XRP Registers Gains Despite Negative Crypto Market Results

31.07.2024 10:39 1 min. read Kosta Gushterov

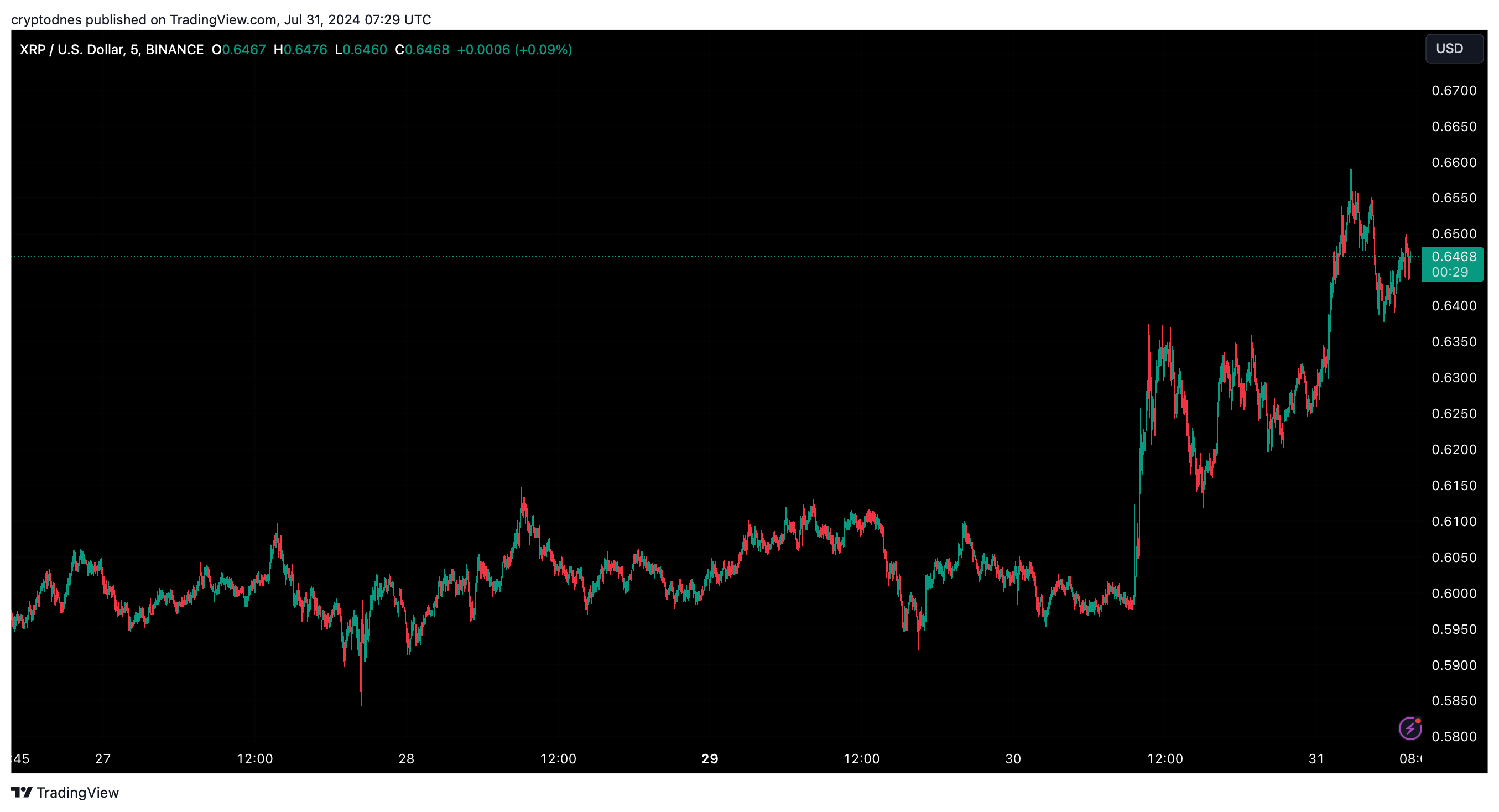

After a fairly long period of trading in a relatively narrow range, XRP appears to be defying the mostly negative results of the broader crypto market by registering gains over the past day.

XRP has appreciated by just over 8% in the last 24 hours, reaching around $0.646 at the time of writing, the highest since March 25, fueled by optimism surrounding the potential settlement of the SEC’s lawsuit against Ripple and the planned unlocking of tokens.

Traders are interpreting the recent SEC filing, which hints at an amendment to the complaint against Binance without naming tokens, as a positive sign for the resolution of the case against Ripple.

This spurs bullish sentiment despite Ripple’s planned unlocking of 1 billion XRP.

This market optimism comes despite the logical expectation that an increase in token supply will lead to a drop in prices. However, research suggests that the additional liquidity from unlocking the tokens may actually support the bullish trend.

In contrast to XRP’s performance, the crypto sector’s market cap has lost just over 0.4% in the past 24 hours. Bitcoin (BTC) and Ethereum (ETH) also registered losses of 0.9% and 0.6% respectively over the same time period.

-

1

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

2

Coinbase Expands 24/7 Futures to Solana, XRP, and Cardano Amid Rising Altcoin Demand

02.06.2025 11:00 2 min. read -

3

Ethereum Begins Quiet Shift From Hype to Financial Backbone

09.06.2025 21:00 1 min. read -

4

Altcoins Losing Steam as Market Momentum Tilts Toward Bitcoin, Says Analyst

03.06.2025 20:00 1 min. read -

5

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

Sui (SUI) has gone up by 3% today as trading volumes shot up despite the overall uncertainty caused by the latest events in the Middle East. The market has started the week with a positive tone ahead of the upcoming meeting of the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve. The market’s […]

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

The altcoin market may be heading into a storm of activity, with technical patterns suggesting a potential shift in momentum.

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

Truth Social, Donald Trump’s social-media platform, has quietly lodged paperwork for a fund that would hold both Bitcoin and Ethereum—marking the first time a Trump-linked business has ventured into the U.S. crypto-ETF arena.

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

Pi Network’s coin clawed back to about $0.61 after a flash crash took it below $0.50 and even briefly to $0.40, unsettling holders already frustrated by months of silence from the core team.

-

1

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

2

Coinbase Expands 24/7 Futures to Solana, XRP, and Cardano Amid Rising Altcoin Demand

02.06.2025 11:00 2 min. read -

3

Ethereum Begins Quiet Shift From Hype to Financial Backbone

09.06.2025 21:00 1 min. read -

4

Altcoins Losing Steam as Market Momentum Tilts Toward Bitcoin, Says Analyst

03.06.2025 20:00 1 min. read -

5

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read