Inflows to US Bitcoin ETFs Decline

12.07.2024 9:07 1 min. read Kosta Gushterov

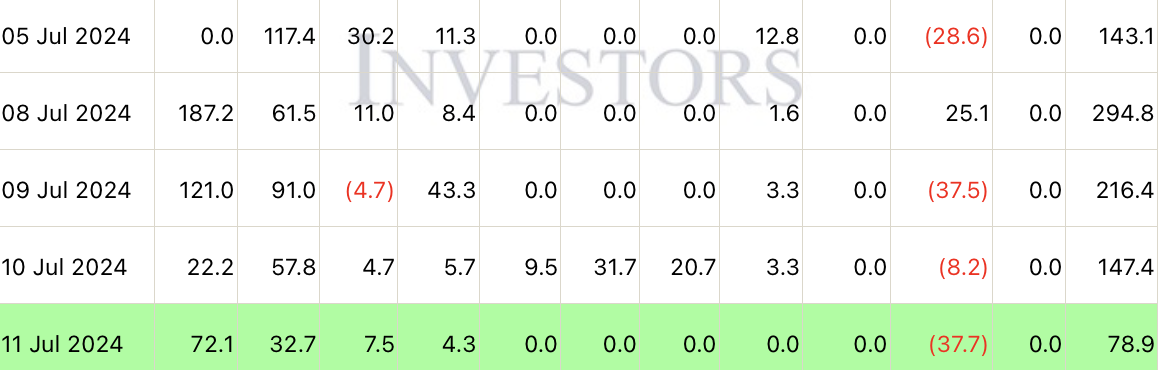

After the U.S.-based spot Bitcoin ETFs recorded two trading days with a higher net income of $200 million this week, they continued the positive streak on July 11, but more modestly.

Registering $295 million on July 8, $216 million the day after and $147 million on July 10, yesterday all-U.S. ETFs attracted just $78.9 million.

On July 11, BlackRock’s ETF, the iShares Bitcoin Trust, attracted $72.1 million, and Fidelity’s Wise Origin Bitcoin Fund followed with $32.7 million.

Bitwise’s BITB ranked third with inflows of just $7.5 million. In total, all U.S. spot Bitcoin exchange-traded funds attracted $78.9 million on the day.

Although the last four trading days saw positive overall results – Grayscale Bitcoin Trust (GBTC) again registered outflows of $37.7 million.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

3

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

4

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read -

5

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

13.06.2025 15:00 2 min. read