Global Crypto Trading Set to Explode in 2024

01.08.2024 9:30 2 min. read Alexander Stefanov

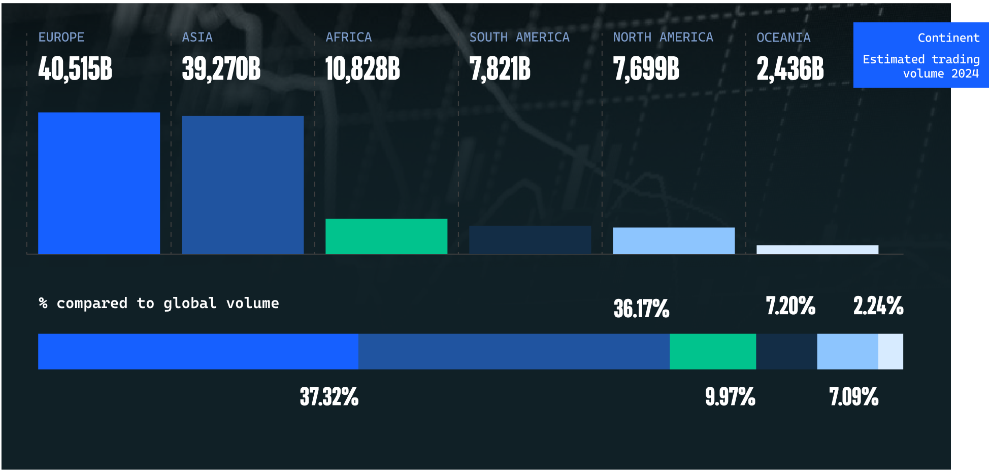

In 2024, global cryptocurrency trading is set to reach over $108 trillion, a dramatic increase of nearly 90% from 2022, according to Coinwire.

The U.S. is expected to lead this surge, with trading volumes projected to exceed $2 trillion.

Crypto trading volumes have grown 42% since 2023, reflecting a broader market expansion of 89% over the past three years. This growth underscores a worldwide rise in the adoption of digital assets.

Europe is the largest player in crypto trading, responsible for 37.32% of the global transaction value, with Russia and the UK leading in volume. Turkey and India are significant contributors, each surpassing $1 trillion in trading activity.

Asia ranks second in global crypto transaction value, holding 36.17% of the market. The region’s growth is driven by high mobile usage and strong technological infrastructure.

Binance remains the top crypto exchange, leading in 100 of 136 countries with a trading volume of $2.77 trillion. Other major exchanges include OKX and CEX.IO, with volumes of $759 billion and $1.83 billion, respectively. Coinbase and Bybit also have substantial volumes, trading in 90 and 87 countries.

Despite recent market turbulence, including the collapse of FTX and regulatory hurdles, centralized exchanges drove $36 trillion in trading last year, spurred by optimism around U.S. Bitcoin ETFs. The latest data also shows stablecoins surpassing Visa’s monthly transaction average, highlighting their growing influence in the financial landscape.

-

1

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

2

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

3

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

4

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

5

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

Whales Buy the Dip as Retail Panics: This Week in Crypto

The latest market turbulence, fueled by geopolitical tensions and investor fear, offered a textbook case of how sentiment swings and whale behavior shape crypto price action.

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

-

1

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

2

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

3

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

4

Why Gold Could Be the Smart Play Amidst US Debt Surge

11.06.2025 11:00 1 min. read -

5

Warren Buffett Narrows His Bets as He Prepares to Step Down

14.06.2025 16:00 2 min. read