Here’s How U.S. Crypto ETFs Performed on Aug. 6 After The Market Crash.

07.08.2024 11:13 1 min. read Kosta Gushterov

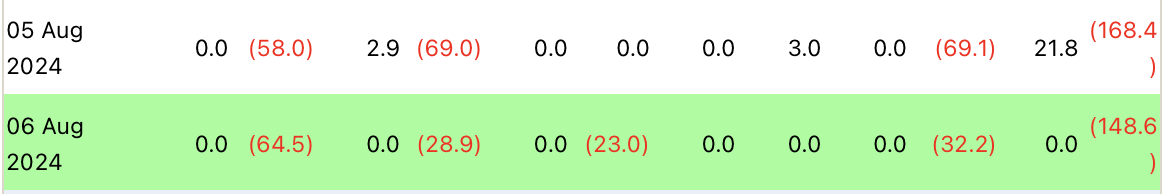

Spot Bitcoin exchange-traded funds in the U.S. recorded net outflows of $148.5 million on Tuesday, continuing Monday's outflows.

According to Farside, Fidelity’s FBTC led the outflows with $64.5 million, followed by Grayscale’s GBTC converted fund with $32.2 million and Ark Invest and 21Shares’ ARKB with $28.9 million.

Franklin Templeton’s Bitcoin fund (EZBC) also declined, losing $23 million.

Interestingly, BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, reported zero flows on Tuesday, along with seven other funds.

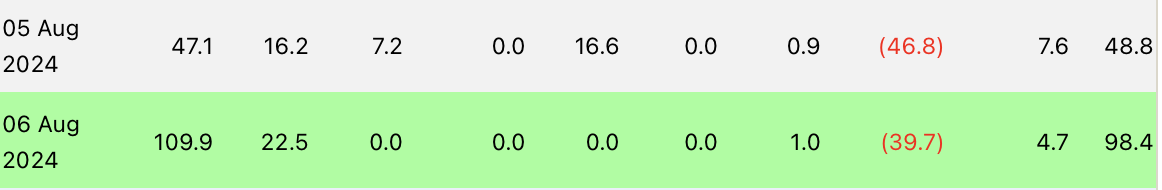

On the other hand, spot Ethereum ETFs saw net inflows on Tuesday, totaling a positive $98.4 million, continuing Monday’s positive results when just under $49 million was raised.

The largest inflow was recorded by BlackRock’s ETHA, which notched $109.9 million. Fidelity’s FETH had inflows of $22.5 million, Grayscale’s minifund (ETH) attracted $4.7 million, and Franklin Templeton’s saw $1 million in inflows.

Grayscale’s ETHE, on the other hand, experienced the weakest outflows since its inception, with just $39.7 million leaving, well down on the $484 million it recorded at launch.

-

1

Ethereum Whale Exits with $2M Loss Despite Market Surge

19.05.2025 11:00 2 min. read -

2

Shiba Inu Struggles to Maintain Momentum as Whale Interest Fades

19.05.2025 12:00 1 min. read -

3

Solana Price Prediction: Can Meme Coins like FARTCOIN Push SOL Back to $200?

23.05.2025 23:08 3 min. read -

4

Solana’s Gains May Be Deceiving, Warns Market Strategist

19.05.2025 13:00 2 min. read -

5

Crypto Markets Heat Up as Bitcoin Tests All-Time High — But Altcoins Remain in Waiting Mode

21.05.2025 16:00 2 min. read

XRP Price Prediction: XRP Nears Key Support That Could Push it Back to $2.65

XRP (XRP) has dropped by 2.4% in the past 24 hours as a much-needed pullback continues to unfold The token currently sits at $2.20 but trading volumes have dropped by 19% in the past 24 hours, meaning that the selling pressure has eased. Crypto liquidations have surged to $230 million in the past 24 hours […]

Ethereum Faces Uphill Battle Despite Optimism from Analysts

While Bitcoin has already set fresh all-time highs, Ethereum continues to lag behind its peak, leaving many investors wondering when the top altcoin will catch up.

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

Rumors are heating up around Solana-based memecoin platform Pump.fun, which is said to be prepping a $1 billion token sale at a $4 billion valuation—though the team has yet to confirm any details publicly.

Truth Social Seeks to Launch Spot Bitcoin ETF via NYSE Arca

Trump Media & Technology Group (TMTG) is making a bold move into the crypto investment space by backing a new spot Bitcoin ETF.

-

1

Ethereum Whale Exits with $2M Loss Despite Market Surge

19.05.2025 11:00 2 min. read -

2

Shiba Inu Struggles to Maintain Momentum as Whale Interest Fades

19.05.2025 12:00 1 min. read -

3

Solana Price Prediction: Can Meme Coins like FARTCOIN Push SOL Back to $200?

23.05.2025 23:08 3 min. read -

4

Solana’s Gains May Be Deceiving, Warns Market Strategist

19.05.2025 13:00 2 min. read -

5

Crypto Markets Heat Up as Bitcoin Tests All-Time High — But Altcoins Remain in Waiting Mode

21.05.2025 16:00 2 min. read