Bitcoin Price on the Road to Strong Recovery, Ethereum Still Lags Behind

27.07.2024 19:03 2 min. read Alexander Stefanov

The cryptocurrency market is showing signs of recovery as the total market cap surged by 1.41% today, reaching $2.44 trillion.

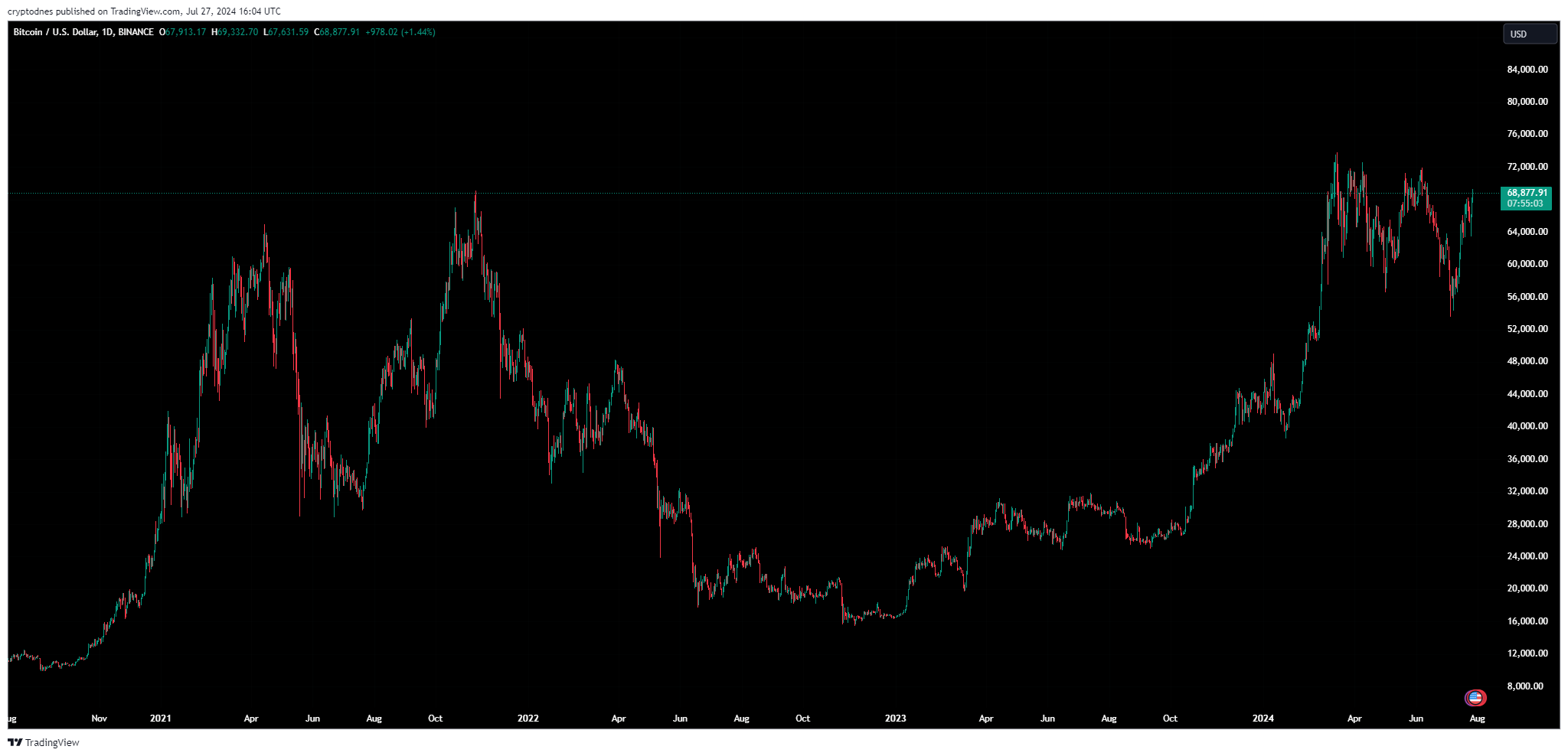

Bitcoin managed to briefly breach the $69,000 level, but retraced to its current price at $68,850.

Despite this retracement, BTC is still up 2.7% on the weekly chart and has 24-hour trading volume of around $23.2 billion.

In the past 24 hours $80.36 million were liquidated from the market ($25.95 million being longs and $54.4 million in shorts).

The 1-day technical analysis from TradingView remains extremely bullish with the summary and moving averages pointing to “strong buy” at 17 and 14, while oscillators show “buy” at 3.

Many altcoins followed suit, with the bigggest gainer for today being eCash, which surged 14.9% and has a trading volume over $100 million.,

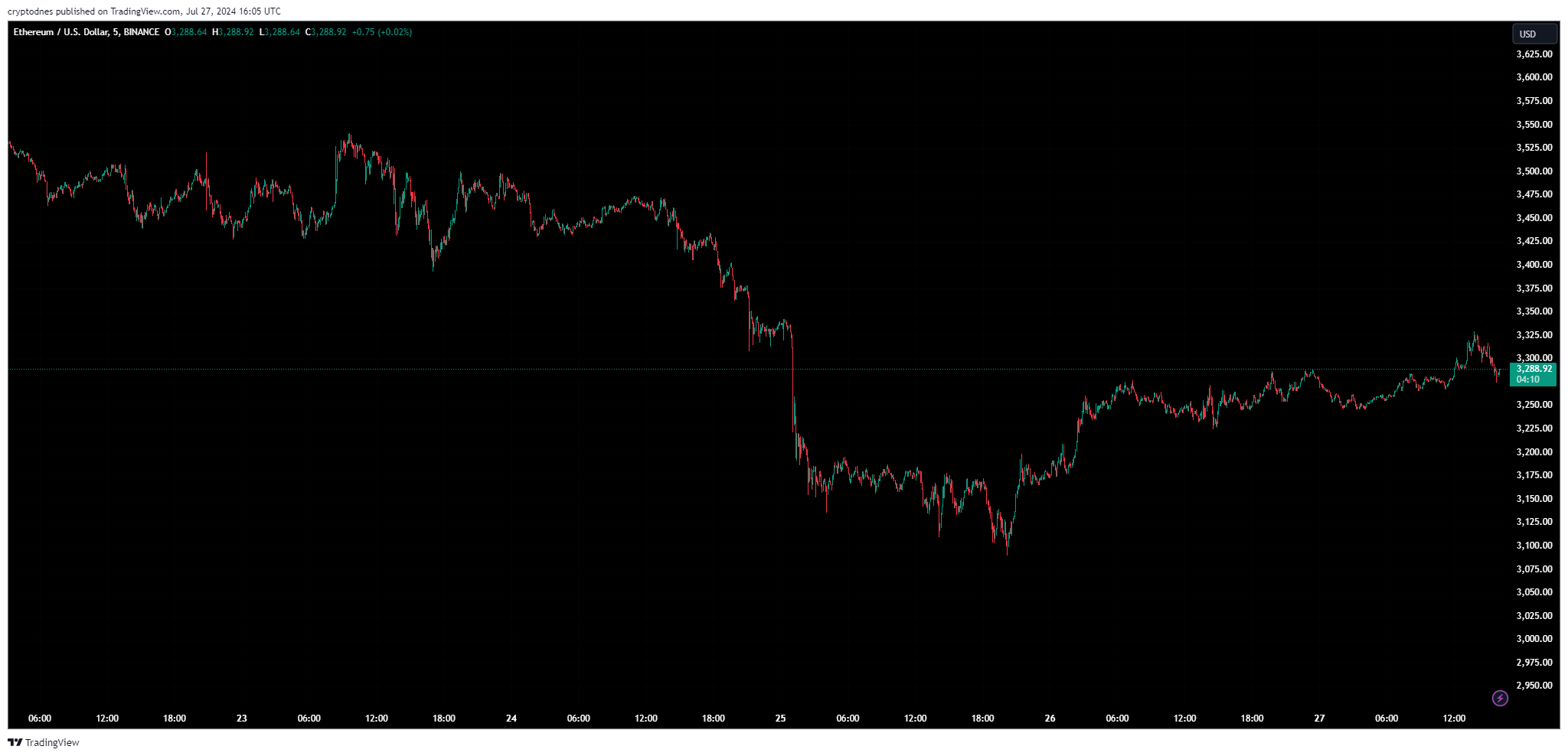

However, there is one altcoin that isn’t showing much bullishness during this surge and that is Ethereum.

Although Ethereum recently got the greenlit from SEC for spot ETFs, the prce of ETH seems to be lagging behind Bitcoin.

At the time of writing, Ethereum is valued at $3.274 with a 6.5% weekly decrease and $11.8 billion trading vokume.

Despite the positive start of spot ETH ETFs, these funds seem to be registering outflows in the past 2 days. Nevertheless, many analysts and crypto experts are optimistic about the ETFs’ future performance and the positive impact on the price of Ethereum.

However, Ethereum’s 1-day technical analysis from TradingView seems rather bearish. The summary and moving averages pont to “sell” at 11 and 10, respectively, while oscillators remain “neutral” at 9.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

3

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read