Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

XRP Price Prediction: Is $6 the Next Target After Ripple’s Latest Banking Deals?

13.02.2025 17:17 4 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

With major banking partnerships and innovations like tokenized assets and stablecoins, Ripple is strengthening XRP’s role in cross-border payments and blockchain adoption.

But as XRP expands its reach, Bitcoin still faces scalability challenges. That’s where PlutoChain ($PLUTO) comes in.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Designed as a Layer-2 solution, it could address Bitcoin’s biggest hurdles — slow transactions, high fees, and energy inefficiency.

By integrating Ethereum-based applications, PlutoChain might bridge the gap between Bitcoin and DeFi.

Here’s all you need to know about both projects.

Ripple Price Prediction: Will Ripple’s Expanding Partnerships Push XRP to $6?

XRP is currently priced at approximately $3.12, which reflects a modest 0.4% uptick over the past 24 hours. Meanwhile, its RSI sits at 53, which places XRP in neutral territory without strong bullish or bearish momentum.

One of Ripple’s standout collaborations is with Ondo Finance which works to bring tokenized U.S. Treasuries to the XRP Ledger (XRPL).

Ripple is also stepping into the stablecoin market with RLUSD, a U.S. dollar-pegged stablecoin designed to compete with industry giants like Tether and USD Coin.

On the financial front, Ripple is deepening its partnerships with major institutions like Santander in the U.K. and the Canadian Imperial Bank of Commerce, which helps streamline and lower costs for cross-border payments.

Beyond banking, Ripple is also investing in blockchain research by teaming up with institutions like Cornell University to push innovation in crypto and blockchain technology.

Crypto analyst Steph Is Crypto on X sees XRP’s breakout as confirmed and predicts a potential climb to $14, with a more conservative target of $5.

How PlutoChain Could Strengthen Bitcoin’s Security, Reduce Costs, and Bridge the Gap Between DeFi and The Bitcoin Ecosystem

Bitcoin changed the financial landscape, but it still struggles with slow transactions, high fees, and network congestion. These issues limit its ability to scale and reach mass adoption.

Add energy inefficiency and limited programmability to the mix, and Bitcoin remains far from its full potential. PlutoChain ($PLUTO) steps in as a Layer-2 solution that could solve these challenges.

PlutoChain works by creating a network that could run alongside Bitcoin’s blockchain to reduce congestion, lower transaction costs, and improve overall efficiency.

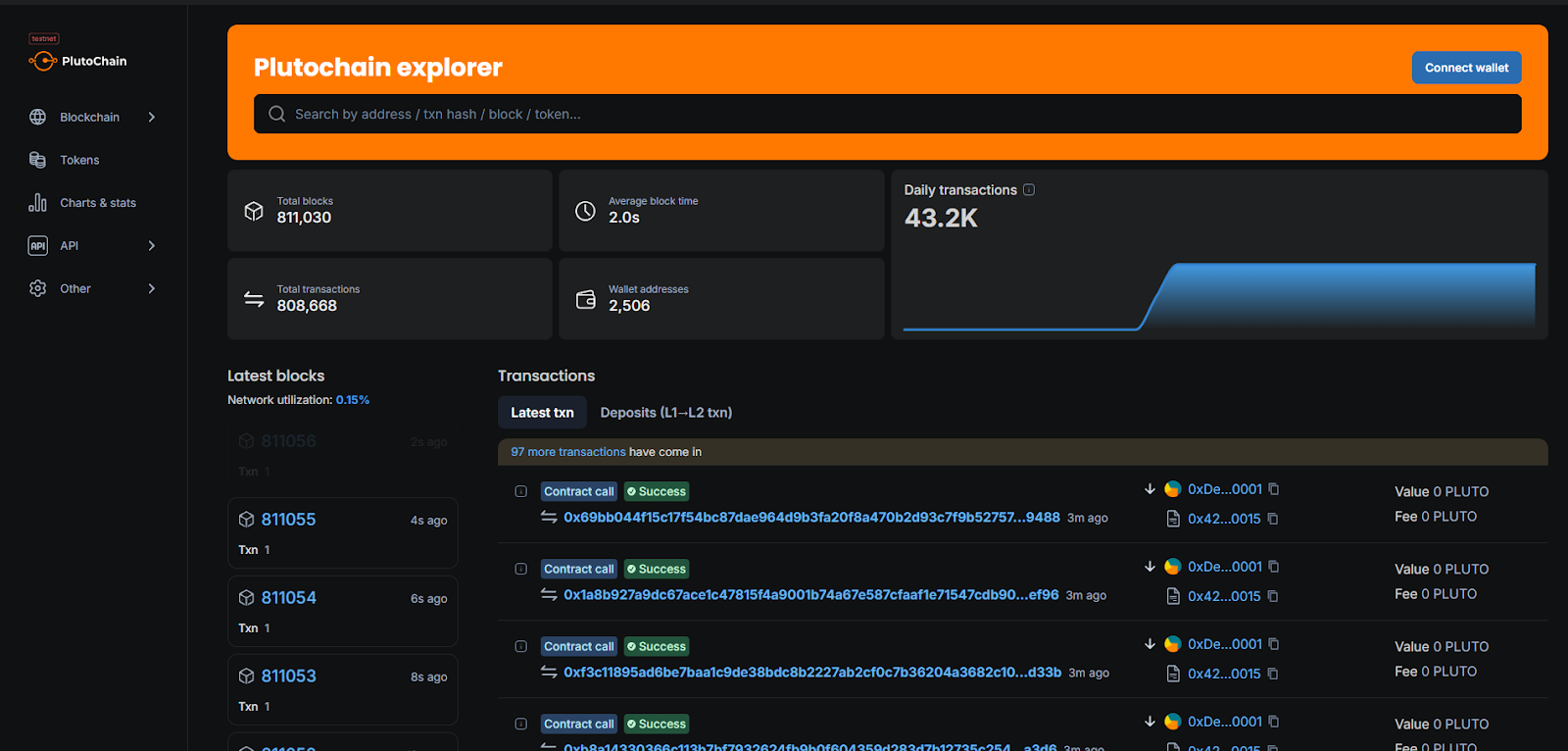

Using Later-2 tech, it offers block times as short as 2 seconds, which is a huge leap from Bitcoin’s standard 10-minute blocks. This speed boost could make transactions much faster while requiring less computational power, which could ease Bitcoin’s energy consumption concerns.

Another major advantage is PlutoChain’s compatibility with the Ethereum Virtual Machine (EVM). This could open the door for Ethereum-based applications — such as DeFi platforms, NFTs, and AI — to integrate with Bitcoin’s ecosystem.

Bridging these two major networks could unlock new possibilities for Bitcoin’s real-world use cases. PlutoChain also showed its real-world use case by processing 43,200 transactions daily.

Security remains a top priority, with thorough audits from SolidProof, QuillAudits, and Assure DeFi, along with ongoing code reviews and stress tests.

Community participation is highly valuable to PlutoChain, which is why it gives users a say in partnerships, upgrades, and new features.

Is PlutoChain the Bridge Bitcoin Needs for Mass Adoption?

XRP and Ripple continue to strengthen their presence in the financial world, securing major banking partnerships and expanding into stablecoins and tokenized assets.

These moves reinforce XRP’s role in global payments, but Bitcoin still struggles with scalability and high fees. That’s where PlutoChain ($PLUTO) could make a big difference.

By improving transaction speed, reducing costs, and integrating Ethereum-based applications, it has the potential to reshape Bitcoin’s ecosystem.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

3

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

4

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read -

5

Bitcoin vs Ethereum: ChatGPT Reveals the Best Crypto to Buy in the Bull Run

20.07.2025 2:00 5 min. read

Best Crypto to Buy Now As UAE Bank Opens Crypto Trading to Retail Customers

For years, the Middle East has been steadily warming to digital assets, with retail interest already strong and active. But what was once seen as a parallel economy is now entering the very core of institutional banking. The change is no longer about passive support or distant partnerships. It is about integration. Institutions are not […]

Best Crypto Presale to Buy: $BEST ICO Nears $15 Million as Traders Bet Big

Bitcoin’s (BTC) resilience has been on full display this week, as the top cryptocurrency continues to trade less than 4% below its all-time high. Over the weekend, a Satoshi-era Bitcoin whale sold roughly 80,000 BTC (worth about $9.6 billion), yet the price of Bitcoin has remained within its broader uptrend. This stability under heavy selling […]

ETH Whale Wallets Hint at Altcoin Season – What Are the Best Meme Coins to Buy Now?

When ETH starts to rally with conviction and wallets swell with fresh inflows, it often foreshadows an altcoin breakout. That pattern appears to be forming again. Ethereum’s buying volume is rising faster than any other large-cap asset, yet the wider altcoin space has yet to catch up. This publication is sponsored. CryptoDnes does not endorse […]

With Cardano (ADA) Slipping Out of Top 20, Investors Prefer Unilabs (UNIL) & SUI For Staking ROI

As the Cardano price risks dropping out of the top 20 rankings, a major shift is shaking up the crypto landscape. Investors are rotating their capital toward promising alternatives like the SUI Blockchain and Unilabs Finance, a newcomer powered by artificial intelligence. This publication is sponsored. CryptoDnes does not endorse and is not responsible for […]

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

3

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

4

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read -

5

Bitcoin vs Ethereum: ChatGPT Reveals the Best Crypto to Buy in the Bull Run

20.07.2025 2:00 5 min. read