World’s Largest Crypto Index Fund Manager Faces $2M Lawsuit

10.07.2024 12:00 1 min. read Alexander Stefanov

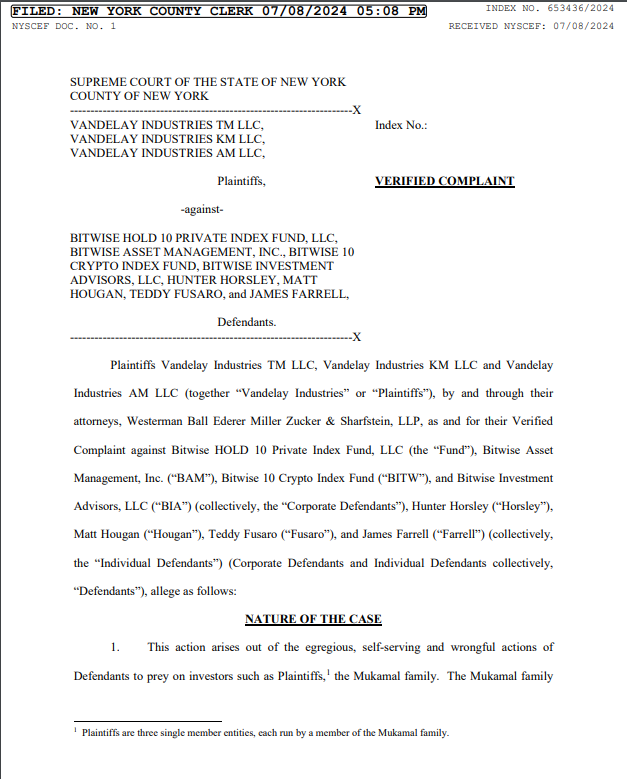

Bitwise Asset Management faces a lawsuit from Vandelay Industries on behalf of a family, accusing the company of financial misconduct and seeking $2 million in damages.

The dispute began with the family’ $1.3 million investment in the Bitwise HOLD 10 Private Index Fund in 2018.

Tensions rose in 2020 when Bitwise proposed converting the fund to a publicly traded entity on OTC markets and increased management fees by 25%, which the plaintiffs claim left them with no real choice but to accept unfavorable terms.

Additional investments totaling $4.85 million in 2021 under allegedly misrepresented terms led to a financial loss of nearly $1.93 million.

The lawsuit accuses Bitwise of breach of fiduciary duty, negligence, fraud, and other charges. Bitwise denies the allegations, stating that Theodore Mukamal has a history of legal threats for personal gain and had acknowledged the risks of investing in their funds.

This legal battle could set important precedents for crypto fund management and investor communication transparency. Bitwise also issues the spot Bitcoin ETF, Bitwise Bitcoin Fund (BITB), which has attracted significant investment.

-

1

Crypto Theft Surges to $2.1B in 2025: State Actors Lead Historic Wave of Attacks

27.06.2025 16:30 2 min. read -

2

Solana PumpFun Bot Turns Out to Be Malware in Disguise

04.07.2025 9:00 2 min. read -

3

Hackers Steal $140 Million from Brazilian Central Bank, Launder Funds Through Crypto

05.07.2025 11:00 2 min. read -

4

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

08.07.2025 10:00 2 min. read -

5

Investor Loses $6.9M After in TikTok Crypto Scam

16.06.2025 19:00 1 min. read

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

A legal clash between Coin Center and the U.S. Treasury Department over sanctions imposed on Tornado Cash has officially come to an end, following a joint decision to dismiss the case.

Hackers Steal $140 Million from Brazilian Central Bank, Launder Funds Through Crypto

A sophisticated cyberattack targeting Brazil’s central bank reserve accounts has resulted in the theft of over $140 million (R$800 million), much of which was swiftly funneled through cryptocurrency channels.

Solana PumpFun Bot Turns Out to Be Malware in Disguise

A malicious open-source project on GitHub disguised as a Solana trading bot has compromised user wallets, according to a July 2, 2025, report by cybersecurity firm SlowMist.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

-

1

Crypto Theft Surges to $2.1B in 2025: State Actors Lead Historic Wave of Attacks

27.06.2025 16:30 2 min. read -

2

Solana PumpFun Bot Turns Out to Be Malware in Disguise

04.07.2025 9:00 2 min. read -

3

Hackers Steal $140 Million from Brazilian Central Bank, Launder Funds Through Crypto

05.07.2025 11:00 2 min. read -

4

U.S. Court Ends Tornado Cash Legal Dispute, Marking Win for Coin Center

08.07.2025 10:00 2 min. read -

5

Investor Loses $6.9M After in TikTok Crypto Scam

16.06.2025 19:00 1 min. read