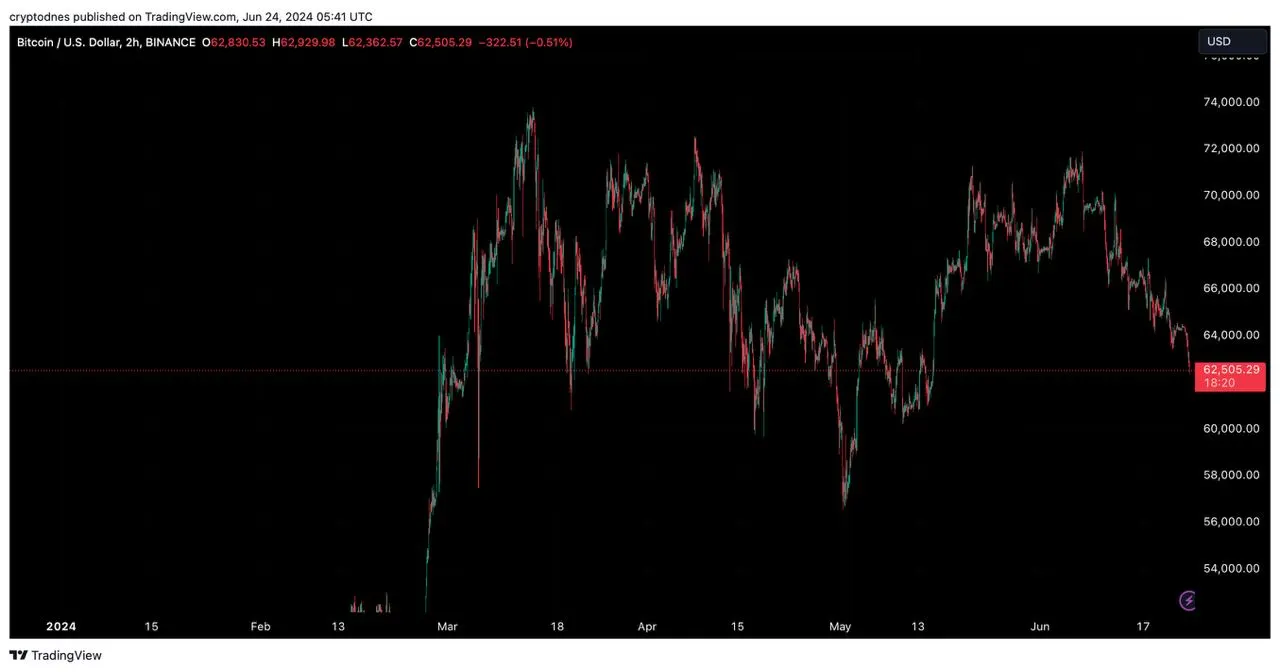

The Price of Bitcoin Fell Below $63,000 – How Far Will It Go?

24.06.2024 9:00 1 min. read Kosta Gushterov

The crypto market is in decline, down over 3.40% in the last 24 hours to $2.27 trillion.

Bitcoin is trading at $62,505, down 6% in the last week.

This downward movement is due to multiple factors.

Perhaps the most significant of these is that BTC miners have sold $2 billion worth of reserves, which is the biggest sell-off in over a year and has led to a 14-year low.

IntoTheBlock’s data shows that about 5.45 million addresses hold 3.03 million BTC priced between $64,300 and $70,800, creating a supply barrier.

If the price of the cryptocurrency drops further, these holders may decide to sell their coins to limit losses, increasing downward pressure on the price.

There have also been some predictions that BTC could reach $60,000 soon, perhaps within the week.

-

1

Pakistan Embraces Bitcoin with National Reserve Plan and New Crypto Framework

29.05.2025 15:02 1 min. read -

2

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read -

3

Bitcoin Slips to $108K After New High, But Bullish Signals Persist

24.05.2025 15:00 1 min. read -

4

Whale Converts $20M in Bitcoin to AAVE, Bags Big Unrealized Profits

26.05.2025 14:00 2 min. read -

5

Pakistan Bets Big on Bitcoin and AI with Energy, Incentives, and a New Regulator

26.05.2025 15:00 2 min. read

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

Pakistan has found an unexpected use for the electricity it routinely leaves untapped: power thousands of Bitcoin rigs and AI servers.

Bitcoin Struggles as Selling Pressure Mounts Amid Geopolitical Turmoil

Bitcoin is under renewed pressure following Friday’s Israeli airstrike on Iran, which has deepened market anxiety and driven investors toward safer assets.

Corporate Bitcoin Adoption Still in Early Days, Says Bitwise CIO

Matt Hougan, CIO at Bitwise Asset Management, believes a powerful shift is underway—one that could reshape how companies manage their capital.

Nasdaq-Listed Mercurity Aims to Join Bitcoin Treasury Trend

As more corporations embrace Bitcoin as a strategic asset, Mercurity Fintech is entering the arena with an ambitious $800 million fundraising effort aimed at building a long-term BTC reserve.

-

1

Pakistan Embraces Bitcoin with National Reserve Plan and New Crypto Framework

29.05.2025 15:02 1 min. read -

2

Bitcoin Pulls Back to $108K, But Options Market Signals Sky-High Expectations

24.05.2025 11:00 1 min. read -

3

Bitcoin Slips to $108K After New High, But Bullish Signals Persist

24.05.2025 15:00 1 min. read -

4

Whale Converts $20M in Bitcoin to AAVE, Bags Big Unrealized Profits

26.05.2025 14:00 2 min. read -

5

Pakistan Bets Big on Bitcoin and AI with Energy, Incentives, and a New Regulator

26.05.2025 15:00 2 min. read