Ethereum ETFs Registered Negative Results on the Second Day of Trading – What is the Reason?

25.07.2024 9:11 1 min. read Kosta Gushterov

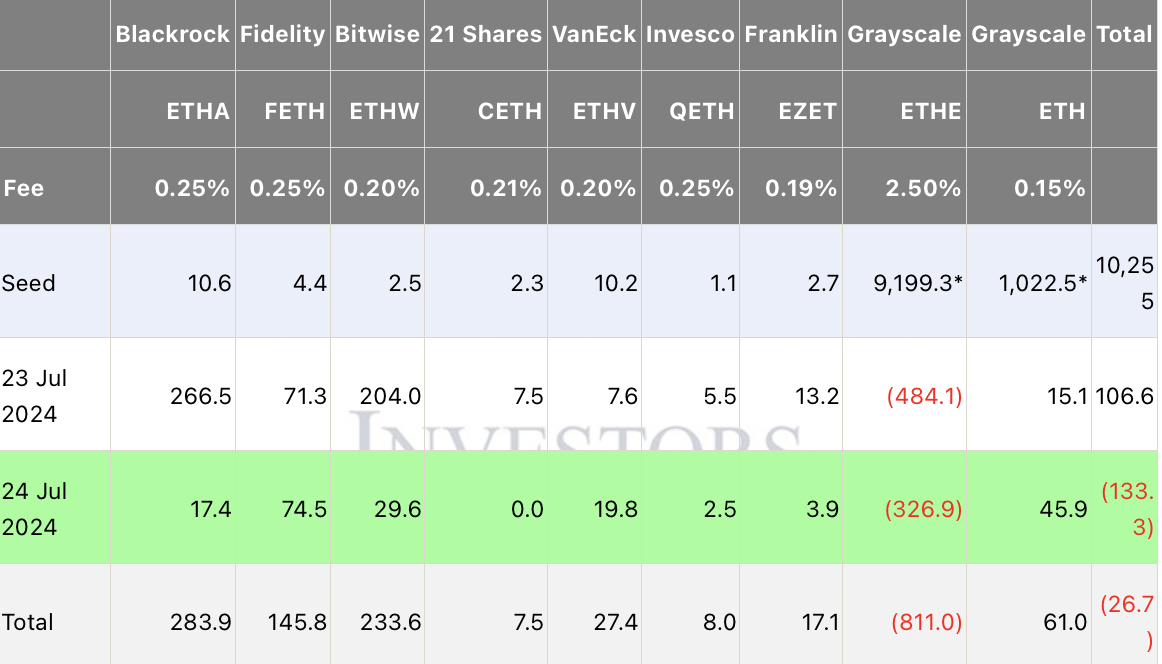

On its second day of trading, the US-based spot Ethereum ETFs performed worse than the first day as they registered a net outflow of $113.3 million.

Despite the negative results, out of the 8 newly launched ETFs, as many as 7 registered net inflows with Fidelity’s FETH and Bitwise’s BITW topping the inflows with $74.5 million and $29.6 million respectively. BlackRock’s ETHA attracted $17.4 million.

What accounts for the poor results?

The overall negative outflows were largely due to significant sales from the recently converted Grayscale Ethereum Trust (ETHE), which saw outflows of $326.9 million.

Grayscale’s ETHE, launched more than seven years ago, allowed institutional investors to buy ETH but imposed a six-month lock-in period on investments.

Since its conversion to a spot ETF, investors can sell their ETH more freely.

In the two days following its conversion, ETHE suffered outflows of $811 million, with existing investors selling just under 10% of the fund’s holdings.

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read

21Shares Files for ETF Tracking Ondo’s Real-World Asset Token

21Shares has submitted an application to launch an exchange-traded product (ETP) that tracks Ondo (ONDO), the native token of Ondo Finance.

BNB Hits New All-time High Above $803 Amid Altcoin Surge

BNB soared past $803, setting a new all-time high before pulling back slightly.

Altcoin Volume on Binance Hits Highest Level Since February

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

-

1

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

2

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read