Bitcoin Dropped Below $60,000 Again – What Could be the Reason?

04.08.2024 18:39 1 min. read Alexander Stefanov

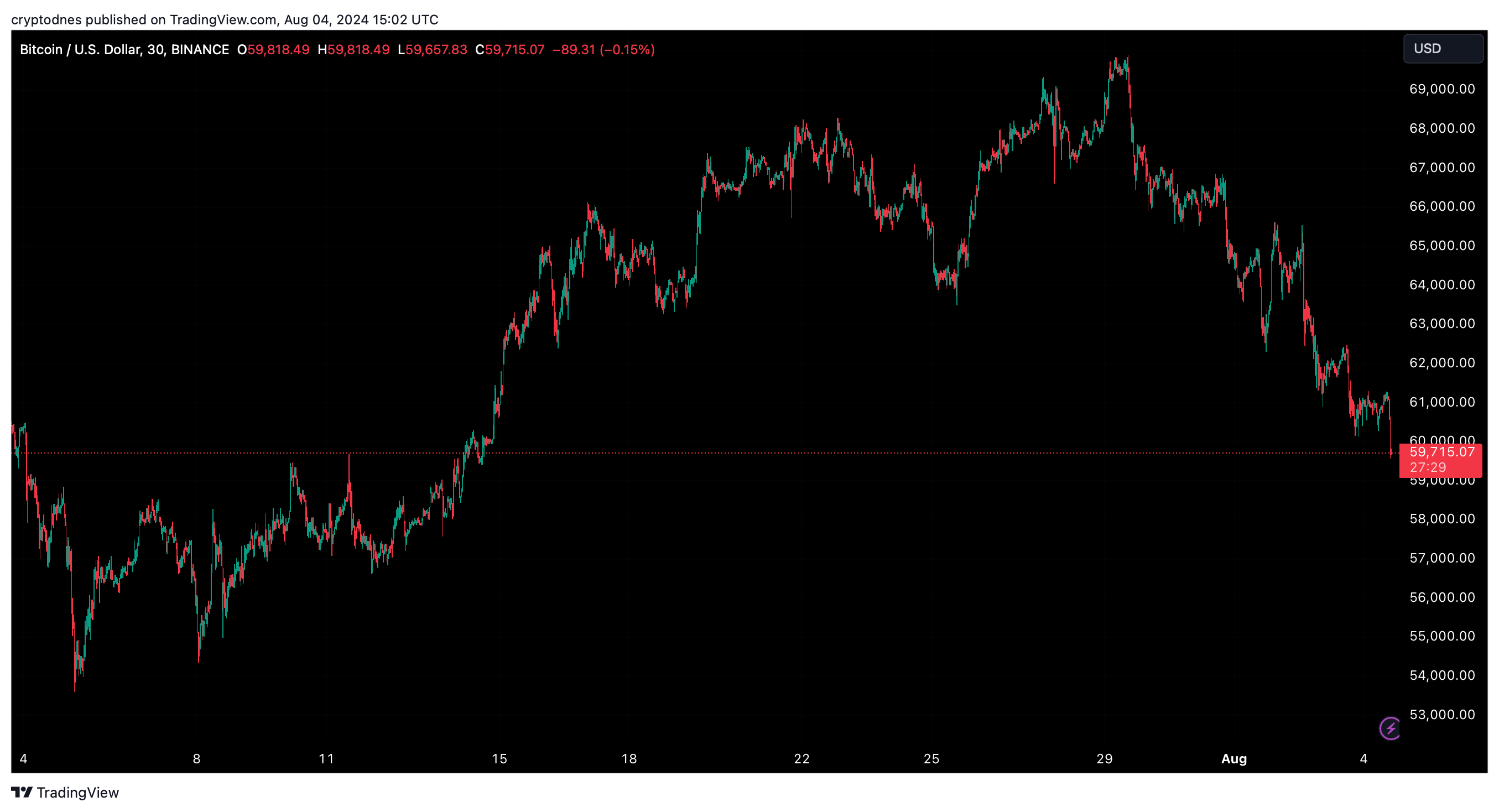

Bitcoin (BTC) saw a significant drop over the weekend, with the token price trying to get back above $60,000.

According to “RLinda,” a crypto trading expert at TradingView, this decline is part of a broader consolidation phase lasting five months.

Bitcoin‘ s losses over the weekend can be attributed to a combination of economic data, market sentiment, significant ETF outflows and the failure to overcome the critical $70,000 resistance level

Macroeconomic indicators played a crucial role in the price decline. The U.S. nonfarm payrolls report released on August 2 showed an increase in unemployment from 4% to 4.3% and rising inflation, which created negative market sentiment. The weak jobs report heightened fears of a recession, leading to a sell-off in Bitcoin.

Additionally, Farside data reveals significant outflows from Bitcoin ETFs, with $237.4 million in outflows on August 2 and $80.4 million for the week.

Additionally, the bankruptcy restructuring of Genesis Trading and the distribution of $4 billion in assets may have contributed to the market’s decline, worsening market sentiment due to emerging concerns of a potential sell-off.

At the time of writing, Bitcoin is trading at $59,700, reflecting a decline of 4% in the last 24 hours and over 11% in the last 7 days

.

.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read