Bitcoin ETFs Register Their Best Performance in 48 Days

23.07.2024 12:39 1 min. read Kosta Gushterov

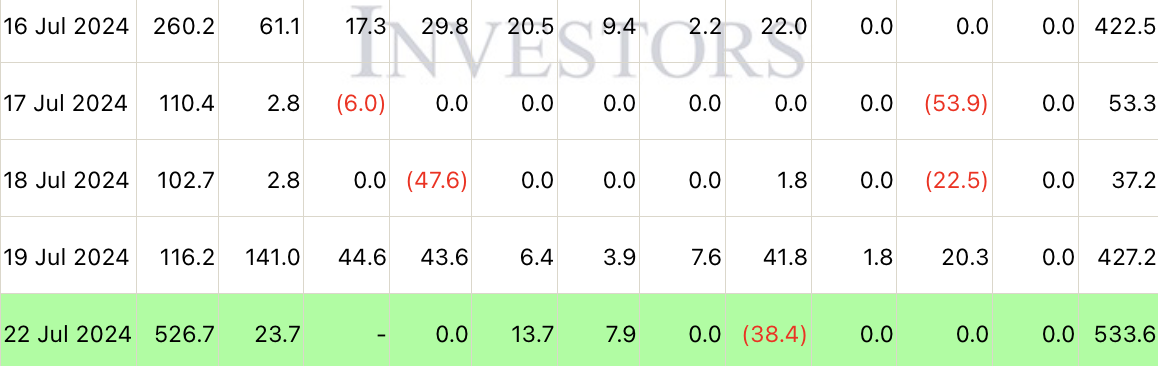

On Monday (July 22), US-based spot Bitcoin exchange traded products (ETFs) saw their highest inflows since June 4.

Farside reported that a total of $533.6 million flowed into spot BTC ETFs on Monday, marking the start of the third consecutive week in which these investment products have recorded positive inflows.

The majority of these inflows, amounting to $526.7 million, were attributable to BlackRock’s iShares Bitcoin Trust (IBIT).

Additionally, the Fidelity (FBTC), Invesco (BTCO) and Franklin Templeton (EZBC) funds saw inflows of $23.7 million, $13.7 million and $7.9 million, respectively.

Despite upbeat market sentiment, VanEck’s ETF (HODL) saw outflows of $38.4 million. Other products, including BTCW, ARK,BRRR, GBTC and DEFI, remained neutral.

-

1

Chinese-Linked Firm Quietly Embraces Bitcoin in Strategic Treasury Shift

17.05.2025 17:00 2 min. read -

2

Bitcoin Poised for Summer Surge if Support Holds Above $90K

18.05.2025 16:00 1 min. read -

3

Americans Want Bitcoin in U.S. Reserves, Survey Reveals Surprising Shift

20.05.2025 17:00 2 min. read -

4

Bitcoin Price Prediction From Galaxy Digital’s CEO

18.05.2025 9:00 2 min. read -

5

Bitcoin Hits New Historic Record Above $109,000, Pushing Market Cap Past $2.17 Trillion

21.05.2025 18:10 1 min. read

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

Bitcoin is treading water near $105,000, but pressure is building on both sides of the trade as macro forces tighten.

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

BlackRock is making another assertive move into digital assets, quietly expanding its crypto portfolio with sizable purchases of both Bitcoin and Ethereum.

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

In a move that signals changing tides in traditional finance, JPMorgan is preparing to accept Bitcoin ETF holdings as collateral for loans—starting with BlackRock’s iShares Bitcoin Trust, according to insiders familiar with the plan.

Bitcoin Gains Spotlight as U.S. Debt Hits Breaking Point

With U.S. debt now over $36 trillion and the August 2025 ceiling deadline approaching, fears of default are mounting.

-

1

Chinese-Linked Firm Quietly Embraces Bitcoin in Strategic Treasury Shift

17.05.2025 17:00 2 min. read -

2

Bitcoin Poised for Summer Surge if Support Holds Above $90K

18.05.2025 16:00 1 min. read -

3

Americans Want Bitcoin in U.S. Reserves, Survey Reveals Surprising Shift

20.05.2025 17:00 2 min. read -

4

Bitcoin Price Prediction From Galaxy Digital’s CEO

18.05.2025 9:00 2 min. read -

5

Bitcoin Hits New Historic Record Above $109,000, Pushing Market Cap Past $2.17 Trillion

21.05.2025 18:10 1 min. read