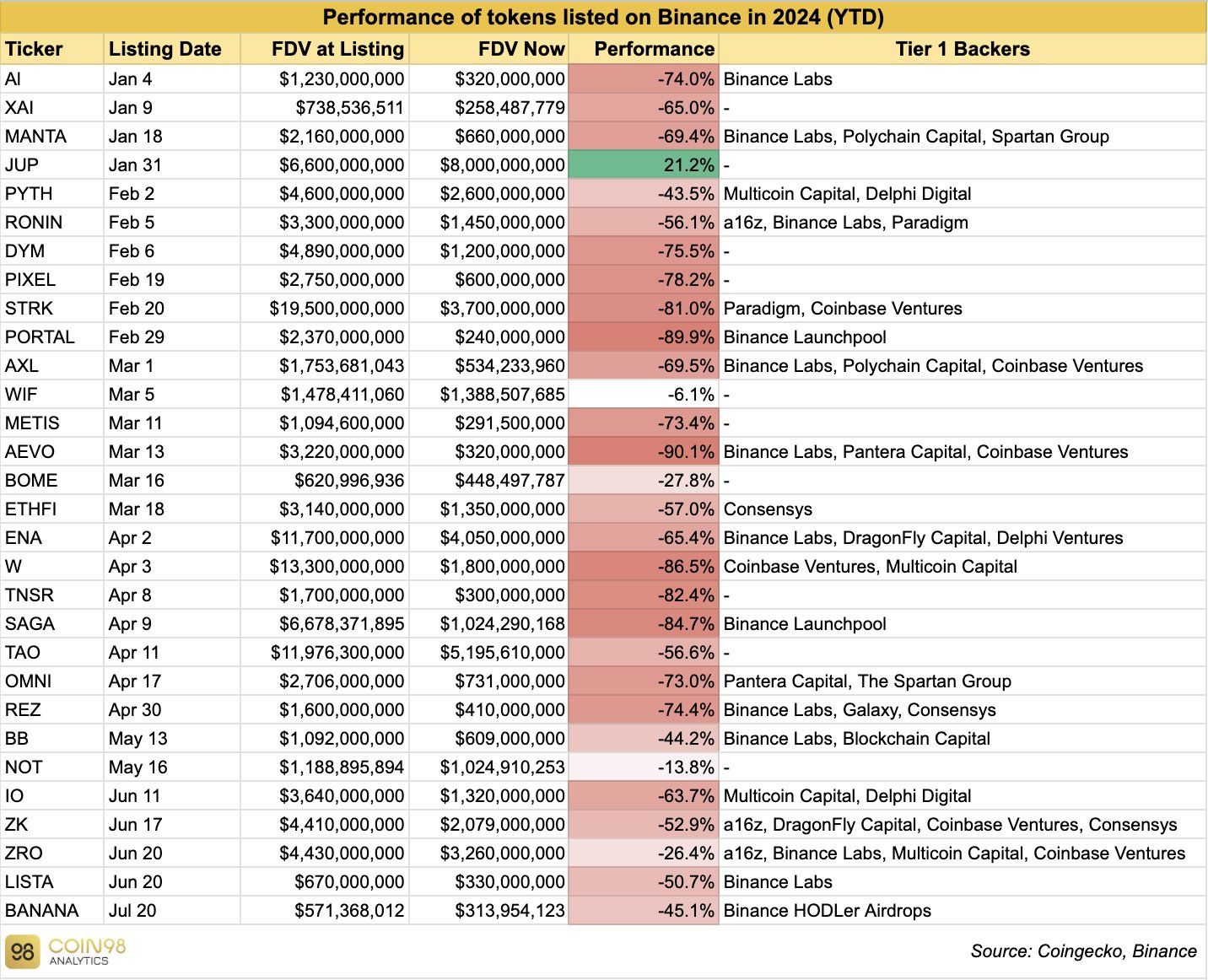

In 2024, Binance has added 30 new tokens to its platform, but the results have been largely underwhelming.

Data from Coin98 Analytics indicates that only Jupiter (JUP) has seen positive gains among these new listings. Most tokens have suffered significant declines, especially those supported by major venture capital firms like Binance Labs. For instance, tokens associated with Binance Labs have experienced drops ranging from 44% to 90%.

Vinay, a Web3 developer, points out that despite the overall market slump, some of Binance’s new projects have managed to stay stable.

He suggests that the broader market conditions rather than the projects themselves might be influencing these outcomes.

A recent study by Flow revealed that investing equally in all new Binance tokens would have resulted in an 18% loss over the past six months. Additionally, research by Haseeb Qureshi from Dragonfly points to the dominance of venture capitalists in these projects as a possible reason for the recent downturn, suggesting that retail investors have exited upon realizing the heavy VC ownership.

Overall, while Binance remains a prominent venue for launching new tokens, the mixed performance of these listings highlights the volatility and challenges within the cryptocurrency market.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

Cryptocurrency analytics firm MakroVision has shared its technical assessment of Chainlink (LINK) price action.

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

Whales Buy the Dip as Retail Panics: This Week in Crypto

The latest market turbulence, fueled by geopolitical tensions and investor fear, offered a textbook case of how sentiment swings and whale behavior shape crypto price action.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read