Which Are The Best Performing Cryptocurrencies from Top 100 Today?

29.07.2024 15:05 2 min. read Kosta Gushterov

The recent market recovery has sparked optimism among cryptocurrency investors, with some altcoins registering significant gains.

Bitcoin Cash (BCH) recently broke out of the inverted “head and shoulders” pattern, a bullish technical formation that has caused its price to jump 15.3% in the last 24 hours.

As of July 29, BCH is trading at a price of approximately $454, which along with BSV makes it the best performing among the top 100 cryptocurrencies. This increase boosted its market capitalization to $8.973 billion,

Several key factors led to this recent price spike. One significant catalyst was Bitcoin and Bitcoin Cash’s recovery of the amounts of injured customers affected by the Mt. Gox hack in 2014.

This resolution of a long-standing issue has renewed interest in BCH. In addition, there was significant activity on the whales, with several large purchases reported.

Trading volume is also considered to be an important factor, with around $503.3 million recorded over the last day.

High trading volumes often correlate with strong price movements, supporting the bullish trend and confirming the strength of the price increase.

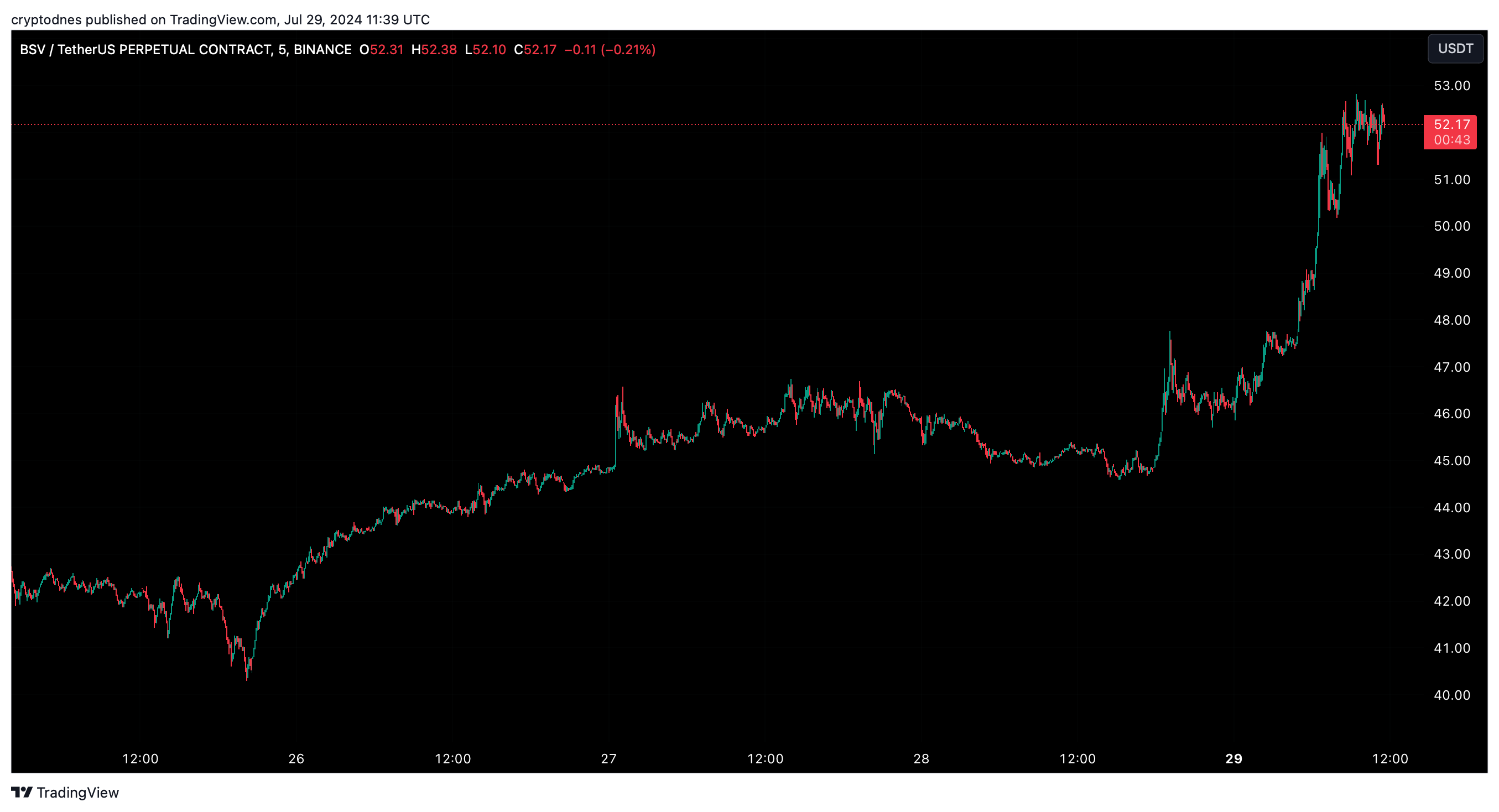

The other best performing asset today (July 29) is Bitcoin Cash’s hard fork, Bitcoin SV (BSV). Over the past 24 hours, BSV has surged just over 15.4% and recorded a trading volume of $68.53 million.

Attention is also focused on 2 cryptocurrencies with a smaller market capitalization, but with a larger intraday jump.

AIOZ Network (AIOZ), for example, gained 27% over the same time period, followed by meme cryptocurrency Book of Memes (BOME) with a 20% increase.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

A new CryptoQuant report highlights a growing divergence between long-term Ethereum holders and short-term Bitcoin buyers, with significant accumulation behavior unfolding in both markets amid increasing political and economic tension in the U.S.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

BNB Chain is set to upgrade the BNB Smart Chain (BSC) by cutting the block time in half, from 1.5 seconds down to 0.75 seconds.

-

1

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

4

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read -

5

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read