27,750 BTC Exit Binance in Historic Outflow Event

25.04.2025 21:00 2 min. read Kosta Gushterov

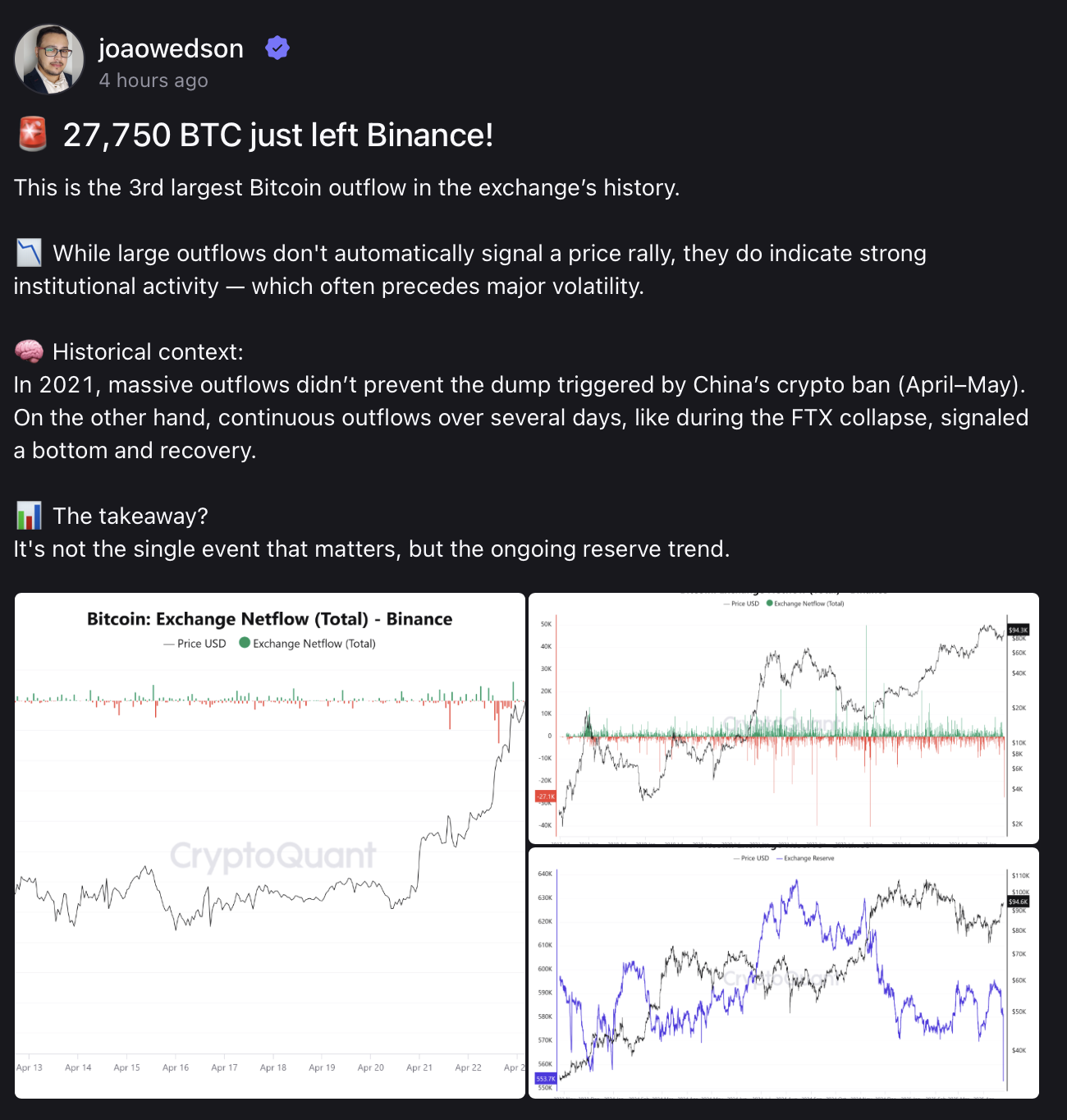

Binance just witnessed one of its most significant Bitcoin outflows ever, with more than 27,750 BTC leaving the exchange in a single day.

This marks the third-largest Bitcoin withdrawal in the platform’s history.

The move has raised eyebrows among analysts and traders, igniting speculation about whether institutions are once again shifting their holdings to cold storage — a pattern often seen ahead of key market pivots.

Institutional Activity or Early Signal?

Large-scale outflows don’t guarantee a price surge, but they often indicate strategic positioning. In many past cases, institutions have moved BTC off exchanges to hold long-term, which can tighten market supply and add upward pressure — especially if retail demand follows.

However, not every outflow leads to a rally. In 2021, massive withdrawals preceded a market crash as China imposed a sweeping ban on crypto. Conversely, during the FTX collapse in late 2022, consistent BTC outflows were an early sign that the market had bottomed, leading to months of recovery.

Trend Over Time Matters Most

Analysts emphasize that it’s not just the size of a single withdrawal that counts. What matters more is the longer-term trend of reserves across exchanges. Sustained outflows over several days or weeks have historically carried more bullish weight than one-off events.

If this latest movement proves to be the start of a new trend — especially amid growing regulatory uncertainty and macro volatility — it could lay the groundwork for the next leg of Bitcoin’s rally.

Whether this marks the beginning of sustained accumulation or remains a blip, it signals growing confidence from large holders. And that, in itself, could be a powerful shift.

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read