XRP Network Sees Surge in Transactions and Trading Volume

09.07.2024 17:00 1 min. read Alexander Stefanov

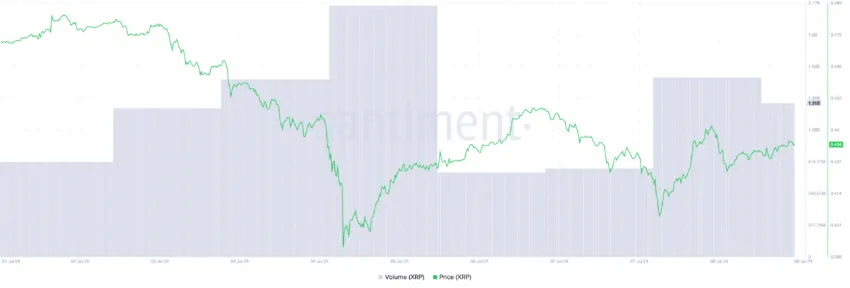

On July 8, the Ripple Network (XRP) experienced a notable increase in adoption, marking its highest daily transaction count since February.

This surge in user activity propelled XRP’s daily trading volume to over $1 billion.

Data from the XRP Ledger indicated a significant uptick, with 2.3 million successful transactions recorded on July 8, a 15% rise from the previous day’s 2 million transactions.

This spike reflects a 97% increase in daily transaction count since the beginning of July.

The heightened demand positively impacted XRP’s market performance, with its trading volume peaking at $1.5 billion.

At the time of writing XRP is trading at $0.4347, down nearly 1.3% in the last 24 hours, accompanied by a slight decrease in trading volume.

Bearish sentiment persists in the XRP market, as the altcoin has declined by 10.5% over the past week.

Currently, XRP’s Parabolic SAR indicator suggests a downward trend continuation, potentially leading to a further decline to $0.41.

-

1

Quick Flip Nets Trader Six-Figure Profit From Memecoin Bet

02.05.2025 8:00 1 min. read -

2

Elon Musk’s Meme Coin Power Is Losing Its Punch

09.05.2025 18:00 2 min. read -

3

Binance to Drop Trading Pairs and Places Multiple Tokens Under Watch

08.05.2025 13:00 2 min. read -

4

Binance Adds New Altcoin with 66% APR Intro Offer

08.05.2025 20:00 1 min. read -

5

SEC Delays Solana ETF Decision, All Eyes on June Rulings for XRP and DOT

14.05.2025 14:30 1 min. read

SHIB Can Withstand the Storm, Says Project Lead

As the crypto market weathers a fresh wave of volatility, a prominent figure from the Shiba Inu project is urging holders not to lose sight of the bigger picture.

SEC Reviews Staked Tron ETF, Boosting Hopes for New Crypto Fund Approval

The U.S. Securities and Exchange Commission has formally begun reviewing a proposal from Canary Capital for a staked Tron (TRX) ETF, a move that stands out amid repeated delays in crypto ETF approvals.

HYPE Token Price Prediction From Bitcoin Founder

In a move that’s turned heads across the crypto market, Arthur Hayes, former CEO of BitMEX and longtime market commentator, has thrown his weight behind HYPE, the native asset of the decentralized derivatives exchange Hyperliquid.

Top Crypto Tradeder Cashes Out $46M Bitcoin Profit, Eyes Altcoins Next

High-profile crypto trader James Wynn has begun paring down his Bitcoin holdings after riding the latest wave to new all-time highs.

-

1

Quick Flip Nets Trader Six-Figure Profit From Memecoin Bet

02.05.2025 8:00 1 min. read -

2

Elon Musk’s Meme Coin Power Is Losing Its Punch

09.05.2025 18:00 2 min. read -

3

Binance to Drop Trading Pairs and Places Multiple Tokens Under Watch

08.05.2025 13:00 2 min. read -

4

Binance Adds New Altcoin with 66% APR Intro Offer

08.05.2025 20:00 1 min. read -

5

SEC Delays Solana ETF Decision, All Eyes on June Rulings for XRP and DOT

14.05.2025 14:30 1 min. read