Bitcoin’s Next Moves: Analyst Reveals Key Support and Resistance Levels

02.08.2024 18:00 1 min. read Alexander Stefanov

On August 1, Bitcoin (BTC) fell to below $63,000, marking its lowest level in more than two weeks.

This decline is related to lowered expectations of a US interest rate cut and the distribution of over 47,000 BTC from the defunct Mt. Gox exchange.

Traders are now watching key support and resistance levels to identify potential buying opportunities.

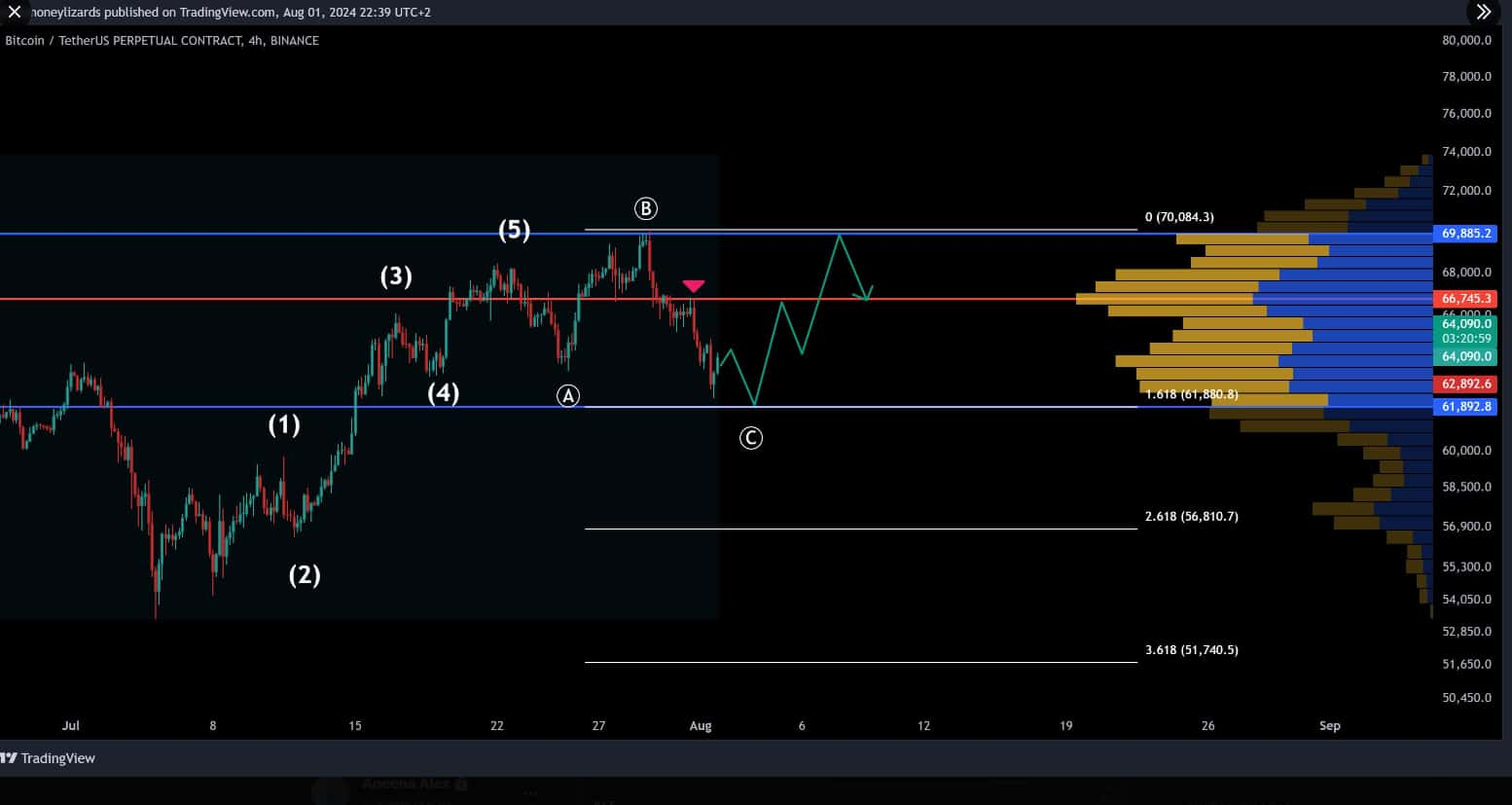

Analyst Stockmoney Lizards notes that Bitcoin is approaching a critical point, representing a potential entry point for investors. His technical analysis highlights a classic 5-wave uptrend, followed by an ABC retracement on the 4-hour chart, indicating a typical Elliott wave pattern.

Key Support and Resistance Zones

Support levels

The immediate buy zone is set between $61,880 and $62,300. A bounce from this range could signal a continuation of the uptrend. If this support fails, the next significant level to watch is around $56,810.

Resistance levels

On the upside, Bitcoin faces resistance at $66,745. A break above this level, on strong trading volume, could indicate the next buying opportunity. The top of the value zone at $69,885 also remains a key resistance point.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read