5 Things You Didn’t Know About Bitcoin’s Market Performance

02.08.2024 9:00 3 min. read Alexander Stefanov

Bitcoin's market performance has been a topic of immense interest and speculation over the years.

As the cryptocurrency continues to evolve, its patterns of growth and decline offer valuable insights for investors and enthusiasts alike. Here are five intriguing aspects of Bitcoin’s performance that highlight its unique position in the financial landscape, according to a recent report.

Top-Performing Asset with Volatile Downturns

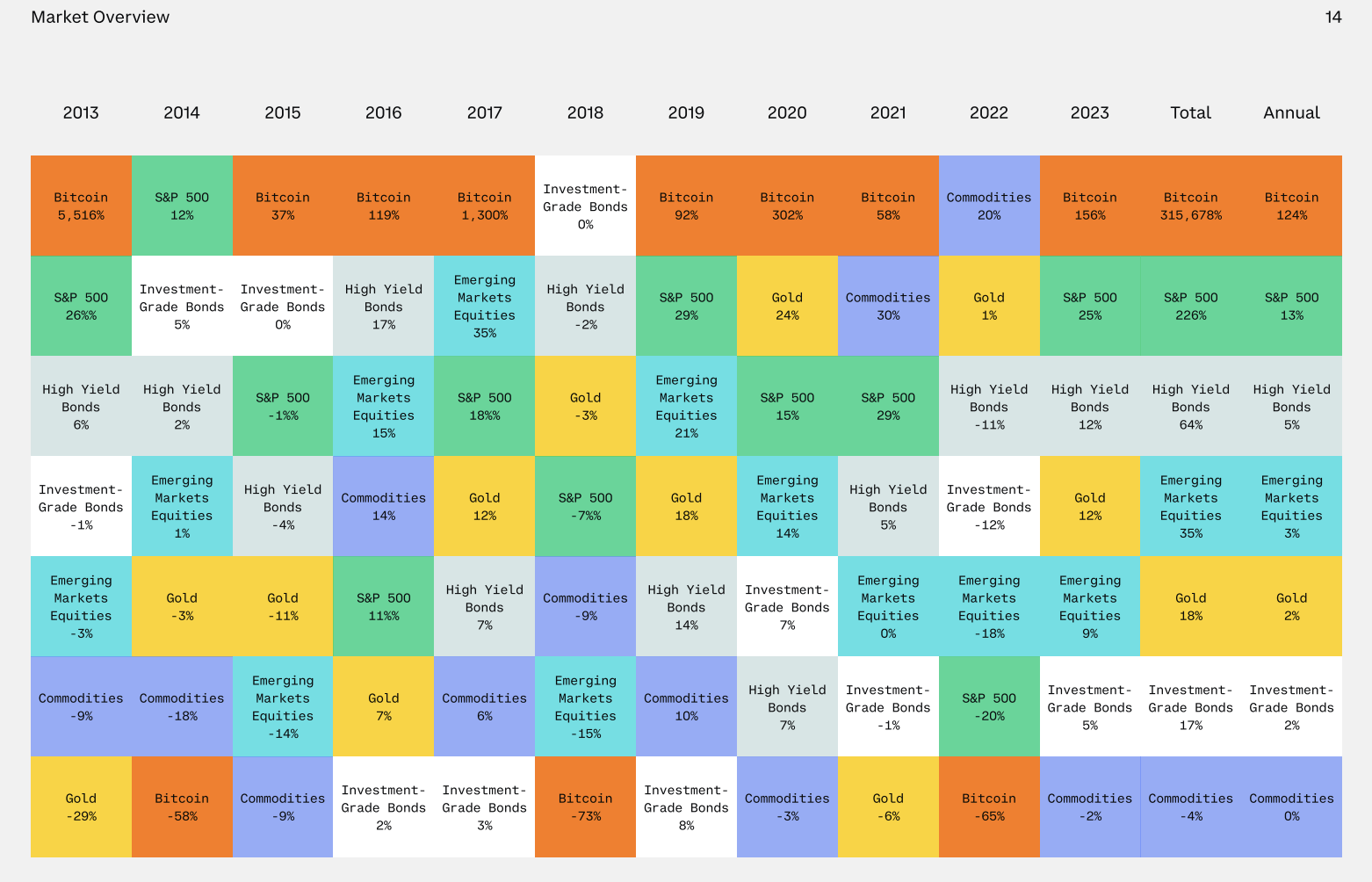

Bitcoin has been the top-performing asset in eight of the past eleven years, showcasing its potential for significant gains. However, it’s essential to note that in the remaining three years, it was the bottom-performing asset, experiencing substantial drawdowns.

This duality underscores the high-risk, high-reward nature of Bitcoin investments.

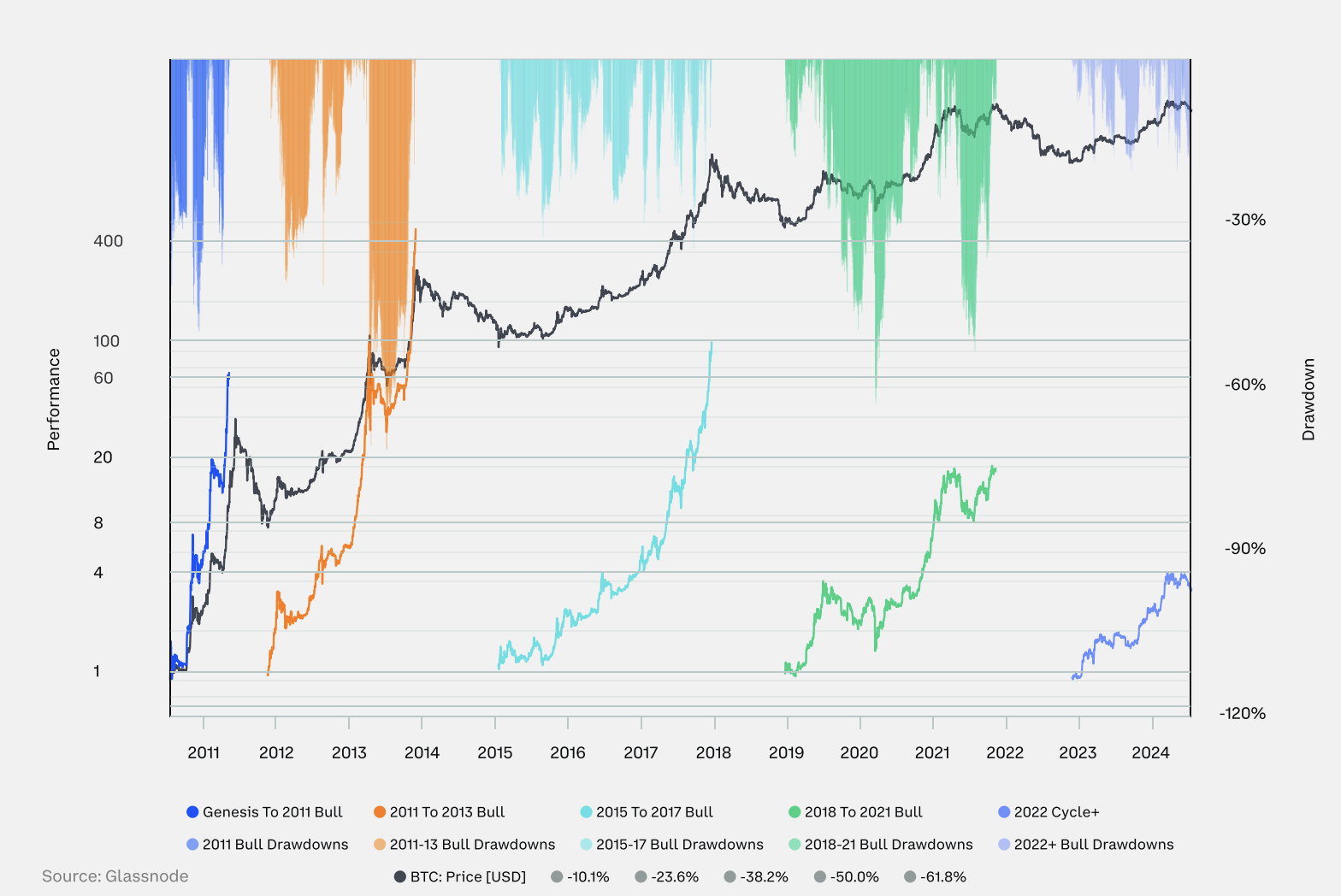

Cycle Performance and Drawdowns

Bitcoin’s bull markets are characterized by exponential gains, but they are also marked by notable drawdowns. Since the current bull market began in November 2022, Bitcoin has surged approximately fourfold from its lows.

In comparison, the bull markets from 2015-2017 and 2018-2021 saw Bitcoin prices increase by 100 times and 20 times, respectively. The current cycle has experienced eight drawdowns of 5%-20%, two drawdowns of 20%-30%, and no drawdowns exceeding 30%, highlighting a relatively resilient performance.

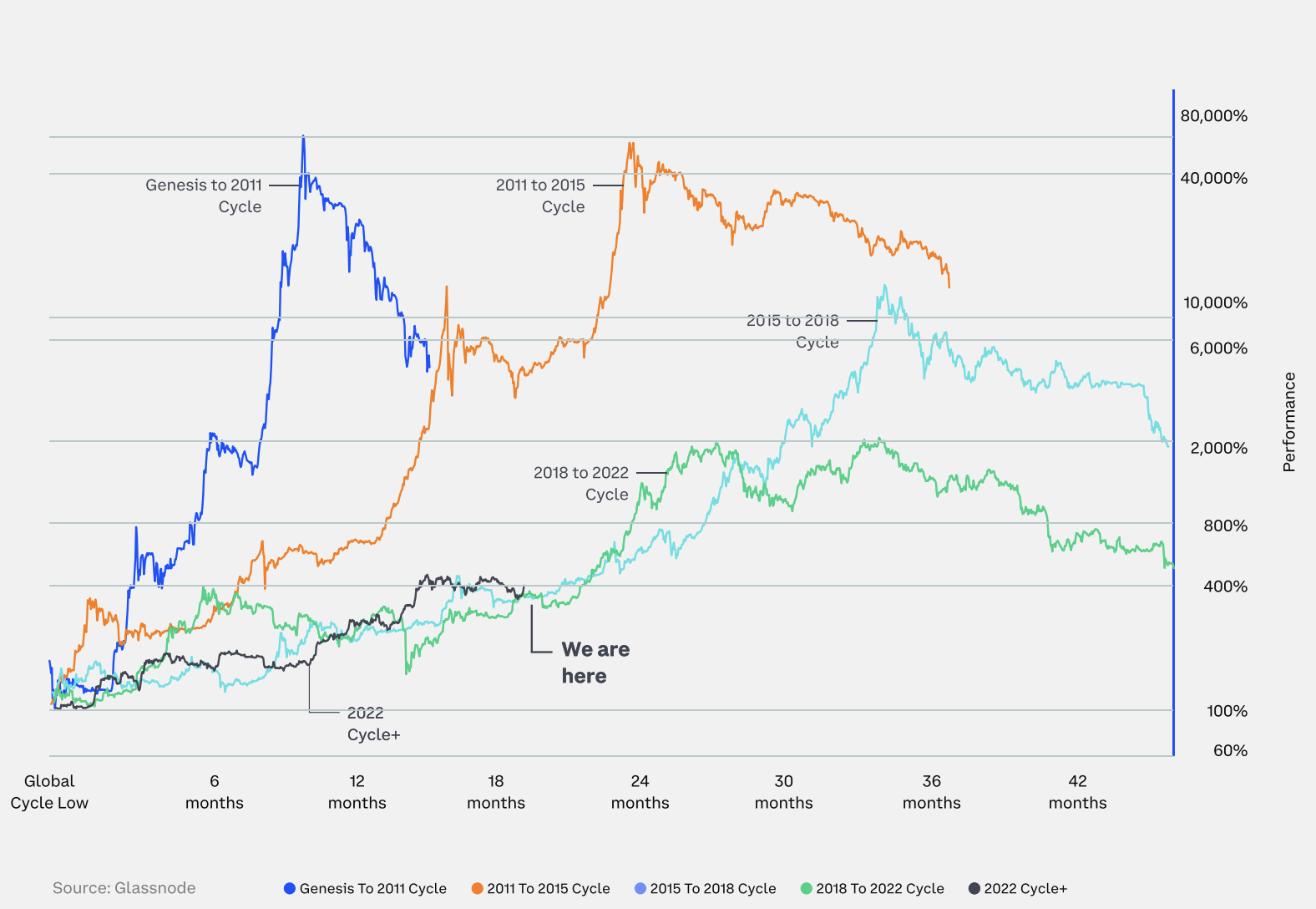

Price Performance Since Cycle Low

Examining Bitcoin’s four market cycles, each comprising both bull and bear phases, reveals that the current cycle (starting in 2022) has seen a 400% increase since its low in November 2022. This performance is reminiscent of the 2018-2022 cycle, where Bitcoin achieved a 2,000% increase from its cycle low. The ongoing cycle’s growth trajectory suggests potential for further appreciation.

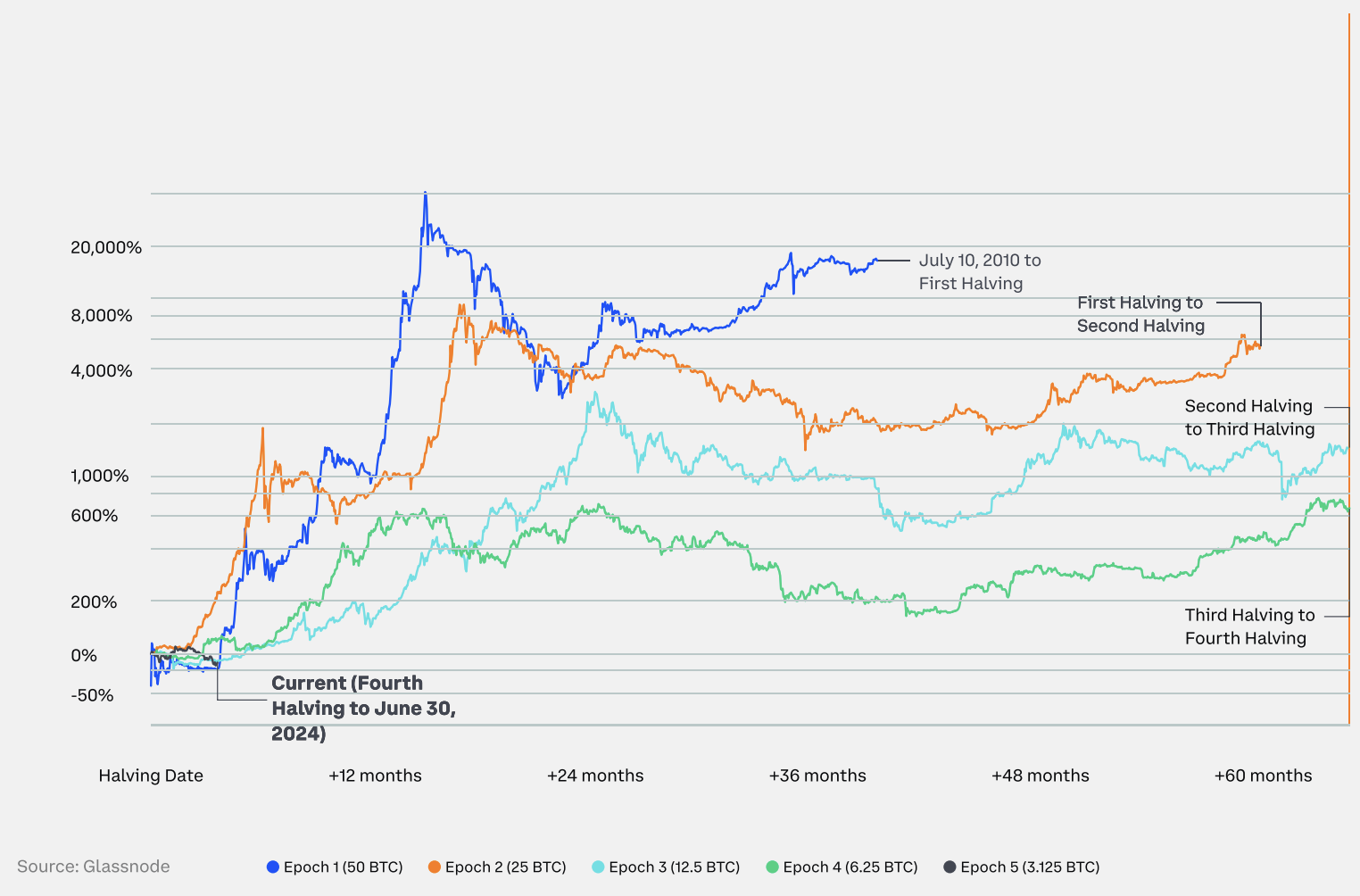

Price Performance Since Halving

Bitcoin’s performance during its Halving cycles, or epochs, shows a pattern of significant price increases within a year after each Halving event. After the first Halving, Bitcoin prices surged over 1,000% in the first 12 months.

The second Halving saw a 200% gain, and the third one experienced a 600% increase. Interestingly, since the fourth Halving on April 19, 2024, Bitcoin’s price has decreased by 2%, indicating a potential buildup for future growth.

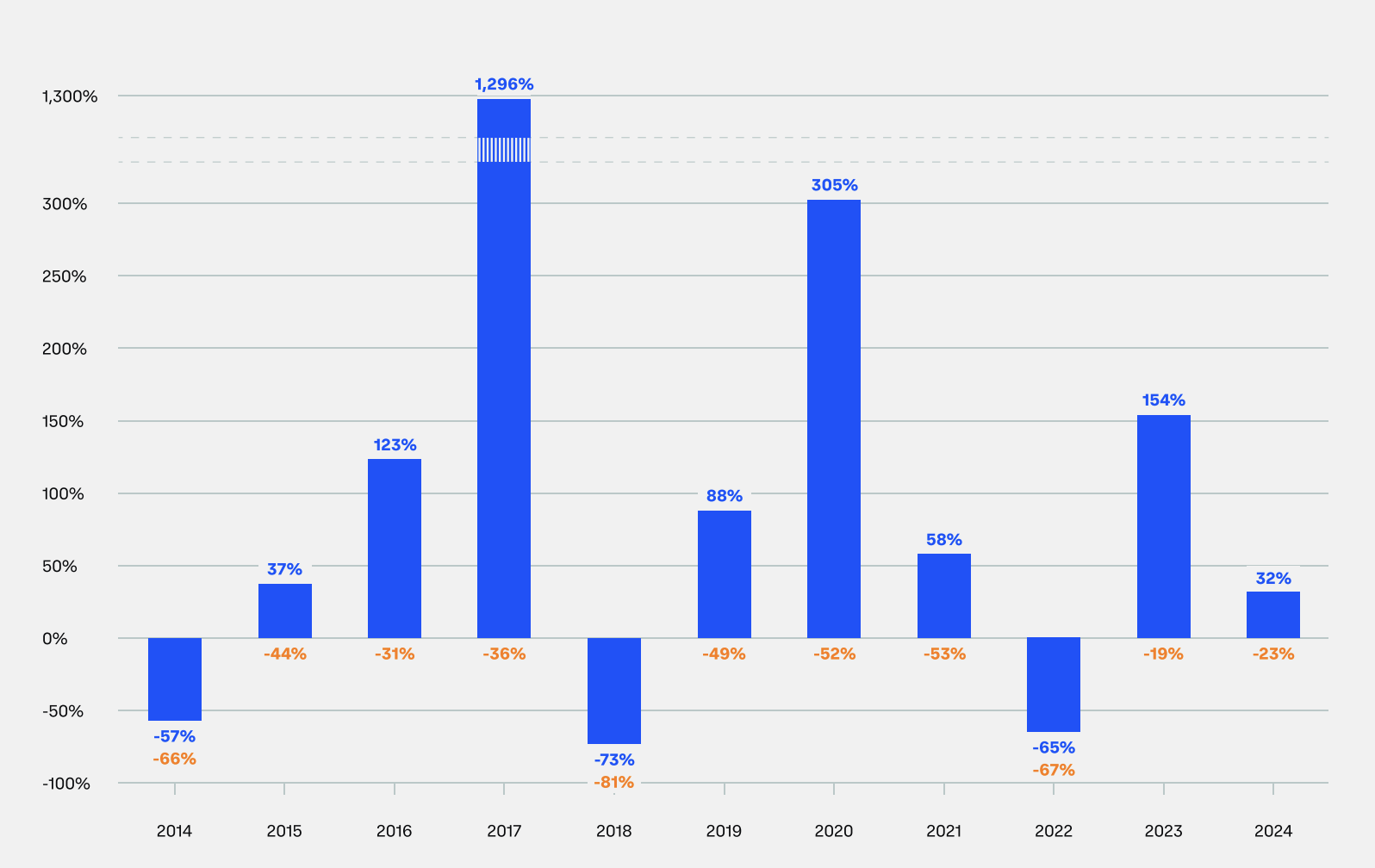

Annual Returns and Intra-Year Drawdowns

Despite facing average intra-year declines of 48%, Bitcoin has consistently delivered positive annual returns in seven of the last ten years. The 23% drawdown observed in the first half of 2024 is relatively modest compared to the significant drawdowns at the end of previous bull cycles. This suggests that the current cycle may still have room for growth, and investors might witness further positive returns.

Conclusion

Bitcoin’s market dynamics reveal a complex interplay of significant gains and substantial drawdowns, reflecting its volatile yet promising nature. Understanding these patterns can help investors navigate the cryptocurrency’s unpredictable landscape and make informed decisions.

As Bitcoin continues to mature, monitoring these key trends will be crucial for anticipating its future performance.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read