Decrease in Crypto Correlations Highlights New Market Trends, Says Report

01.08.2024 16:40 1 min. read Alexander Stefanov

A significant shift in cryptocurrency market dynamics has emerged, according to a recent report.

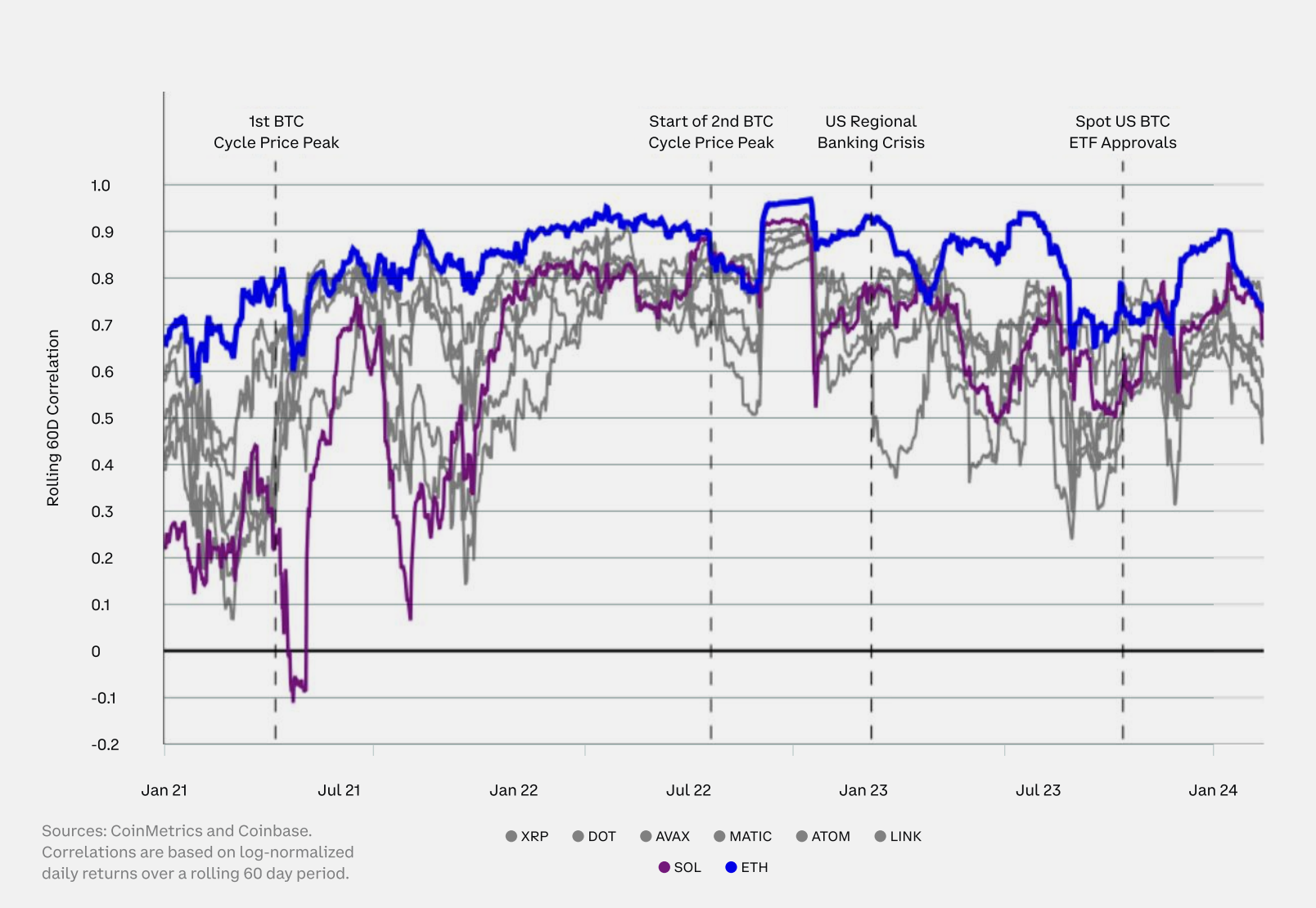

A notable trend observed in the second quarter is the decrease in correlations among various crypto assets, with coefficients now ranging from 0.7 for Ethereum to below 0.5 for some altcoins.

This trend suggests that diversifying into cryptocurrencies could be an effective strategy for portfolio management, according to David Duong, Head of Institutional Research at Coinbase.

Interestingly, this decline in correlations is distinct from past patterns, as it was not preceded by a rise in Bitcoin’s price.

This shift may be attributed to the increasing acceptance of cryptocurrencies, which has enhanced the understanding of differences among various tokens.

The introduction of spot Ethereum ETFs in the US might have also contributed to this trend, though historically, major Ethereum events such as the Merge or Shapella upgrades have led to only brief periods of decreased correlation.

The current six-week trend of reduced correlation highlights that the crypto market is likely still in a growth phase, with interest spread across different assets.

Looking ahead, greater regulatory clarity and growing institutional investment could further decrease correlations among cryptocurrencies over time.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

Crypto Analyst Sees HYPE Cooling After Explosive Run, Eyes New Entry

Crypto analyst Altcoin Sherpa has weighed in on $HYPE’s recent price action, suggesting that the token may have completed the majority of its current bullish leg.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read