Why is Bitcoin (BTC) Back to $67,000?

30.07.2024 10:57 1 min. read Kosta Gushterov

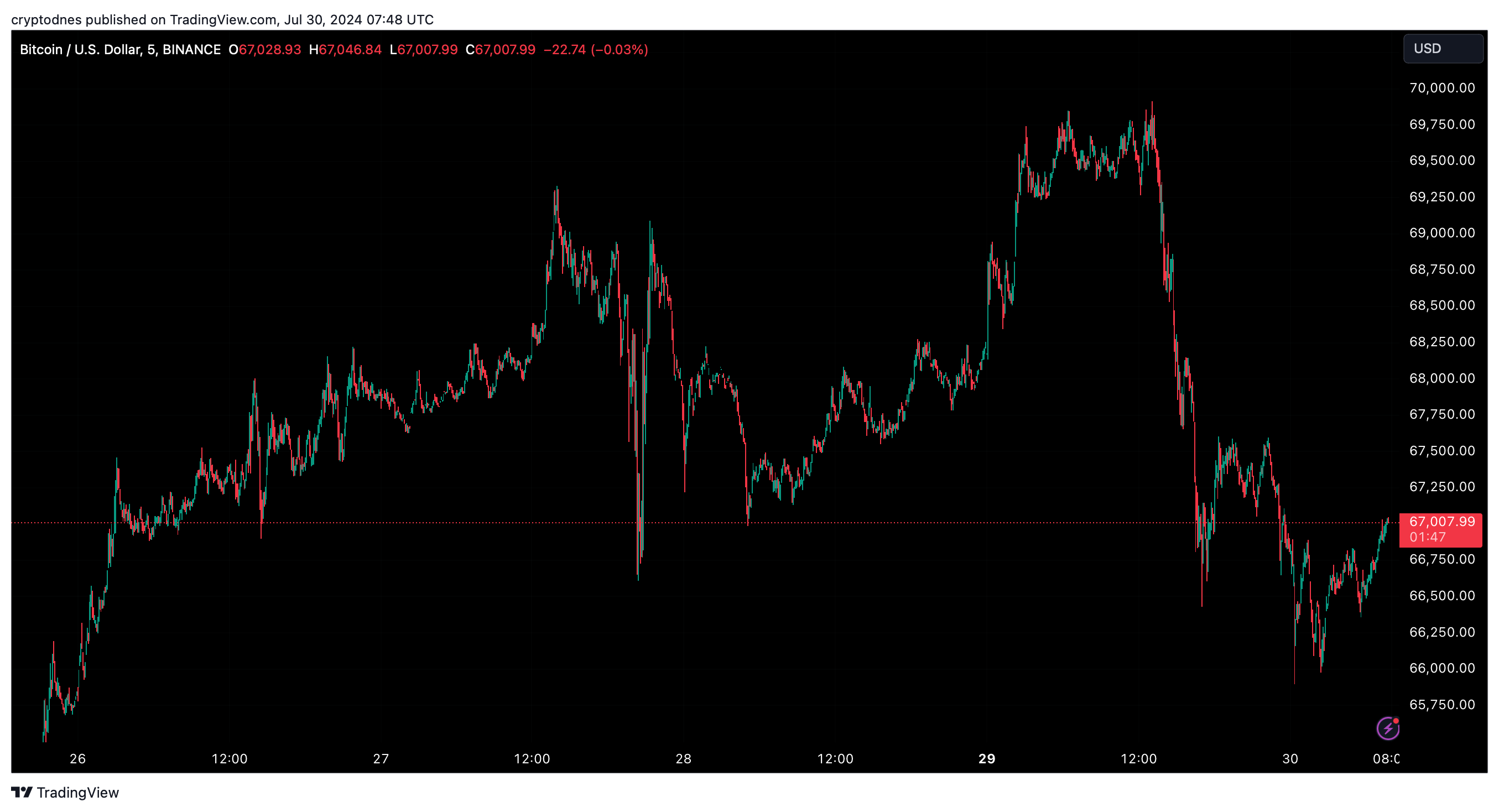

Bitcoin (BTC) headed toward the $66,000 mark early Tuesday, erasing last week's gains that reached the $70,000 mark.

Earlier in the morning, the cryptocurrency dropped to the $66,000 level, but then regained some of its losses. At the time of writing, Bitcoin is trading at $67,007, representing a 3.7% loss over the past 24 hours on trading volume of $39.5 million.

According to some crypto enthusiasts, these losses have occurred as market sentiment has deteriorated due to a large-scale movement of BTC from US government-linked portfolios.

The U.S. Marshals Service transferred $2 billion worth of Bitcoin into two new wallets, with the Arkham onchain movement tracking platform claiming that at least one of them was likely custodial, raising concerns about potential selling pressure among traders.

Other major cryptocurrencies also saw declines, mirroring the movement of the largest cryptocurrency. ADA fell 4.3 percent, DOGE and BNB each lost 3.1 percent and XRP declined 2 percent.

Despite these widespread losses, ETH showed relative resilience, falling just 0.7%.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

4

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read -

5

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

Oslo-based seabed-mining firm Green Minerals is shifting its treasury reserves from kroner and dollars into bitcoin, calling the move a hedge against inflation and geopolitical risk.

Crypto Funds Pull in $1.2B Despite Market Drop and Global Tensions

Global crypto funds just logged a tenth straight week of fresh capital, pulling in another $1.24 billion even as prices slid and geopolitics turned tense.

Anthony Pompliano Unveils Bitcoin Treasury Giant After Landmark Merger

Investor and entrepreneur Anthony Pompliano is rolling his private outfit, ProCap BTC LLC, into blank-check firm Columbus Circle Capital to form ProCap Financial, a new Nasdaq-listed business built around Bitcoin.

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

The tech-turned-Bitcoin play Strategy (formerly MicroStrategy) has quietly scooped up another batch of BTC, its eleventh consecutive weekly buy, undeterred by the market’s slide below $100,000.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

4

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read -

5

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read