Crypto Market on Edge: Warning Signs of an Imminent Collapse

04.08.2024 10:00 1 min. read Alexander Stefanov

Henrik Zeberg, a well-known trader and analyst who runs The Zeberg Report, has reiterated his prediction of a major economic downturn, the worst since the 1929 Great Depression.

He has revised his timeline for this forecast, suggesting that the downturn could begin this October. Zeberg believes that the cryptocurrency market, along with some small-cap assets, will peak this October, leading to widespread market excitement.

Zeberg maintains that we are on the brink of a significant collapse in the Western economy, similar to the Great Depression. He expects some assets, including Bitcoin (BTC), to reach a “blow-off” top before this downturn begins. Based on Fibonacci analysis, he anticipates that Bitcoin could peak at around $120,000 in this cycle.

Zeberg has adjusted his predictions several times. Initially, he suggested watching for a market top by the end of 2023, then revised this to August 2024, and now expects it to occur by October.

His forecast is based on the Elliott wave theory, which outlines stock market phases and suggests that the end of the fifth phase could lead to a substantial decline, potentially reducing Bitcoin’s value by 60% to 80%.

-

1

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

2

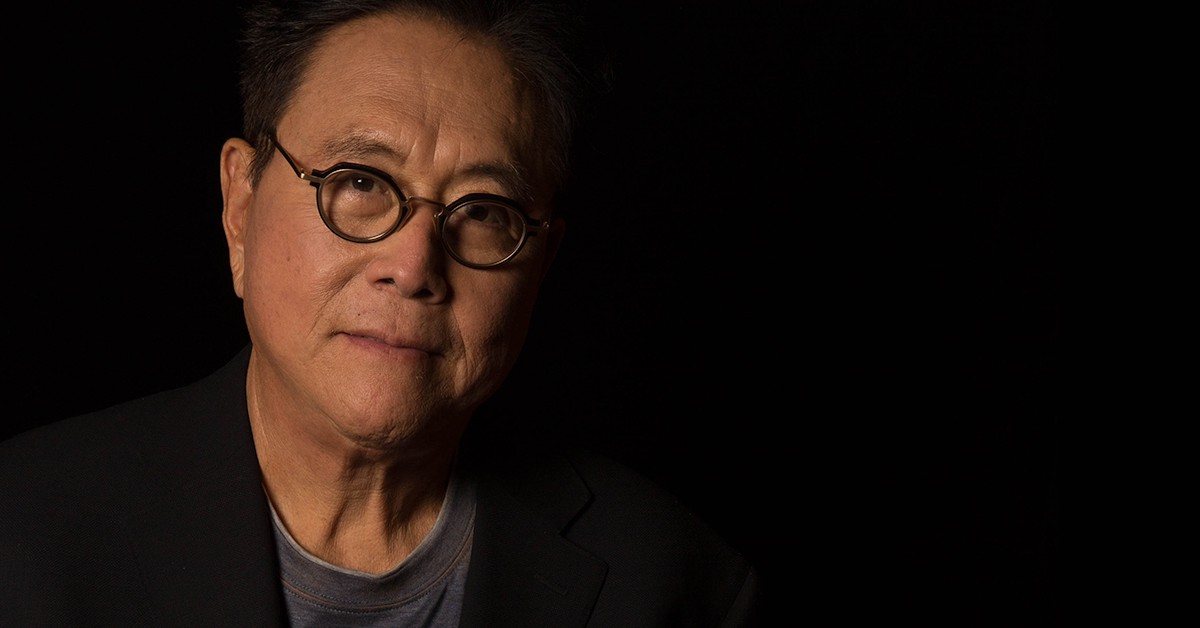

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

Whales Buy the Dip as Retail Panics: This Week in Crypto

The latest market turbulence, fueled by geopolitical tensions and investor fear, offered a textbook case of how sentiment swings and whale behavior shape crypto price action.

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

-

1

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

2

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read