Why Most Americans Still Avoid Crypto Despite Growing Adoption

27.07.2025 8:34 2 min. read Kosta Gushterov

Cryptocurrency ownership in the U.S. has grown steadily over the past few years, but it remains far from widespread.

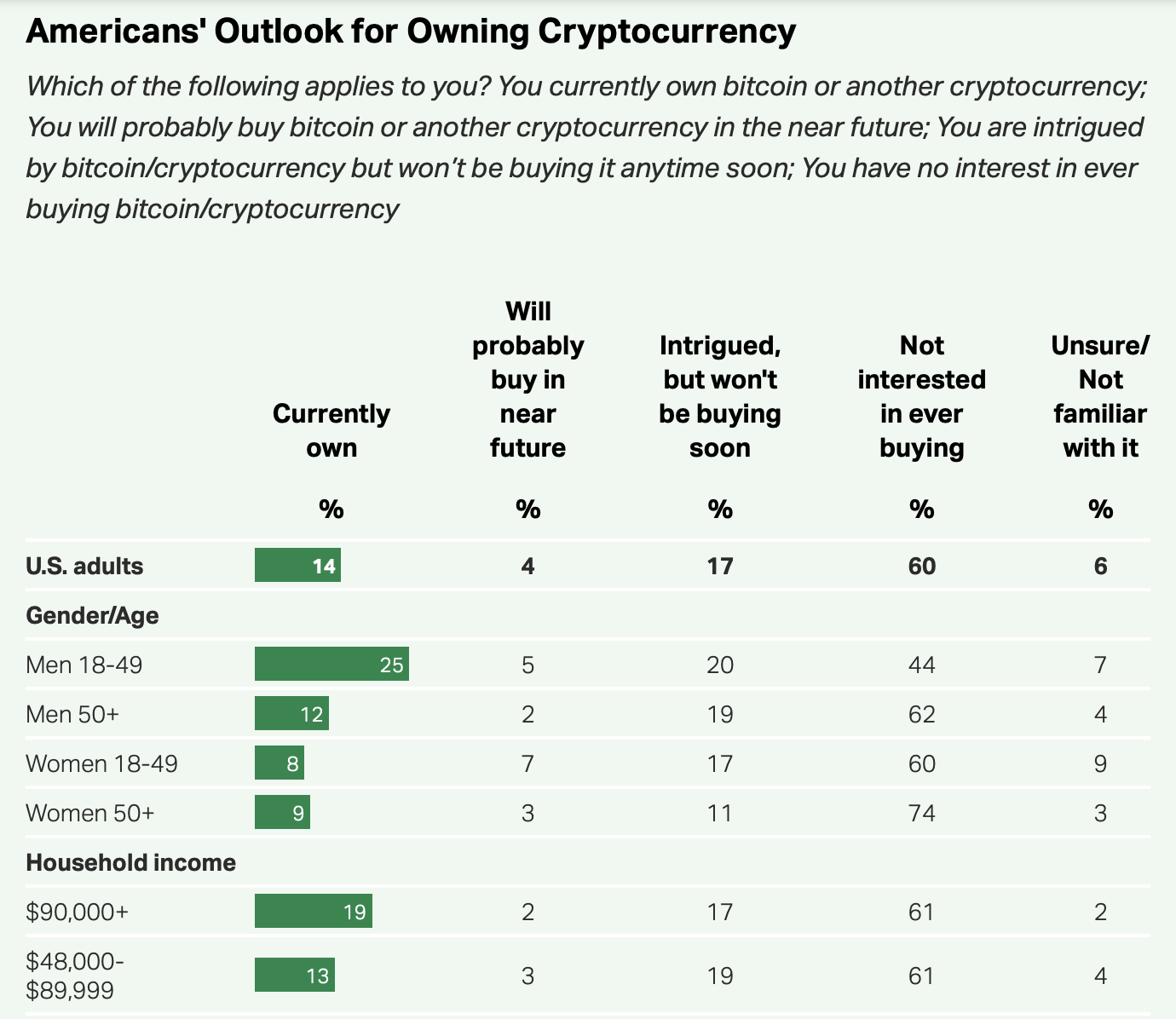

Today, around 14% of American adults report owning digital assets like Bitcoin or Ethereum. While this marks a clear increase from single-digit figures in 2021, most Americans continue to stay on the sidelines.

For many, the risk factor looms large. Over half of respondents say they view cryptocurrency as a very risky investment, with another third labeling it somewhat risky. These concerns appear to outweigh the excitement around blockchain innovation or digital finance’s future potential.

Younger men and high earners lead the way

Crypto ownership is far from evenly distributed. Men under 50 are leading adopters, with 25% in this group reporting crypto holdings. In contrast, only 8–9% of women—regardless of age—say they own any digital currency. Similarly, adults with higher incomes and college degrees are far more likely to be involved in the crypto space.

This demographic divide suggests that exposure to crypto is still concentrated among those with both the risk appetite and financial literacy to explore emerging technologies.

Familiar name, unfamiliar concept

Nearly all Americans say they’ve heard of cryptocurrency, but only 35% claim to understand it beyond a basic level. For many, it remains a complex and abstract financial product. This knowledge gap, paired with headlines about scams or volatility, continues to discourage broader participation.

Even among those intrigued by the idea, just 4% say they plan to buy crypto soon, while 60% express no interest at all.

Regulatory clarity may shift sentiment—but slowly

The introduction of federal crypto regulation has sparked debate around safety, oversight, and innovation. While clearer rules may improve long-term confidence, it’s unlikely to drive an immediate adoption wave. For now, cryptocurrency remains a niche holding for younger, higher-income men, while the general public waits for stronger incentives—or fewer risks.

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

2

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

3

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read -

4

Majority of U.S. Crypto Investors Back Trump’s Crypto Policy, Survey Finds

05.07.2025 18:09 2 min. read -

5

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read