XRP Sees Whale Accumulation and Surge in Activity – What’s Next?

06.11.2024 11:02 1 min. read Kosta Gushterov

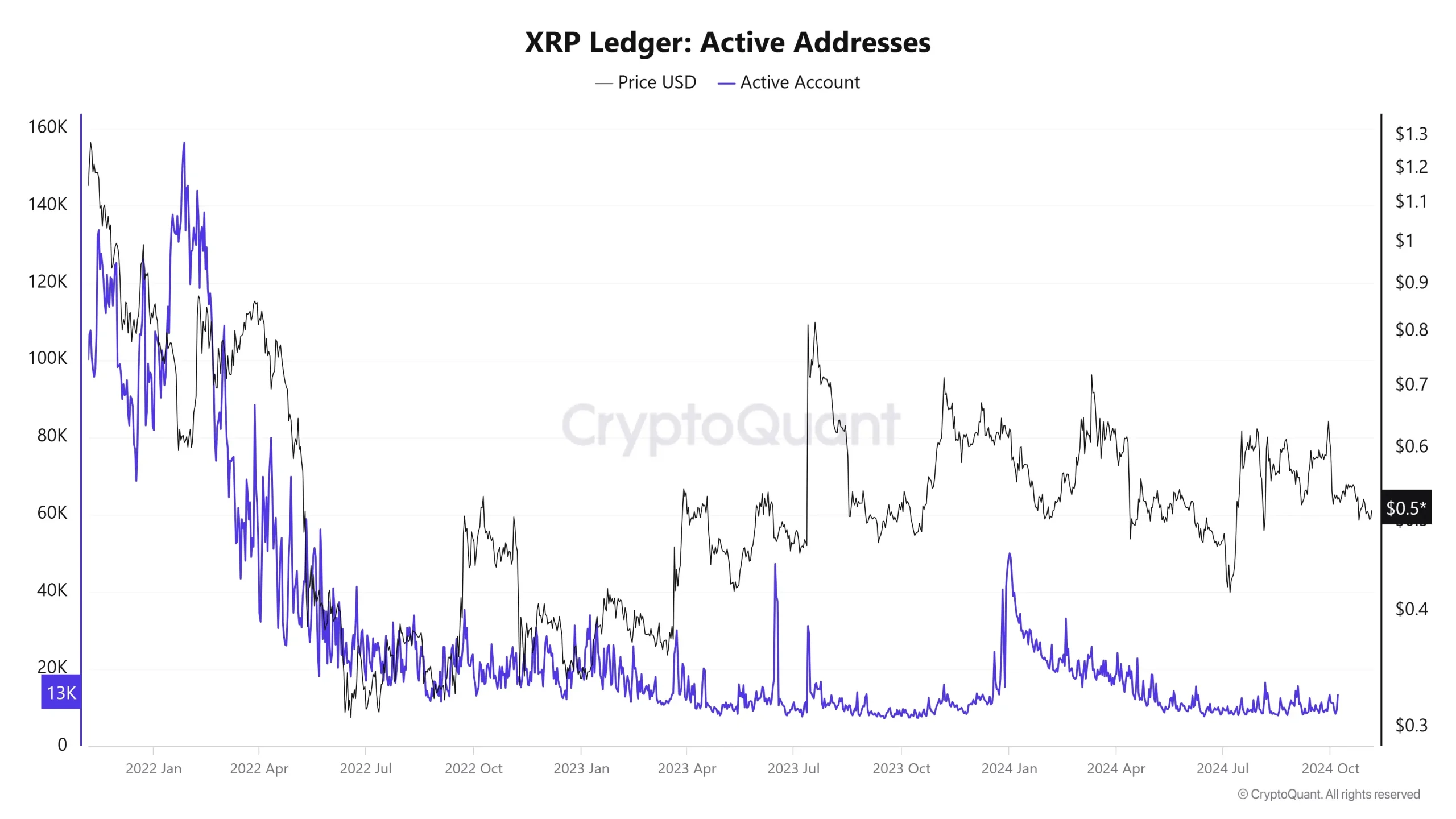

XRP, known for its role in low-cost cross-border payments, has seen a resurgence in activity, with active accounts on the XRP Ledger (XRPL) hitting a seven-month high.

Data from CryptoQuant reveals that active accounts rose from under 10,000 in early October to over 24,000 by November 1, a level last seen in March 2024. This uptick suggests renewed interest in XRP, though the direction of price depends on whether the activity is driven by buying or selling.

In parallel, XRP has seen substantial whale accumulation, with large holders adding around 390 million XRP (worth approximately $198.9 million) to their wallets over two weeks, a bullish signal that could support the price if these investors hold long term.

Despite these positive on-chain metrics, XRP’s price recently dropped from a high of $0.53 on October 29, dipping to the $0.50 support level before a mild recovery.

The market is also being influenced by the U.S. presidential election outcome, which some analysts say could boost sentiment if it favors crypto-friendly policies.

As such, while XRP has underperformed year-to-date, the recent rise in network activity and whale accumulation points to a potentially positive outlook, with external factors like the election outcome also playing a role. Investors remain watchful, hoping these metrics translate into sustained growth.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read

SOL Price Tests Key Level: Can a Weekly Close Above $170 Trigger a Bull Run?

Solana (SOL) is approaching a critical technical level that could trigger a major breakout. According to crypto analyst Ali Martinez, a weekly close above $170 may ignite a new bull run and potentially open the door for a rally toward the $2,000 mark.

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

Smart contract platforms Ethereum and Solana are shaping the crypto market’s future with big upgrades and shifting strategies.

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

Arthur Hayes has radically changed his stance on crypto markets. After months of caution, the BitMEX co-founder now believes a powerful altcoin rally is on the horizon.

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

4

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

5

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read