Here’s How Ethereum ETFs Performed in Their First Week

30.07.2024 11:22 1 min. read Kosta Gushterov

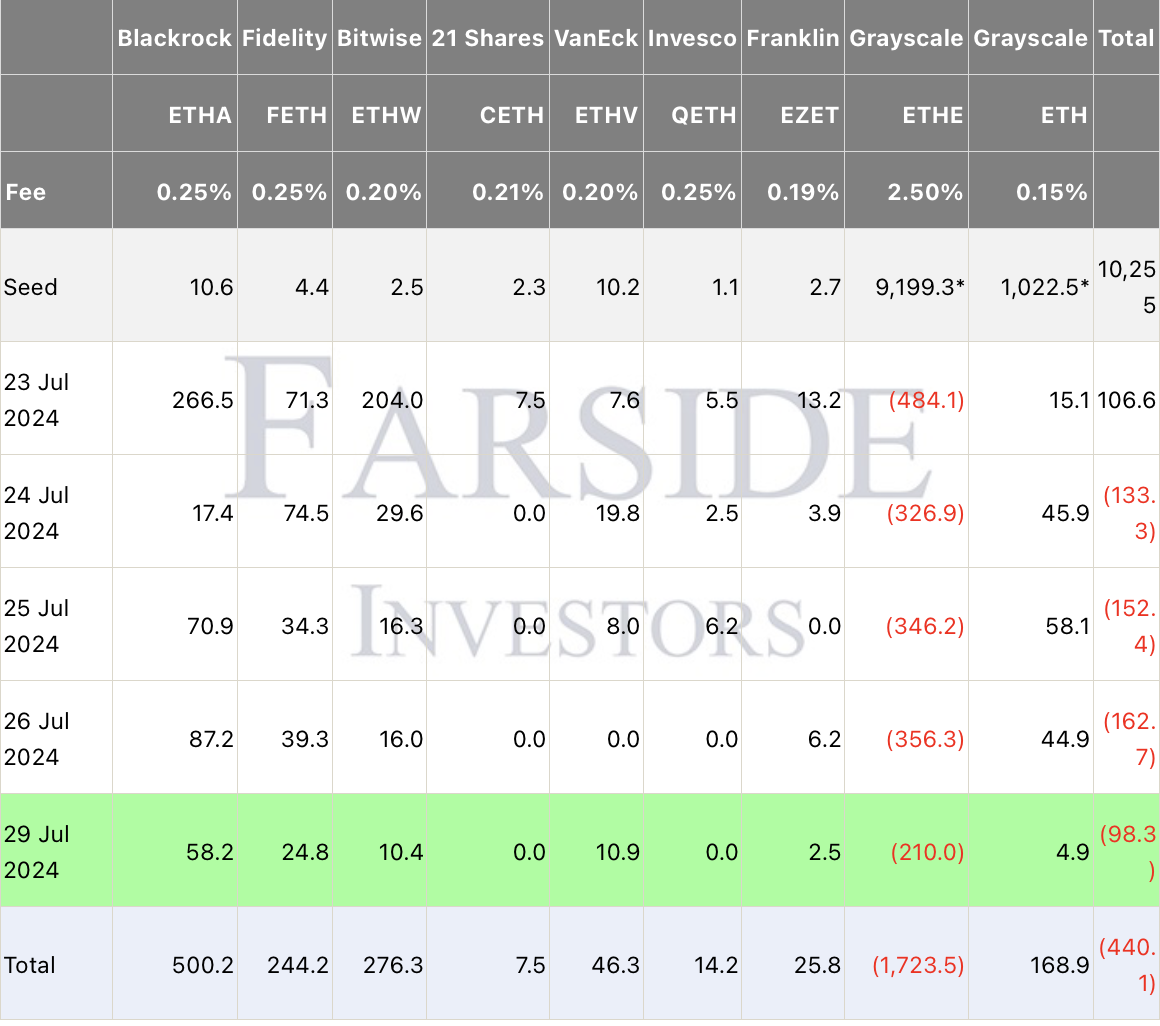

On July 29, U.S. ethereum ETFs saw net outflows of $983 million, the fourth consecutive day of negative results.

According to data from Farside, the Grayscale Ethereum Trust (ETHE) saw a significant one-day outflow of $210 million. In contrast, the Grayscale Ethereum Mini Trust (ETH) attracted inflows of $4.9 million.

On the other hand, BlackRock’s iShares Ethereum Trust (ETHA) saw inflows of $58.2 million, while Fidelity’s FETH garnered $24.8 million.

Overall, Ethereum ETFs saw outflows of $340 million in the first week of trading ending July 26. Adding in Monday’s outflows brings the total to $440.1 million.

This period was characterized by investor withdrawals from legacy high-fee products converted to exchange-traded funds.

The most significant inflows were into the BlackRock, Bitwise and Fidelity funds, which attracted $500.2 million, $276 million and $244 million, respectively, from launch through July 30.

In contrast, the Grayscale-created Ethereum Trust suffered outflows of $1.723 billion over the same time period.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read