27,750 BTC Exit Binance in Historic Outflow Event

25.04.2025 21:00 2 min. read Kosta Gushterov

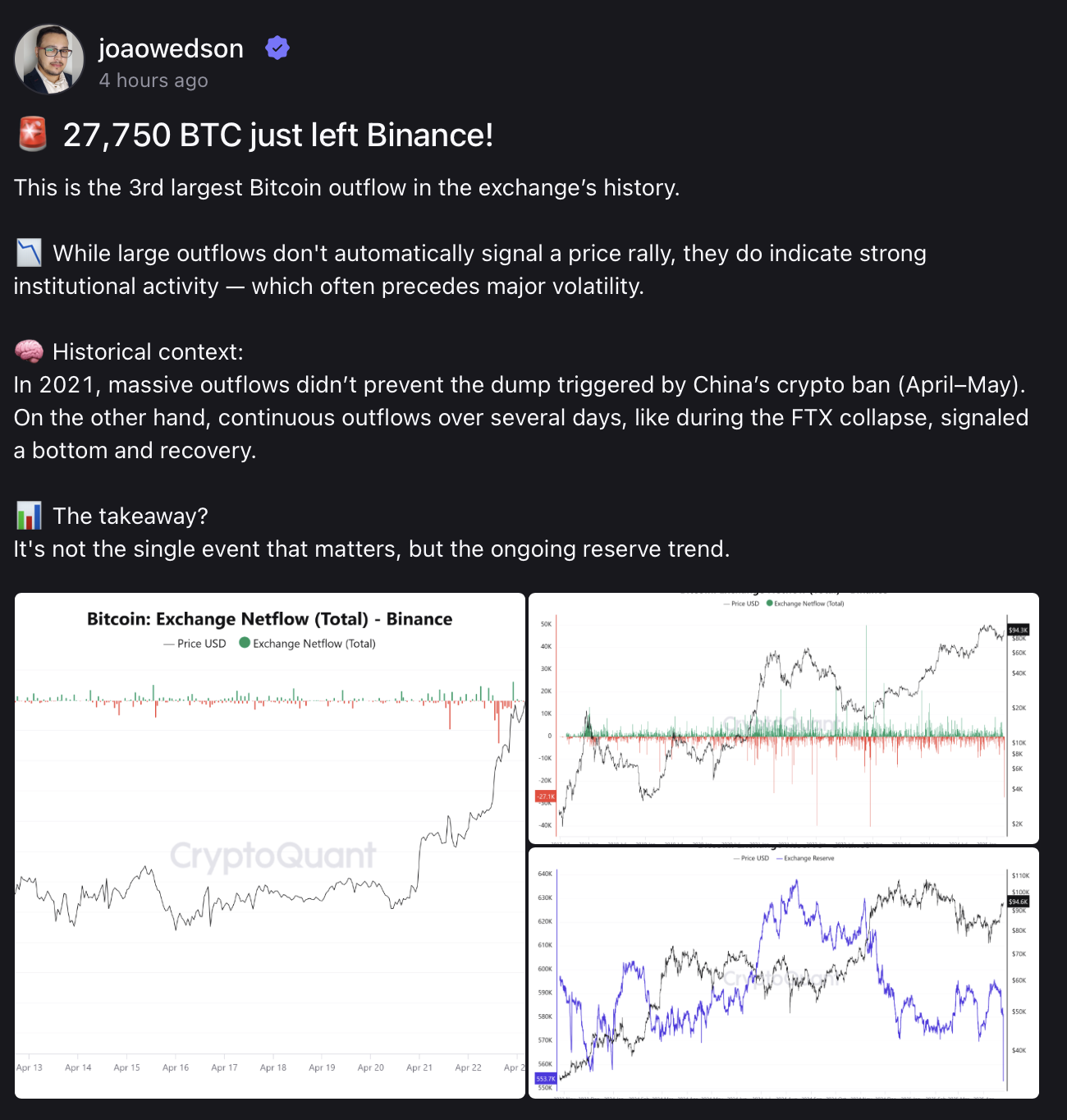

Binance just witnessed one of its most significant Bitcoin outflows ever, with more than 27,750 BTC leaving the exchange in a single day.

This marks the third-largest Bitcoin withdrawal in the platform’s history.

The move has raised eyebrows among analysts and traders, igniting speculation about whether institutions are once again shifting their holdings to cold storage — a pattern often seen ahead of key market pivots.

Institutional Activity or Early Signal?

Large-scale outflows don’t guarantee a price surge, but they often indicate strategic positioning. In many past cases, institutions have moved BTC off exchanges to hold long-term, which can tighten market supply and add upward pressure — especially if retail demand follows.

However, not every outflow leads to a rally. In 2021, massive withdrawals preceded a market crash as China imposed a sweeping ban on crypto. Conversely, during the FTX collapse in late 2022, consistent BTC outflows were an early sign that the market had bottomed, leading to months of recovery.

Trend Over Time Matters Most

Analysts emphasize that it’s not just the size of a single withdrawal that counts. What matters more is the longer-term trend of reserves across exchanges. Sustained outflows over several days or weeks have historically carried more bullish weight than one-off events.

If this latest movement proves to be the start of a new trend — especially amid growing regulatory uncertainty and macro volatility — it could lay the groundwork for the next leg of Bitcoin’s rally.

Whether this marks the beginning of sustained accumulation or remains a blip, it signals growing confidence from large holders. And that, in itself, could be a powerful shift.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

3

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Bitcoin on the Edge: Why One Veteran Trader Sees a 75% Plunge

11.06.2025 13:00 1 min. read