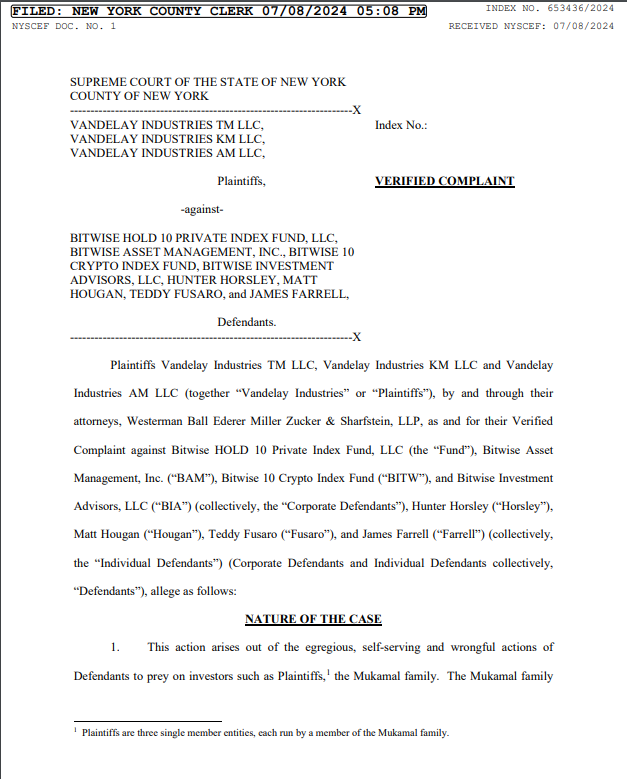

World’s Largest Crypto Index Fund Manager Faces $2M Lawsuit

10.07.2024 12:00 1 min. read Alexander Stefanov

Bitwise Asset Management faces a lawsuit from Vandelay Industries on behalf of a family, accusing the company of financial misconduct and seeking $2 million in damages.

The dispute began with the family’ $1.3 million investment in the Bitwise HOLD 10 Private Index Fund in 2018.

Tensions rose in 2020 when Bitwise proposed converting the fund to a publicly traded entity on OTC markets and increased management fees by 25%, which the plaintiffs claim left them with no real choice but to accept unfavorable terms.

Additional investments totaling $4.85 million in 2021 under allegedly misrepresented terms led to a financial loss of nearly $1.93 million.

The lawsuit accuses Bitwise of breach of fiduciary duty, negligence, fraud, and other charges. Bitwise denies the allegations, stating that Theodore Mukamal has a history of legal threats for personal gain and had acknowledged the risks of investing in their funds.

This legal battle could set important precedents for crypto fund management and investor communication transparency. Bitwise also issues the spot Bitcoin ETF, Bitwise Bitcoin Fund (BITB), which has attracted significant investment.

-

1

FBI Seizes $17M in Crypto as Major Dark Web Marketplace Collapses

05.06.2025 22:00 1 min. read -

2

Nevada Man Jailed for Multimillion-Dollar Scheme Involving Stolen Treasury Checks

02.06.2025 17:00 1 min. read -

3

French Police Bust Youth-Led Ring Behind Crypto Kidnap Attempts

02.06.2025 14:00 2 min. read -

4

Crypto Hacks Shift Toward Social Engineering in 2025

05.06.2025 9:00 2 min. read -

5

$14M Vanishes in Fresh Attack on Bitcoin-Based DeFi Protocol

08.06.2025 17:00 2 min. read

CoinMarketCap Potentially Compromised in Ongoing Front-End Attack

CoinMarketCap, one of the most widely used crypto data tracking platforms, is reportedly facing a front-end security breach, with multiple users encountering a suspicious prompt to verify their wallets.

Russia Struggles to Bring Underground Crypto Miners Into the Light Despite New Laws

Russia’s attempt to formalize its crypto mining sector is falling short, with most miners opting to remain off the books despite new regulations.

Crypto Investor Falls for Elaborate Social Engineering Trap

A well-known investor at crypto VC firm Hypersphere has fallen victim to an elaborate phishing attack that wiped out a substantial portion of his personal savings.

Iran Limits Crypto Trading Hours After Politically Charged Hack on Nobitex

Iranian authorities have imposed new restrictions on domestic cryptocurrency exchanges following a large-scale cyberattack on Nobitex, the country’s leading trading platform.

-

1

FBI Seizes $17M in Crypto as Major Dark Web Marketplace Collapses

05.06.2025 22:00 1 min. read -

2

Nevada Man Jailed for Multimillion-Dollar Scheme Involving Stolen Treasury Checks

02.06.2025 17:00 1 min. read -

3

French Police Bust Youth-Led Ring Behind Crypto Kidnap Attempts

02.06.2025 14:00 2 min. read -

4

Crypto Hacks Shift Toward Social Engineering in 2025

05.06.2025 9:00 2 min. read -

5

$14M Vanishes in Fresh Attack on Bitcoin-Based DeFi Protocol

08.06.2025 17:00 2 min. read