Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

XRP News Today: Ripple CEO Reacts Shocked to SEC’s Decision

23.02.2025 17:30 3 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The SEC’s unexpected decision to drop its case against Coinbase shocked the industry.

Ripple CEO Brad Garlinghouse expressed surprise and stated that the agency seems eager to move on from its previous enforcement-based approach. This shift raises speculation—could Ripple be next?

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

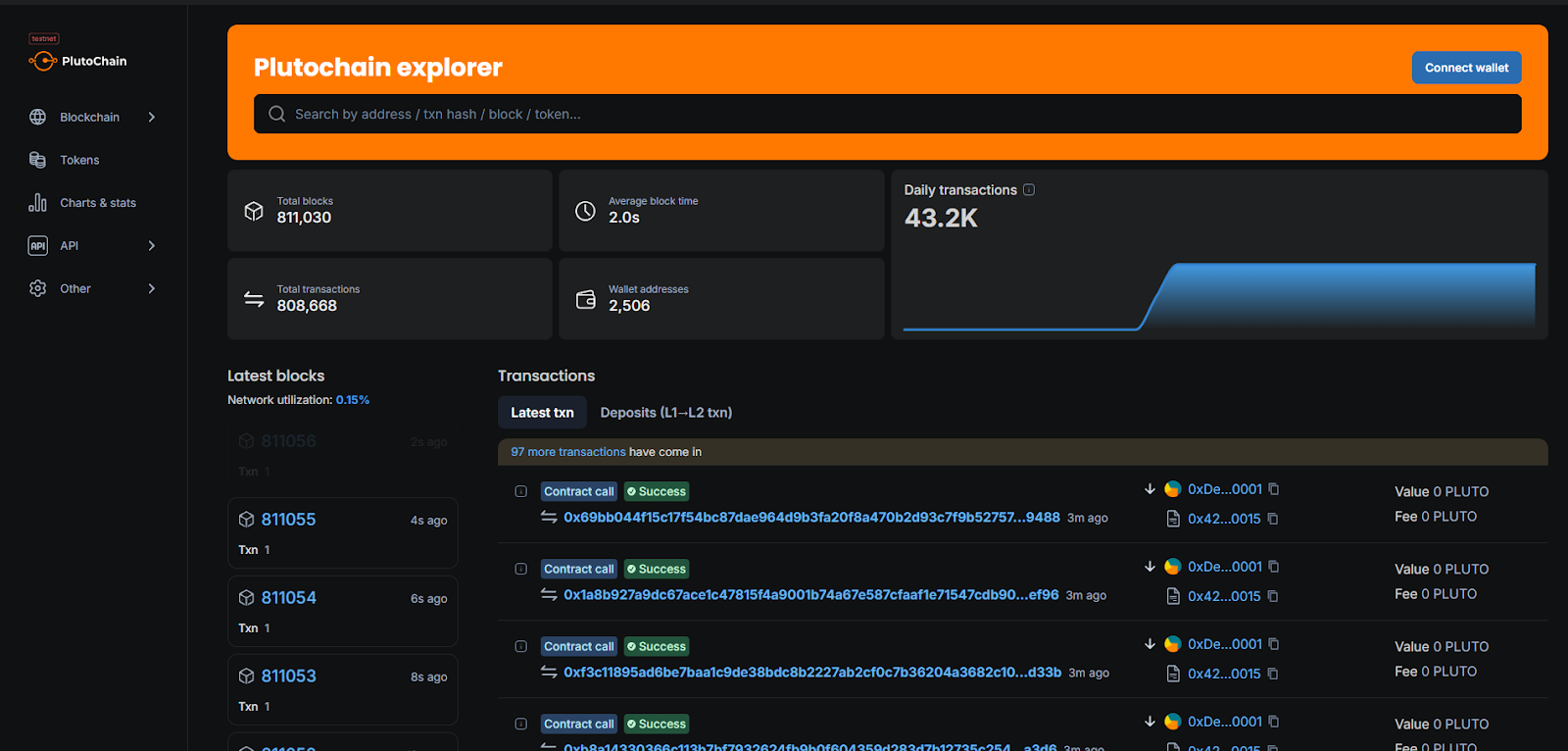

While regulatory battles take the spotlight, PlutoChain ($PLUTO) might tackle a different issue—Bitcoin’s speed and cost. Its hybrid Layer-2 offers a block time of just two seconds. With Ethereum compatibility, it could also bring DeFi and smart contracts to Bitcoin.

Today, we take a closer look at XRP’s price outlook and whether the SEC’s latest move could signal a turning point for Ripple.

Ripple CEO Breaks Silence on SEC’s Decision

The SEC’s unexpected move to drop its case against Coinbase took many by surprise. Ripple CEO Brad Garlinghouse weighed in and said that the agency seems to be shifting away from its previous enforcement-driven strategy.

His reaction sparked speculation—if the SEC steps back from aggressive legal action, could Ripple be next?

Attorney Jeremy Hogan pointed out that the case against Coinbase was dismissed “with prejudice” – this means it could return in the future. However, for now, the decision signals a shift in regulatory priorities.

Some industry experts, including former SEC official John Reed Stark, believe the agency might also drop its appeal against Ripple. An analyst from X suggests that this possible outcome could improve XRP’s market sentiment in the coming weeks.

Why PlutoChain ($PLUTO) Could Be the Upgrade Bitcoin Needs

Bitcoin has always had a scalability problem—slow transactions, high fees, and constant congestion. While networks like Ethereum and Solana have evolved with faster solutions, Bitcoin’s core technology has remained largely the same.

That’s where PlutoChain ($PLUTO) may help. This hybrid Layer-2 solution is designed to boost Bitcoin’s efficiency without changing its base layer.

By processing transactions off-chain before finalizing them on Bitcoin’s main network, PlutoChain could ease congestion and significantly speed up transactions—making Bitcoin faster, cheaper, and more practical for everyday use.

One key feature is Ethereum Virtual Machine (EVM) compatibility. Developers could use PlutoChain to bring smart contracts, DeFi platforms, and NFT marketplaces to Bitcoin’s network without any changes to its core structure. Bitcoin has struggled to support these functions, but PlutoChain may change that.

Block costs could also decrease. PlutoChain operates on its own high-speed network, which might help businesses and users avoid high fees.

Security remains a priority. PlutoChain has completed audits from SolidProof, QuillAudits, and Assure DeFi. Testing has shown it can process over 43,200 transactions per day.

PlutoChain could make Bitcoin more practical and improve speed, lower costs, and enable new use cases. With these changes, Bitcoin may become more than just a store of value.

The Bottom Line

The SEC’s decision to drop its case against Coinbase suggests a shift in approach, leaving many to wonder if Ripple could see a similar outcome. Analysts remain divided on whether the agency will withdraw its appeal, but traders continue to watch for key developments.

Then there’s PlutoChain, a project that could offer a way to improve Bitcoin’s speed and efficiency.

PlutoChain might make Bitcoin more practical for payments, decentralized finance, and other applications.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read -

2

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read -

3

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read -

4

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

5

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read

Best Crypto Presales to Invest in this Month: 4 Projects with Huge Potential

The overall crypto market cap is now valued at $3.47 trillion, marking a 2.36% jump over the past week and a near 50% increase year-on-year. This wave of bullish sentiment is partly driven by fresh macro developments, including the U.S. government’s pro-crypto stance and new housing policies that could soon allow crypto assets to count […]

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

BTC Bull Token has reached a critical moment. With less than 24 hours left in its presale, the project has already raised $8 million, signalling huge investor confidence. Buyers now have one last chance to secure tokens at a lower price before claiming goes live and the token becomes tradable on exchanges. Many crypto traders […]

Best Crypto to Buy Now as $8.6B Bitcoin Whale Awakens After 14 Years

When a Bitcoin whale that had lain dormant since 2011 sprang to life this week, it unleashed a colossal 80,000 BTC, worth about $8.6 billion, onto the blockchain. Such a historic stir not only shattered records for daily movements of decade‑old coins but also underscored how long‑term holders can reshape market dynamics in a heartbeat. THE FINAL […]

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

One of the most talked-about new meme coin launches of 2025, BTC Bull Token (BTCBULL) has already raised over $8 million through its presale, signalling huge investor confidence. BTC Bull Token stands out by tracking Bitcoin’s performance and rewarding BTCBULL holders whenever BTC hits specific milestones for the first time. The concept blends meme coin culture […]

-

1

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read -

2

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read -

3

Best Crypto to Buy Now as Whales Sell But ETFs Scoop Up Billions

27.06.2025 15:46 7 min. read -

4

Pepe & Dogwifhat Soar as Crypto Prices Rebound: Best Meme Coins to Buy

25.06.2025 16:45 6 min. read -

5

Best Altcoin to Buy in July? Best Wallet Token Presale Hits $13.5 Million

26.06.2025 16:33 5 min. read