Ethereum Losses 7% of its Value Overnight – Here is Why

25.07.2024 9:16 2 min. read Alexander Stefanov

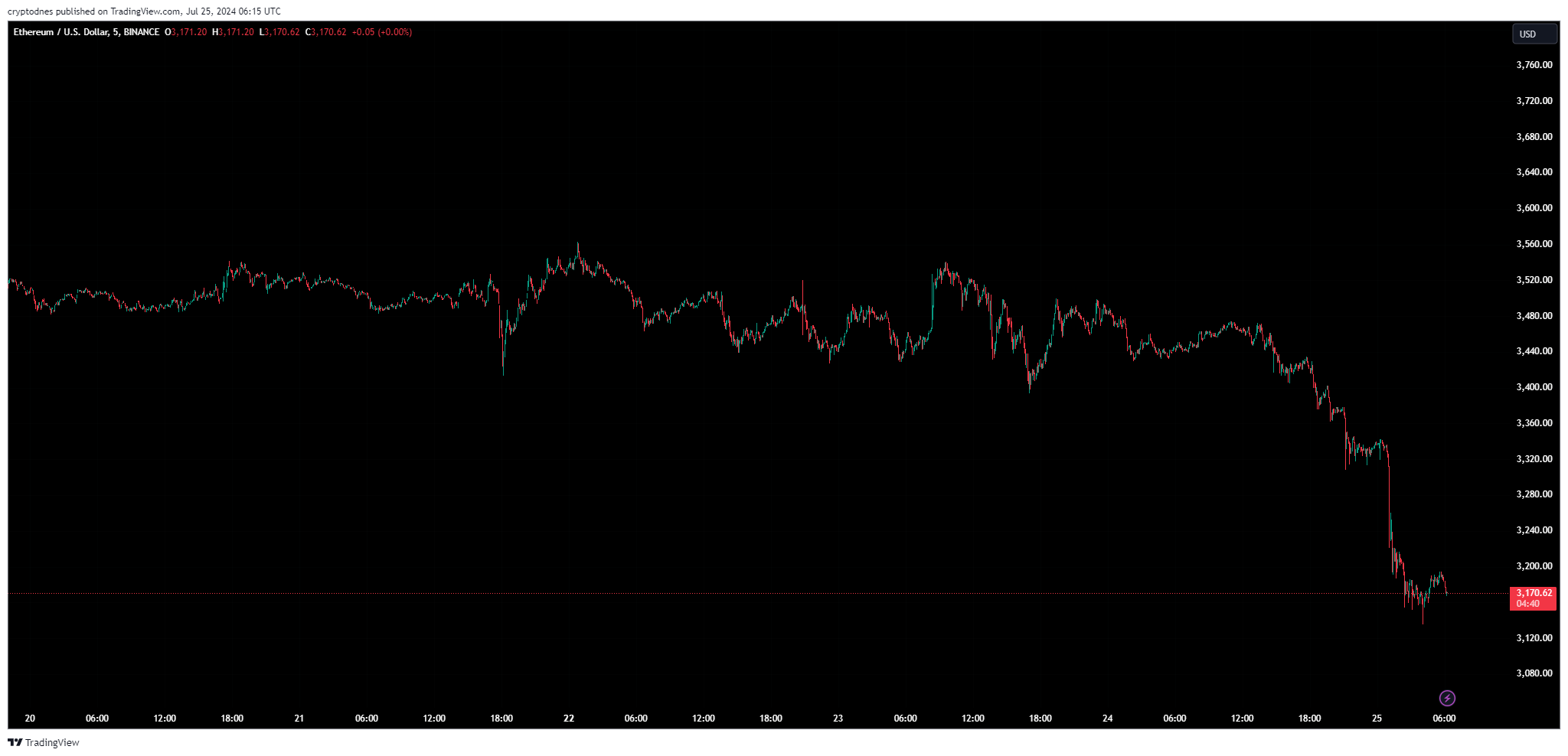

A day after the successful launch of the spot Ethereum ETF, the price of Ethereum has experienced a significant drop which triggered substantial liquidations of long ETH positions within the last 24 hours.

Data from Coinglass reveals that Ethereum liquidations have surpassed those of Bitcoin in the past 24 hours. Specifically, Ethereum liquidations have reached $100.85 million, compared to $83.35 million for Bitcoin.

The approval of the spot Ethereum ETF appears to have become a “sell-the-news” event, similar to what happened with Bitcoin earlier this year. After Ethereum’s price climbed to $3,500 in July, investors seem to be cashing in on the ETF-related excitement.

Additionally, on-chain data indicates that a significant Ethereum whale has been offloading its holdings. According to Spot on Chain, this whale made $173 million in profit by depositing 10,000 ETH, worth $34.2 million, on Kraken just before the price drop. This whale had withdrawn 96,639 ETH from Coinbase at $1,580 per ETH in September 2022. Since March, the whale has moved nearly 40,000 ETH to Kraken and still holds 56,639 ETH, valued at $188 million at the current price.

10xResearch has also pointed out that current distributions from Mt. Gox are putting pressure on the broader cryptocurrency market. They noted that if this trend continues, the crypto market will need more support to rally, with Ethereum possibly being the most vulnerable due to stagnant or declining fundamentals like new users and revenue.

Popular crypto analyst Michael van de Poppe suggests that Ethereum’s price might see a reversal amid significant outflows from the Grayscale Ethereum Trust. He predicts that Ethereum might experience a two-week downward trend before potentially rallying to new all-time highs. According to his analysis, Ethereum could find support around $3,150 before resuming its upward trajectory.

If the markets copy the price action of the #Bitcoin ETF, then it’s likely that we’ll have a slight sell-off due to the outflows of the Grayscale trust.

One-two weeks for downward momentum, before the real surge of Ethereum towards a new all-time high. pic.twitter.com/fmjE7z7We9

— Michaël van de Poppe (@CryptoMichNL) July 24, 2024

At the time of writing Ethereum is trading at $3,180 after a 7.4% decline in the past 24 hours and a $20.95 billion trading volume.

-

1

Here Are Four Altcoins That Could Collapse Soon, According to a Top Analyst

02.04.2025 11:00 2 min. read -

2

Blockchain Project Prepares 50 Million Token Airdrop Ahead of Mainnet Launch

02.04.2025 9:00 2 min. read -

3

Binance Introduces New Trading Pairs and Bot Services on Spot Platform

02.04.2025 20:00 1 min. read -

4

SEC Delays Decision on Grayscale’s Ethereum Staking ETF Proposal

15.04.2025 12:00 2 min. read -

5

Elon Musk’s Dogecoin Comments Stir Concern, But HODLers Keep Hope Alive

31.03.2025 15:00 2 min. read

New Proposal Aims to Resolve Solana’s Inflation Dispute

A fresh attempt to address Solana’s ongoing inflation debate is back on the table—this time with a restructured voting model designed to foster consensus and move the network toward its long-term economic goals.

Another Stablecoin Loses Its Peg, Sparking Fresh Investor Anxiety

Synthetix’s native stablecoin, sUSD, is once again under pressure as it continues to drift further from its intended $1 peg—raising fresh concerns over the resilience of decentralized stablecoins.

Bitcoin ETFs Rebound With $107M Inflows, Ethereum Sees No Movement

On April 17, 2025, U.S. spot Bitcoin ETFs experienced a significant uptick in inflows, while Ethereum ETFs saw no net movement, according to data from Farside Investors.

Top 5 Worst Performing Cryptocurrencies Today

Several cryptocurrencies among the top 100 by market cap have faced heavy losses over the past seven days, with a few tokens seeing sharp double-digit declines.

-

1

Here Are Four Altcoins That Could Collapse Soon, According to a Top Analyst

02.04.2025 11:00 2 min. read -

2

Blockchain Project Prepares 50 Million Token Airdrop Ahead of Mainnet Launch

02.04.2025 9:00 2 min. read -

3

Binance Introduces New Trading Pairs and Bot Services on Spot Platform

02.04.2025 20:00 1 min. read -

4

SEC Delays Decision on Grayscale’s Ethereum Staking ETF Proposal

15.04.2025 12:00 2 min. read -

5

Elon Musk’s Dogecoin Comments Stir Concern, But HODLers Keep Hope Alive

31.03.2025 15:00 2 min. read