Will Biden’s Debate Struggles Affect Stock Market Confidence?

05.07.2024 11:00 1 min. read Alexander Stefanov

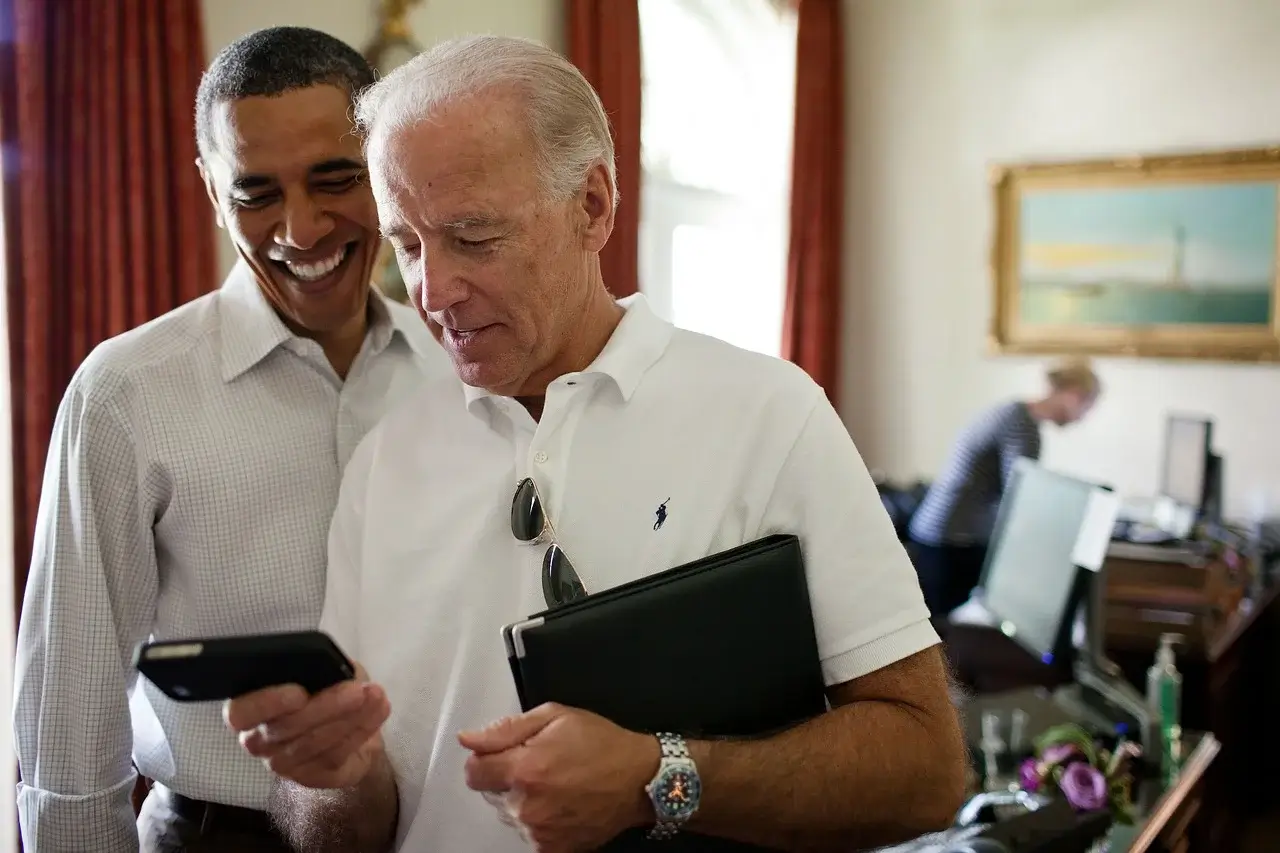

As President Joe Biden faces mounting challenges following a tumultuous TV debate last week, investors are contemplating the potential market impact of any shift in Democratic leadership.

Market trends have closely mirrored the fluctuating fortunes of Biden and his Republican opponent, former President Donald Trump, observed Adam Turnquist, chief technical strategist at LPL Financial.

He noted a correlation between market movements and Trump’s electoral prospects since March, suggesting that market sentiment aligns with perceptions of political stability rather than endorsing specific policies.

Turnquist emphasized that market reactions indicate a preference for certainty over uncertainty, with earlier trends showing a positive market response when Biden was initially favored to win.

Recent debates and subsequent speculation about Biden’s candidacy have intensified concerns within the Democratic party. While the White House has affirmed Biden’s commitment to remain in the race, Vice President Kamala Harris has gained traction in betting markets as a potential alternative.

Meanwhile, PredictIt odds favor Trump’s reelection at 59%, contrasting sharply with Biden’s diminished support at around 16% post-debate.

Polls following the debate reflect a tightening race, with Trump pulling ahead in some surveys, underscoring ongoing uncertainties in the political landscape.

-

1

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

2

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read -

3

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

4

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

5

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read

Greed Holds as Market Momentum Builds: What is the Market Sentiment

The crypto market remains firmly in “Greed” territory, with CoinMarketCap’s Fear & Greed Index clocking in at 69/100 on July 19. Despite a modest 24-hour dip from 71, the index has now held above 60 for 11 consecutive days.

Top 7 Crypto Project Updates This Week

The crypto industry saw major advancements this past week across DeFi, NFT, Layer 2, and AI-powered platforms.

Peter Thiel-Backed Crypto Exchange Files for IPO

Cryptocurrency exchange Bullish, backed by billionaire investor Peter Thiel, has officially filed for an initial public offering (IPO), marking a major step toward entering the public markets.

Tether Plans U.S.-Issued Stablecoin After Trump Signs GENIUS Act

With President Trump officially signing the GENIUS Act into law, the regulatory landscape for stablecoins in the U.S. has entered a new phase—prompting major reactions from the industry’s top players.

-

1

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

2

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read -

3

U.S. Bank Advises Clients to Drop These Cryptocurrencies

29.06.2025 10:00 2 min. read -

4

Chinese Tech Firms Turn to Crypto for Treasury Diversification

26.06.2025 17:00 1 min. read -

5

FTX Halts Recovery Payments in 49 Countries: Here Is the List

04.07.2025 18:00 2 min. read