USDC Gains Popularity as Demand for Regulated Stablecoins Rises

10.07.2024 19:00 1 min. read Alexander Stefanov

Circle’s USDC stablecoin is currently experiencing the highest demand among regulated stablecoins, according to data from Kaiko.

Kaiko’s recent report highlights that after Circle announced that its USDC and EURC stablecoins would comply with European Markets in Crypto-assets Regulation (MiCA), both have seen significant volume increases.

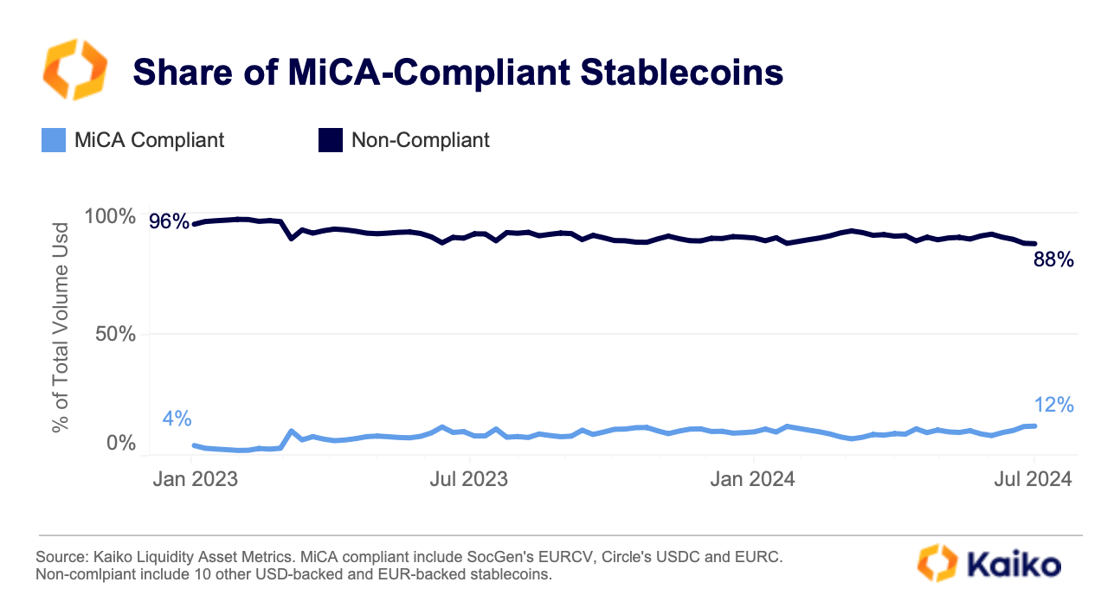

While non-compliant stablecoins still dominate the market, comprising 88% of the total stablecoin volume, there is a noticeable shift towards regulated products.

This shift could be driven by a growing preference for transparency in the market. Exchanges and market makers may begin favoring compliant stablecoins, especially as major crypto exchanges like Binance, Bitstamp, Kraken, and OKX have started restricting or delisting non-compliant stablecoins for their European users.

In the past year, the volume share of compliant stablecoins has risen, reflecting this increased demand for regulated alternatives. So far, this trend has mainly benefited USDC.

Another contributing factor to USDC’s growth is its rising use in perpetual futures settlement, even though its market share is still much smaller compared to Tether’s USDT.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

Ethereum Jumps 8% to Reclaim $3,000

Ethereum surged 8.4% in the past 24 hours, reaching $3,010 as renewed interest in altcoins follows Bitcoin’s explosive rally.

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

Grayscale, one of the leading cryptocurrency asset managers, has unveiled its latest benchmark update structured around its Crypto Sectors framework.

Trump’s Truth Social to Launch Utility Token for Subscribers

Truth Social, the platform founded by Donald Trump, is moving deeper into the crypto space with plans for a utility token tied to its premium services.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read