Ethereum ETFs Registered Positive Flows on Their First Day

24.07.2024 10:17 1 min. read Kosta Gushterov

On its first day of trading, the U.S. spot Ethereum exchange traded funds (ETF) saw $1.08 billion in trading volume.

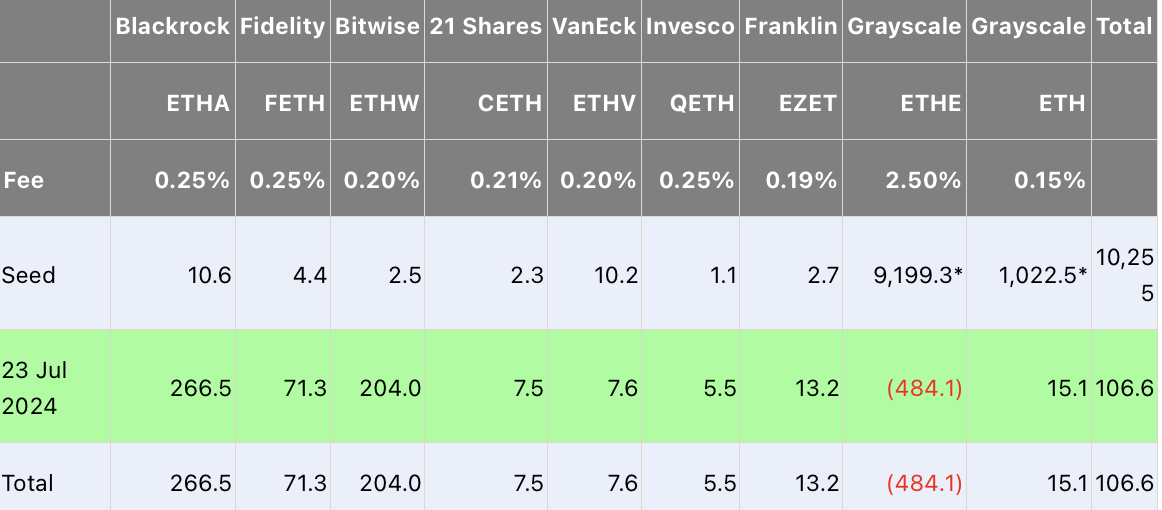

Net inflows to them equaled $106.6 million, despite significant withdrawals from Grayscale’s recently converted Ethereum Trust.

Leading the way was BlackRock’s iShares ETF (ETHA), which received $266.5 million in net inflows, while Bitwise’s ETHW attracted $204 million.

Fidelity’s FETH secured the third spot with a result of $71.3 million in inflows.

These inflows were substantial enough to offset the outflows recorded by Grayscale’s ETHE, which reached $484.9 million.

Grayscale’s Ethereum Mini Trust, a separate lower-fee product, attracted inflows of $15.2 million. Franklin Templeton’s ETF (EZET) reported $13.2 million and 21Shares’ Core Ethereum ETF (CETH) attracted $7.4 million.

Overall, on their first day of trading, the spot ETH funds achieved a cumulative trading volume of $1.08 billion, according to data provided by Bloomberg ETF analyst James Seyfarth, which is 23% of the volume that the spot Bitcoin ETFs recorded on their debut.

First day of the ETHness stakes done. The group’s volume was just shy of $1.1 billion. My *prediction* on flows for the day is anywhere from $125 million to $325 million but will depend on how many investors these firms had lined up. We’ll know some official flows in a few hours https://t.co/p6Wjty8VyY pic.twitter.com/1gYYrU1CW1

— James Seyffart (@JSeyff) July 23, 2024

-

1

Analyst Flags Altcoin Momentum Building Amid Market Quiet

12.05.2025 14:29 2 min. read -

2

XRP Rebounds Strongly as Legal Troubles Fade and Market Sentiment Lifts

14.05.2025 15:08 1 min. read -

3

SUI Price Prediction: Is $5 The Next Target for Solana’s Biggest Rival?

20.05.2025 22:53 3 min. read -

4

How This Crypto Trader Turned $9,000 Into Millions in a Month

17.05.2025 18:00 1 min. read -

5

XRP Prepares for Next Big Move as Technical Setup Strengthens

18.05.2025 17:00 2 min. read

Staking ETFs Aim to Bring Yield Generation to US Crypto Investors

Two asset managers are preparing to introduce a new class of cryptocurrency investment products that combine traditional exchange-traded fund (ETF) structures with staking income from Ethereum and Solana holdings.

Ethereum ETF Inflows Grow, But Price Impact Remains Muted

Institutional interest in Ethereum is clearly picking up—at least on paper. Spot Ethereum ETFs have seen nine straight days of net inflows, with BlackRock’s ETHA and Fidelity’s FETH leading the charge.

Ethereum Price Prediction: ETH Buy Signal Confirmed Despite Today’s Retreat

Ethereum (ETH) has gone down by 2.4% in the past 24 hours and currently sits at $2,580 in what has been mostly a red week for the crypto market. Trading volumes have retreated by 5% during this same period, indicating that the selling spree is not that strong at the moment. However, crypto liquidations have […]

Chinese Firm Unveils $300M XRP Reserve Plan Amid Crypto Ban

A China-based tech company is taking a bold step into the world of digital finance, despite the country’s strict stance on cryptocurrency.

-

1

Analyst Flags Altcoin Momentum Building Amid Market Quiet

12.05.2025 14:29 2 min. read -

2

XRP Rebounds Strongly as Legal Troubles Fade and Market Sentiment Lifts

14.05.2025 15:08 1 min. read -

3

SUI Price Prediction: Is $5 The Next Target for Solana’s Biggest Rival?

20.05.2025 22:53 3 min. read -

4

How This Crypto Trader Turned $9,000 Into Millions in a Month

17.05.2025 18:00 1 min. read -

5

XRP Prepares for Next Big Move as Technical Setup Strengthens

18.05.2025 17:00 2 min. read