Why is Bitcoin (BTC) Back to $67,000?

30.07.2024 10:57 1 min. read Kosta Gushterov

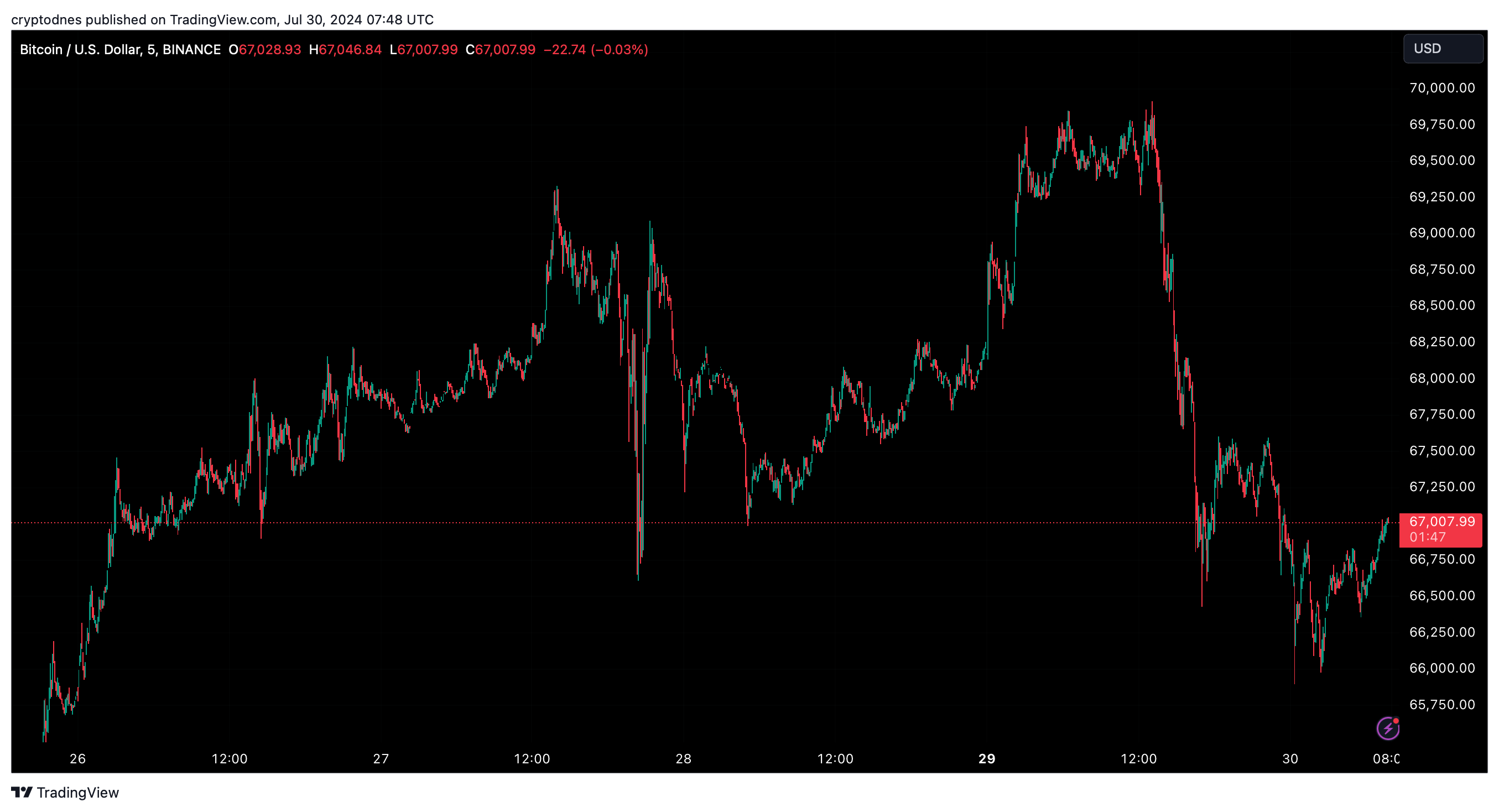

Bitcoin (BTC) headed toward the $66,000 mark early Tuesday, erasing last week's gains that reached the $70,000 mark.

Earlier in the morning, the cryptocurrency dropped to the $66,000 level, but then regained some of its losses. At the time of writing, Bitcoin is trading at $67,007, representing a 3.7% loss over the past 24 hours on trading volume of $39.5 million.

According to some crypto enthusiasts, these losses have occurred as market sentiment has deteriorated due to a large-scale movement of BTC from US government-linked portfolios.

The U.S. Marshals Service transferred $2 billion worth of Bitcoin into two new wallets, with the Arkham onchain movement tracking platform claiming that at least one of them was likely custodial, raising concerns about potential selling pressure among traders.

Other major cryptocurrencies also saw declines, mirroring the movement of the largest cryptocurrency. ADA fell 4.3 percent, DOGE and BNB each lost 3.1 percent and XRP declined 2 percent.

Despite these widespread losses, ETH showed relative resilience, falling just 0.7%.

-

1

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

2

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

5

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

-

1

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

2

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

3

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

4

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

5

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read