XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read Kosta Gushterov

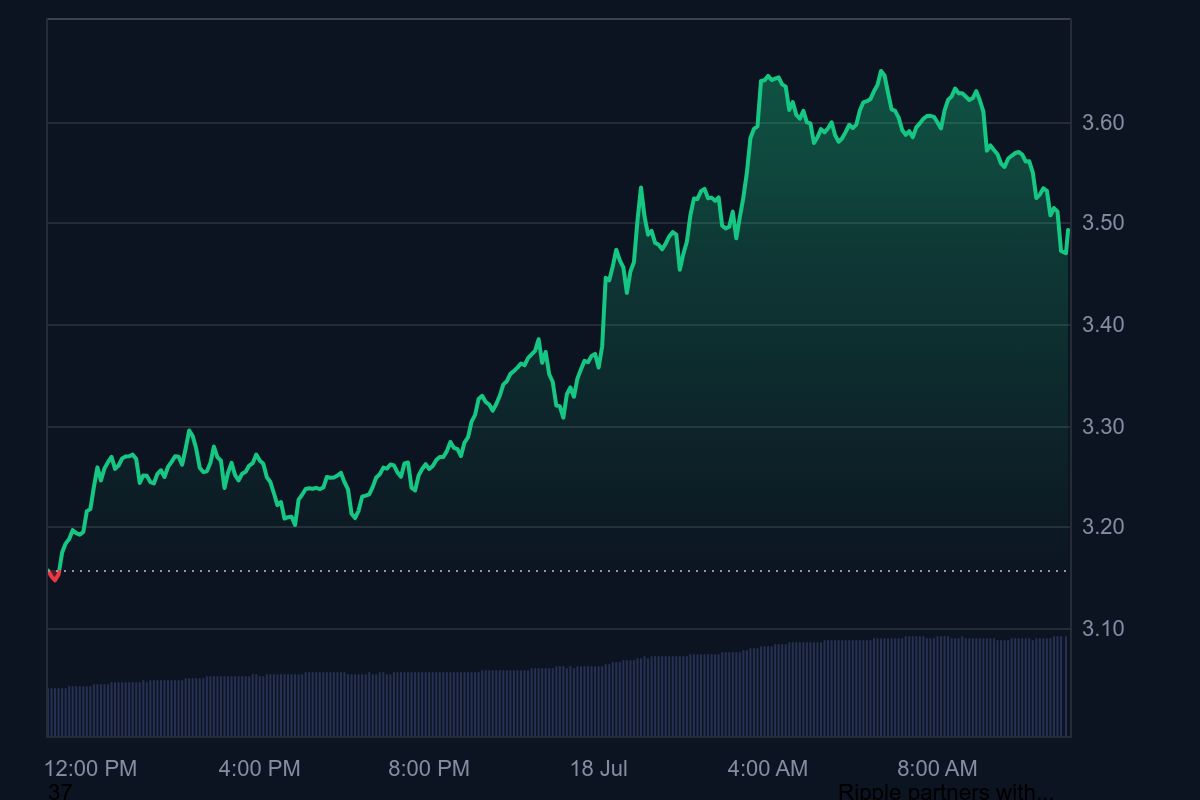

XRP officially entered uncharted price territory on July 18, surging past its previous record to hit a new all-time high of $3.64, fueled by a powerful combination of U.S. regulatory progress, technical breakouts, and heavy whale accumulation.

The primary catalyst was the July 17 approval of the GENIUS Act in the U.S. House of Representatives. This landmark legislation introduces a clear federal framework for stablecoins and is seen as a green light for Ripple’s RLUSD rollout. Markets responded swiftly, pricing in President Trump’s expected signature on the bill, with XRP climbing 9% immediately after the news broke.

This development eases regulatory uncertainty that has weighed on Ripple since its legal battle with the SEC, and positions the company for greater adoption and utility.

Golden cross and whale inflows confirm bullish structure

XRP’s technical outlook is equally bullish. A golden cross has formed, with the MVRV ratio crossing above its 200-day moving average—last seen ahead of a 630% rally in late 2024. Meanwhile, the Relative Strength Index (RSI) sits at an elevated 88.68, indicating potential overbought conditions, but the MACD histogram continues expanding, suggesting strong upside momentum.

Price has decisively broken the $3.50 resistance, aligned with the 127.2% Fibonacci extension. The next major target lies at $4.55, the 161.8% Fibonacci level.

Altcoin season rotation and whales drive capital flows

XRP’s surge comes as altcoin capital rotation intensifies. The CMC Altcoin Season Index has soared 78.57% in 30 days, with XRP dominating large-cap inflows. On-chain data from Ali Martinez shows that addresses holding over 1 million XRP have accumulated 2.2 billion tokens—worth around $7.6 billion—since July 1, signaling institutional conviction behind the rally.

Outlook: Can Ripple decouple further from Bitcoin?

While short-term consolidation is possible due to RSI levels, XRP’s rally is underpinned by solid fundamentals and macro catalysts. If Ripple finalizes its long-anticipated SEC settlement this quarter, XRP could further decouple from Bitcoin and extend its historic breakout toward new highs.

With momentum on its side, XRP is fast becoming the standout performer of the altcoin season.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

2 Main Reasons Behind Ethereum’s Surge to $3,600

Ethereum surged 5.18% in the past 24 hours, crossing the $3,600 level and reaching $3,670 before going back to $3,590 at the time of writing.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read