XRP Network Sees Surge in Transactions and Trading Volume

09.07.2024 17:00 1 min. read Alexander Stefanov

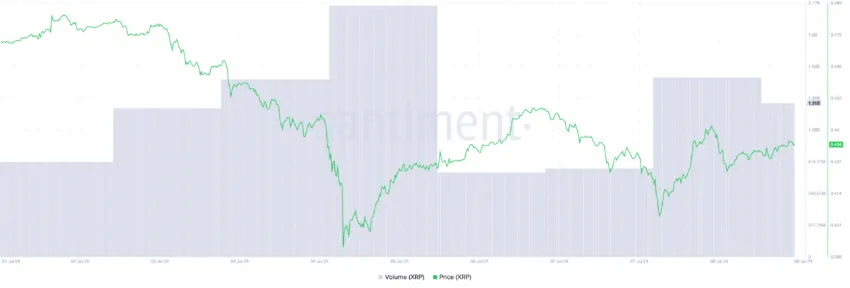

On July 8, the Ripple Network (XRP) experienced a notable increase in adoption, marking its highest daily transaction count since February.

This surge in user activity propelled XRP’s daily trading volume to over $1 billion.

Data from the XRP Ledger indicated a significant uptick, with 2.3 million successful transactions recorded on July 8, a 15% rise from the previous day’s 2 million transactions.

This spike reflects a 97% increase in daily transaction count since the beginning of July.

The heightened demand positively impacted XRP’s market performance, with its trading volume peaking at $1.5 billion.

At the time of writing XRP is trading at $0.4347, down nearly 1.3% in the last 24 hours, accompanied by a slight decrease in trading volume.

Bearish sentiment persists in the XRP market, as the altcoin has declined by 10.5% over the past week.

Currently, XRP’s Parabolic SAR indicator suggests a downward trend continuation, potentially leading to a further decline to $0.41.

-

1

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

2

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

3

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

06.06.2025 15:00 1 min. read -

4

Whale Activity Triggers Caution for Select Altcoins Amid Bitcoin Optimism

05.06.2025 20:00 1 min. read -

5

Pi Network Urged to Act as Users Demand Token Transparency

08.06.2025 9:00 2 min. read

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

Shiba Inu has surrendered roughly a quarter of its market value over the past month, hovering this morning near $0.0000113.

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

Confidence is surging among analysts that U.S. regulators are preparing to greenlight a wide array of cryptocurrency ETFs, marking a pivotal change in the SEC’s approach to digital assets.

Ripple’s Stablecoin Edges Toward $500M Milestone After Latest Mint

Ripple has minted another 13 million RLUSD tokens, pushing its dollar-pegged stablecoin closer to the half-billion-dollar mark in circulating supply.

Pi Price Prediction: Top Community Member Believes PI Will Drop to $0.40

Pi Coin (PI) has gone down by 33% in the past month and has dropped below a key support at $0.60 as the community has been disappointed by a lack of updates from the Pi Core Team and delays in the migration of Pi tokens to the public mainnet. One notable supporter of Pi whose […]

-

1

Pump.fun Reportedly Planning Massive Token Sale Despite Revenue Drop

04.06.2025 20:00 2 min. read -

2

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

3

Corporate Interest in XRP Surges as Firms Eye It for Treasury Reserves

06.06.2025 15:00 1 min. read -

4

Whale Activity Triggers Caution for Select Altcoins Amid Bitcoin Optimism

05.06.2025 20:00 1 min. read -

5

Pi Network Urged to Act as Users Demand Token Transparency

08.06.2025 9:00 2 min. read