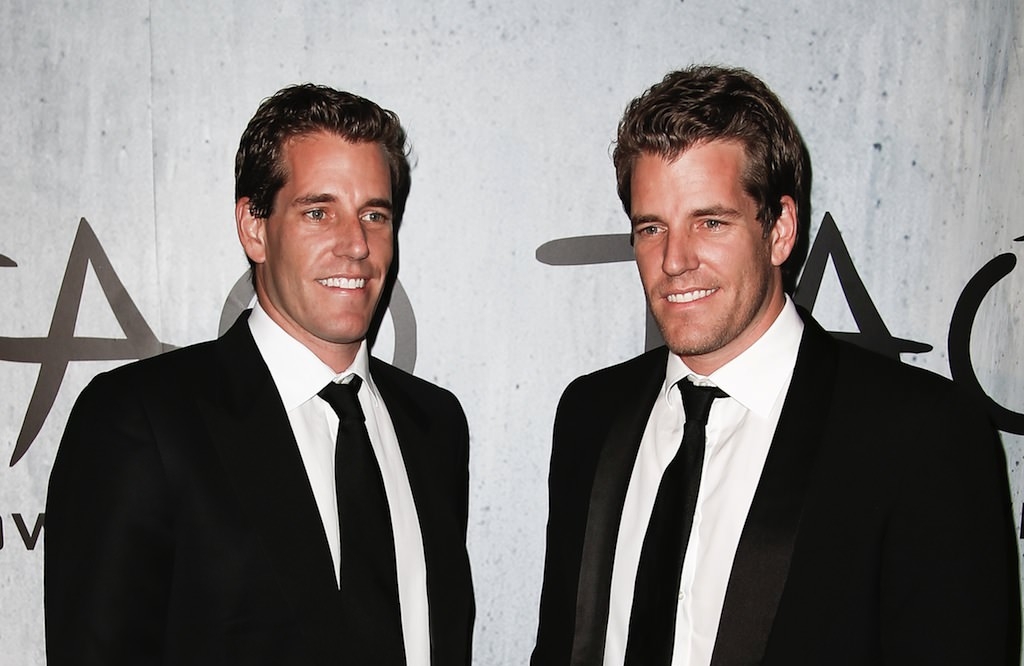

Winklevoss Twins Donate $1 Million in Bitcoin to Support Senate Bid Against Elizabeth Warren

19.07.2024 15:45 1 min. read Alexander Stefanov

On July 18, Tyler Winklevoss, co-founder of the Gemini crypto exchange, announced a notable political donation of $500,000 worth of Bitcoin to support John Deaton’s Senate campaign in Massachusetts.

Tyler’s twin, Cameron Winklevoss, matched this amount, totaling a $1 million contribution aimed at helping Deaton challenge Senator Elizabeth Warren, a well-known critic of cryptocurrency.

Tyler Winklevoss described Warren as a significant threat to American prosperity, claiming she has been influential in shaping anti-crypto policies through her role in the Biden administration. He criticized her for using her position to undermine the crypto industry and stifle innovation.

The Winklevoss brothers, along with Ripple Labs—which donated $1 million earlier this year to support Deaton’s campaign—are advocating for Deaton as a defender of crypto. Deaton is recognized for his legal defense of the industry and his criticism of regulatory overreach by agencies like the SEC.

The support from the Winklevoss twins and Ripple Labs reflects growing political engagement within the crypto community, though some, like Ethereum co-founder Vitalik Buterin, caution against backing candidates solely based on their crypto stance.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

3

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

4

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

5

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Greed Holds as Market Momentum Builds: What is the Market Sentiment

The crypto market remains firmly in “Greed” territory, with CoinMarketCap’s Fear & Greed Index clocking in at 69/100 on July 19. Despite a modest 24-hour dip from 71, the index has now held above 60 for 11 consecutive days.

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

3

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

4

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

5

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read