Dogecoin on the Brink of a Major Price Surge – What to Expect

15.07.2024 15:00 1 min. read Alexander Stefanov

Dogecoin's recent activity has drawn attention, particularly due to a significant decline in its active addresses, now standing at 40,000, a level last seen in March 2020.

This historical trend has previously preceded a major price surge for Dogecoin several months later, highlighting a potential pattern that could repeat around March or April 2025.

Currently trading at $0.1168, Dogecoin has seen a notable 60% increase over the past year, yet it remains considerably significantly below its all-time high (almost 85%).

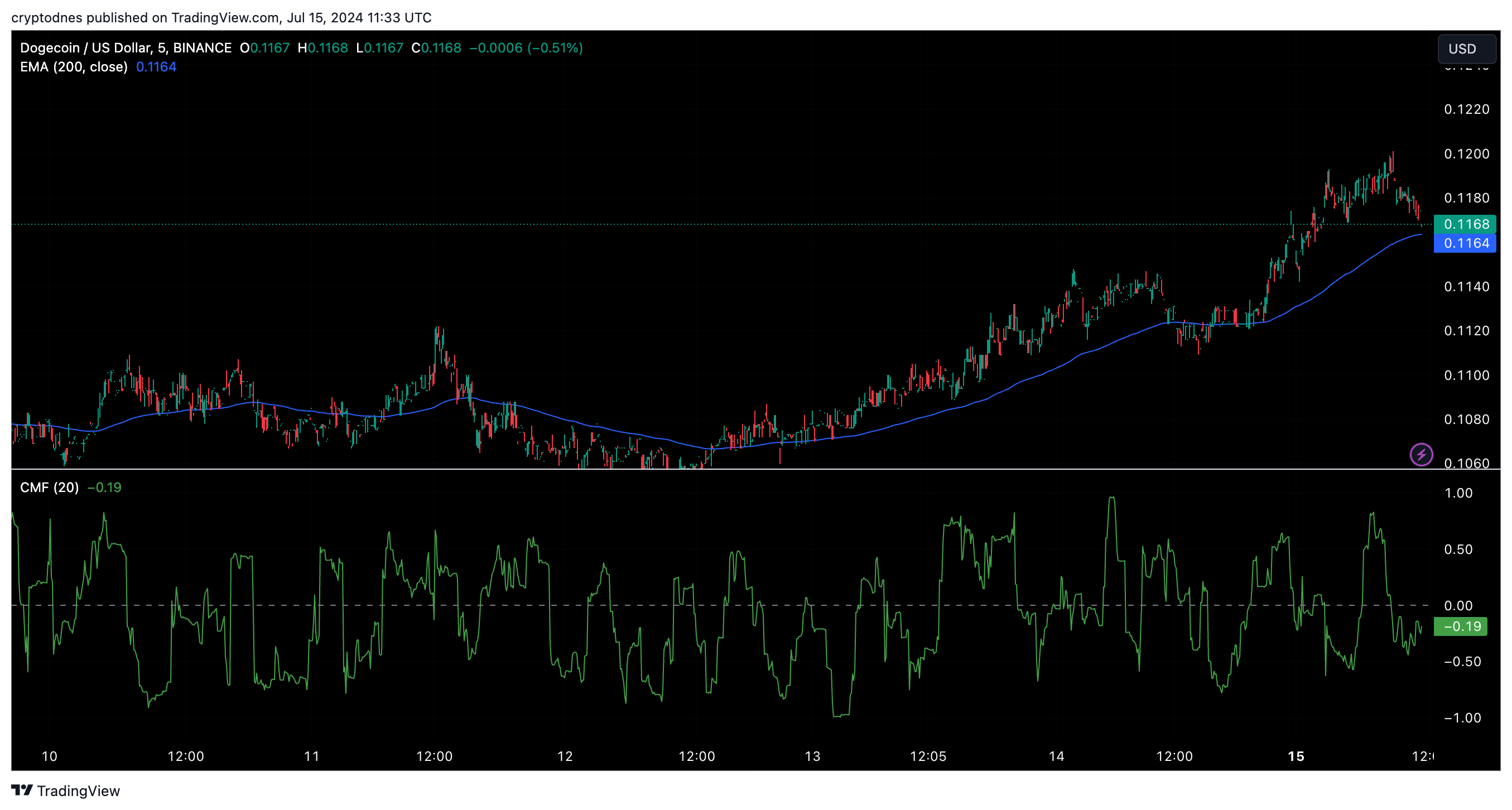

Technical indicators such as the 200-day Exponential Moving Average (EMA) indicate a pivotal point; the price currently sits below this level, suggesting potential for a bullish breakout if it breaches above.

Additionally, the Chaikin Money Flow (CMF) indicator has signaled increased buying pressure, possibly driving Dogecoin up by 27.56% to $0.13 if momentum persists.

Investors are closely monitoring market sentiment, as indicated by the Bulls and Bears indicator, which leans slightly towards bulls in recent trading volumes.

This could potentially fuel a short-term rally towards $0.13, with long-term projections eyeing a bullish scenario towards $1. However, caution is advised, as heightened selling pressure could prompt a retracement towards $0.10 in the near future, despite promising long-term prospects for Dogecoin.

-

1

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

2

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

3

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read

Top Trending Cryptocurrencies Today

As crypto markets navigate another week of volatility and shifting sentiment, traders are increasingly turning their attention to emerging altcoins and high-momentum tokens.

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

A new milestone in cryptocurrency investment products is set to unfold this Wednesday, as REX Shares prepares to launch the first-ever U.S.-listed staked crypto exchange-traded fund (ETF), according to a company announcement shared on X.

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

A community-driven initiative launched Monday is inviting Ethereum users to lock art, memories, and personal messages inside a decentralized “time capsule,” set to be opened on the network’s 11th anniversary next year.

-

1

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

2

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

3

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

4

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

5

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

17.06.2025 8:00 1 min. read