Will Ethereum ETFs help ETH Reach a New ATH in 2024?

24.07.2024 13:00 1 min. read Kosta Gushterov

Will Kay, head of indexes at Kaiko, pointed out in a report Monday that "ETH prices may be particularly sensitive to early inflows into newly launched ETFs.

He cautioned that an overall understanding of demand may not become apparent for several months and it is unclear how initial product receipts may impact the asset.

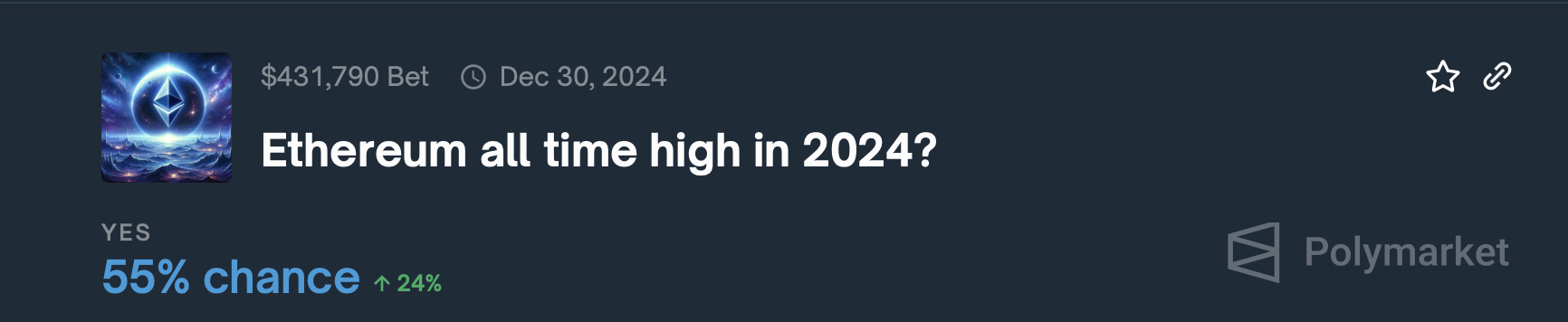

Despite expectations of significant inflows into spot ETFs this year, traders on the Polymarket prediction market are less optimistic about the likelihood of ETH reaching a new all-time high thanks to these ETFs.

Prediction markets, which use geographically diverse consumer forecasts of future events, are theoretically less biased as participants consider “risk-on versus forecast.”

In Polymarket’s largest pool of predictions versus price movements for Etheriem, 55% of participants predict ETH could reach a new all-time high in 2024.

Approximately 30% believe ETH could exceed $4,600 by the fourth quarter.

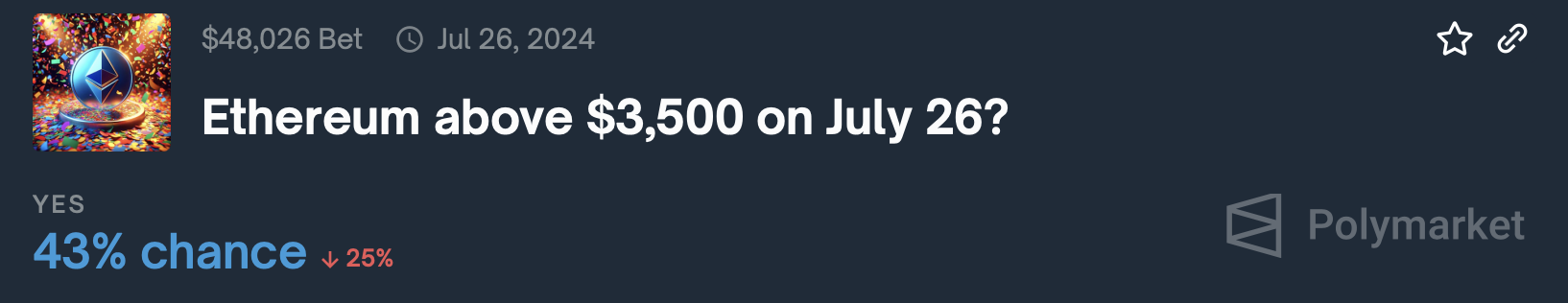

In a separate pool, forecasters are betting on a less than 43% chance ETH will exceed $3,500 by July 26.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

Can Stellar bounce again? XLM returns to crucial retest zone

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

Altcoin Breakout: ResearchCoin, Electroneum, and REI Network Lead The Rally

A wave of bullish momentum is sweeping through smaller-cap altcoins, with ResearchCoin (RSC), Electroneum (ETN), and REI Network (REI) all recording substantial 24-hour gains.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

4

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read